The Governing Council of the ECB decided to raise 25bp its bid rate to 3.50% as it was widely expected. This decision has not surprised analysts nor the markets, which have shown almost no reaction to the result of the meeting. This hike is aimed to combat inflation, at a 1.6% y/y rate.

Analysts now turn their attention to the 1330 GMT press conference where JC Trichet is expected to confirm the ECB's strengthening bias without giving any clues of its possible interest rate movements for 2007.

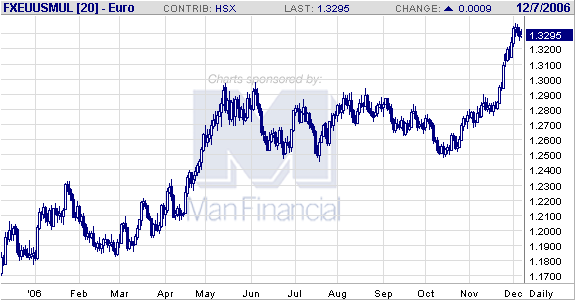

The interest rate differential between the dollar and various currencies has been a boost to the dollar for the last year. That differential is going away, making the dollar less attractive relative to the euro. Here's the chart:

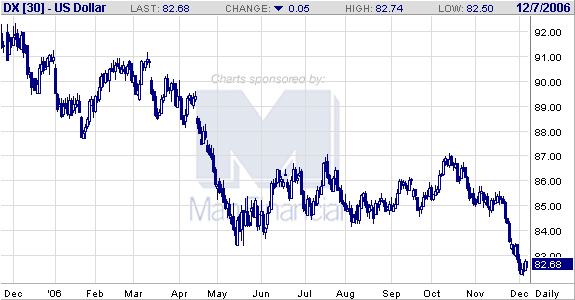

This drop in the dollar euro trade is one of the primary reasons for the drop in the overall dollar index.

From May until November, both charts were in a trading range. This indicates traders were accumulating positions. The great trade W.D. Gann said the longer the accumulation pattern, the longer the ensuing run. If that adage holds, the dollar is in for a lower value.

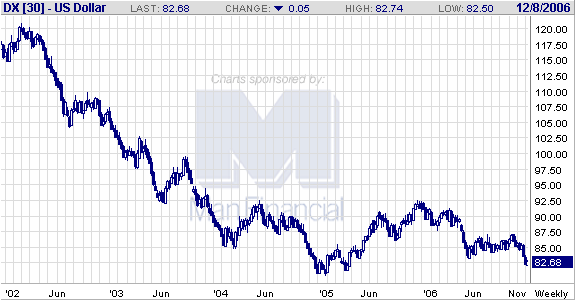

Here's the monthly dollar chart:

This chart shows the dollar is near multi-year lows. If the dollar crosses below those levels and maintains the trend for a bit after crossing, we're in for a lower dollar for awhile.