Let me now turn to the inflation situation. Overall consumer price inflation has come down since last year, primarily as a result of the deceleration of consumers’ energy costs. The consumer price index (CPI) increased 2.4 percent over the twelve months ending in February, down from 3.6 percent a year earlier. Core inflation slowed modestly in the second half of last year, but recent readings have been somewhat elevated and the level of core inflation remains uncomfortably high. For example, core CPI inflation over the twelve months ending in February was 2.7 percent, up from 2.1 percent a year earlier. Another measure of core inflation that we monitor closely, based on the price index for personal consumption expenditures excluding food and energy, shows a similar pattern.

Overall consumer price inflation has come down since last year, primarily as a result of the deceleration of consumers’ energy costs.

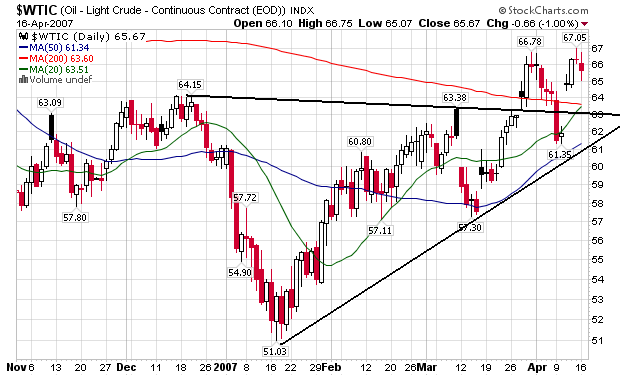

Problem: Oil prices are increasing. They are in an uptrend and have broken through resistance.

The consumer price index (CPI) increased 2.4 percent over the twelve months ending in February, down from 3.6 percent a year earlier.

Problem: That number is now 2.7% according to the latest CPI news.

Another measure of core inflation that we monitor closely, based on the price index for personal consumption expenditures excluding food and energy, shows a similar pattern.

Core prices were only .1% in the latest report. But, the more volatile elements of inflation - food and energy have strong upward price pressures, and will for the foreseeable future. I explain those pressures here and here

It looks as though Bernanke's ideal situation -- the economy naturally slowing inflation for the Fed -- isn't going to happen.