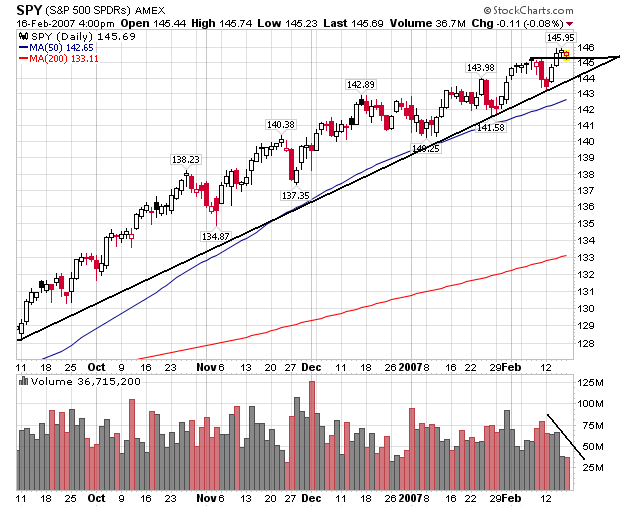

We're still firmly in the uptrend that started in September. We had two strong rallies this week, followed by two days of consolidation. The last two days of consolidation were on weaker volume, but the markets didn't sell-off. This indicates traders are willing to hold their positions over the weekend. The only negative of the last few days was the decreased volume.

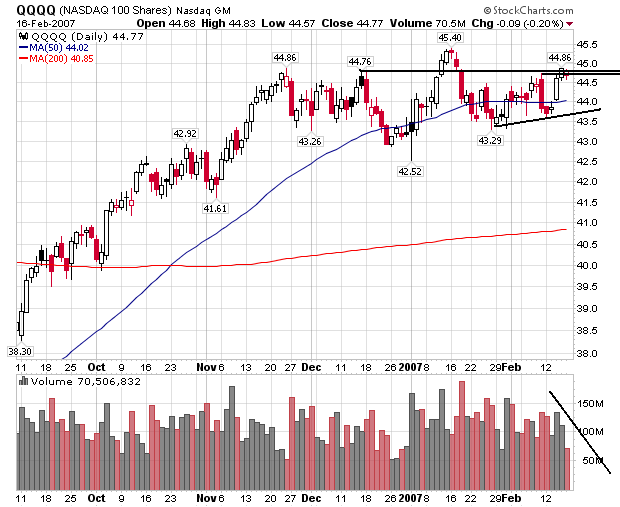

Here's a chart for the QQQQs

The QQQQs are still mired in a trading range between 42.5 to 45.5. While the QQQQs also rallied, we have three days of decreasing volume. The decreasing volume is always a concern. However, as with the SPYs, traders were willing to take their gains over the weekend, which is bullish for next week.

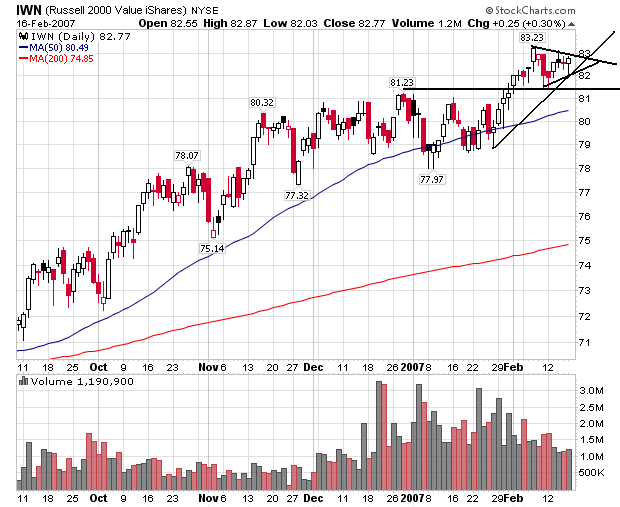

Here's a chart for the IWNs

This is a classic consolidation chart. After making new highs, the IWNs are forming a triangle on lower volume. While we didn't have the same type of gains as the QQQQs or SPYs, we also didn't have any major losses either.

All of these charts are a net positive going into next week. The QQQQs are the weakest because they are still in a trading range, but as with the SPYs and IWNs, QQQQ traders were willing to hold their gains over the weekend.