The US Energy Information Administration said crude oil stocks rose by 1.2 mln barrels in the week ending March 9 to a total of 325.3 mln barrels. The latest figure was in line with analysts' expectations of an increase of 1.3 mln barrels, according to an AFX poll.

However, gas prices are still increasing, as shown by this chart from the latest DOE report:

Here's what the DOE said in their latest report:

Gasoline prices rose sharply again, increasing 12.2 cents to 250.5 cents per gallon for the week of March 5, 2007. Prices are now 17.4 cents per gallon higher than at this time last year. All regions reported price increases. The East Coast had the largest increase, with prices up 15.4 cents to 249.1 cents per gallon. Midwest prices rose 9.5 cents to 246.5 cents per gallon. Prices for the Gulf Coast were up 13.3 cents to 236.7 cents per gallon. Rocky Mountain prices increased 10.4 cents to 235.3 cents per gallon, while prices for the West Coast were up 10.1 cents to 276.5 cents per gallon. California prices were also up 10.1 cents, to 289.7 cents per gallon, 41.7 cents per gallon above last year’s price.

Note two things. First, they said prices have increased sharply again. Those are two words you don't like to see in front of gas prices. Secondly, prices are higher than they were at this time last year when gas hit $3/gallon and above in some regions.

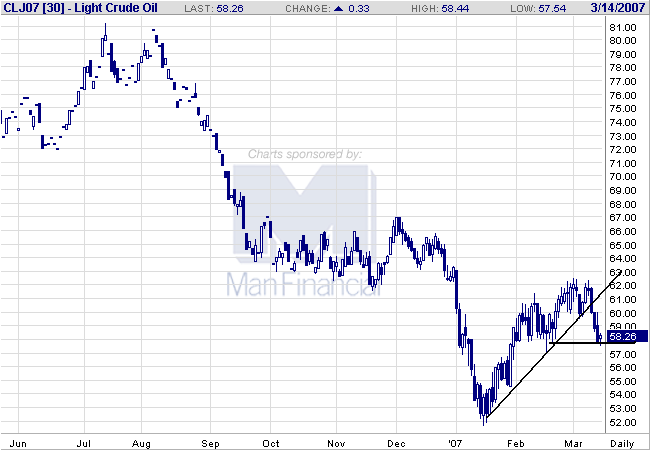

Here's a chart of oil:

Oil has sold-off and broken its rally that started in mid-January. So far, it appears to be bottoming at roughly $58/bbl.

Let's sum up so far. Crude oil prices are lower now than this time last year (when they were about $66-$70/bbl). However, gasoline prices are higher now than they were last year. What's odd is now we have a higher stockpile of gasoline than we did last year. Here's the chart of gasoline inventories, with last summer marked 1 and the current level marked 2:

We have more supply now (although it is dropping), but prices are higher. Gas prices may be moving up in response to the drop in inventories and the speed of the drop.

Maybe the issue is the overall oil inventory, which has dropped since the summer peak:

Why all of this talk about oil? In his latest Congressional testimony, Bernanke said inflation was down largely as the result of decreasing energy prices. Therefore, as energy prices increase we can probably expect an uptick in inflation. This will hem the Fed in and prevent them from lowering interest rates if there is a continued economic slowdown.