What I am about to propose is a radical departure from the overall current economic policy of the United States. Implementing this policy will require an incredibly difficult debate and policy application. The application of this program will hurt many people. Ideally, we should spread the pain out among as many people as possible. However, the pain cannot be avoided. In addition, implementation will take a great deal of time. The method of paying for this plan will be extremely controversial, especially among Democratic circles. Implementation will take consistent effort and sacrifice.

THERE ARE NO EASY ANSWERS TO THE OVERALL PROBLEM. The sooner we accept the reality there will be some pain for everyone, the better off the process will be. As a country, we have lived beyond our means for far too long; it’s time to pay the bill. We have a very bitter pill to swallow. The best thing we can do is swallow the pill and move on.

The short version of this plan is simple: The US must move from a debt to an equity economy.

Overview of the Problem

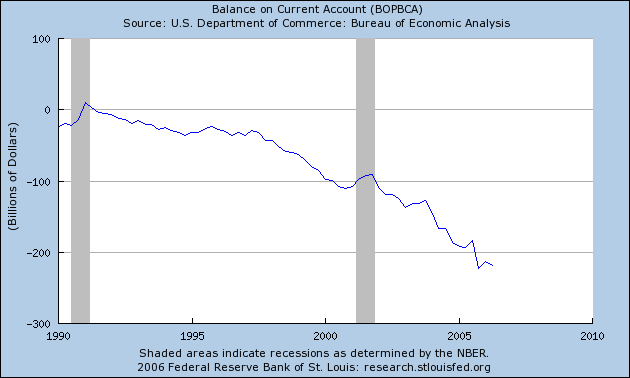

The US international trade deficit has trended to a more negative position over the last 15 years. The following chart is from the St. Louis Federal Reserve:

A trade imbalance indicates a country is consuming more than it produces. The country with the trade deficit must borrow money too fund the difference between consumption and production. At the current level, the US must import roughly $2 billion/day to finance its consumption. At some point, creditors will demand a higher interest rate for the increased risk associated with holding US debt. In addition, it is also possible for the host country’s currency to drop in value. Should the currency drop in value, the host country has a greater likelihood of importing inflation. Neither possible scenario – an increase interest rates caused by increased perception of risk or a devaluation of the host country’s currency – is beneficial for the host country.

The federal debt situation is just as dire. The problem started with the implementation of supply-side economics in 1981. While the Reagan administration loved cutting taxes, they did not cut spending. As a result, the Federal government issued a large amount of debt, increasing the debt/GDP ration from roughly 30% in 1980 to over 60% in 1988. Bush 43 implemented the same policies with the exact same result. According to the Bureau of Public Debt, the US has issued over $550 billion in net new debt each year for the last 4 years. (For a complete listing of government and revenue and expenditures, please go the historical budget data (PDF) at the Congressional Budget Office.) As a result of Reagan’s and Bush’s policies, the US federal government has issued debt to pay for growth. Here is a graphical representation of the situation.

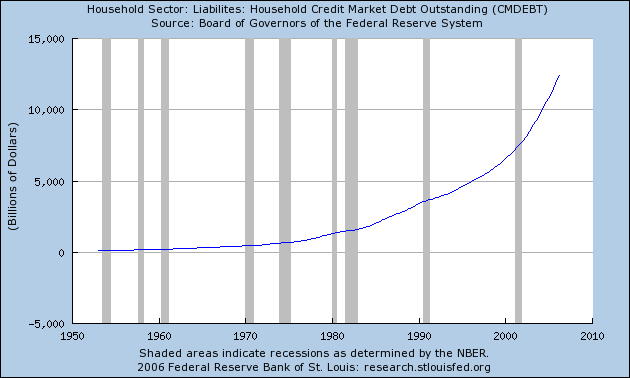

At the household level, we have seen the exact same situation develop over the last 20 or so years. As wages have largely stagnated for a large percentage of the population, households have increased the use of debt to finance their lifestyle. As a result, household debt has continually increased, as the chart below from the St. Louis Federal Reserve indicates.

So, why is all of this debt bad? To quote Dave Ramsey, you’re making someone else rich. The person that lent you the money gets some of the benefits of your growth. As the amount of debt increases, the lender receives more benefits in the form of higher interest payments. Eventually, the borrower must pay an amount so large that growth is almost painful. While current payments on US debt are not a large amount of money, we have also been the beneficiary of historically low interest rates. It’s only a matter of time before lenders realize the US may not pay its debts and ask for a higher interest rate on their respective debt. This is when we will run into big trouble.

So, we’ve outlined the problem. That’s the easy part. Let’s move into how to solve this problem. This is where a great deal of pain comes in, because there are no easy answers. In fact, there are only difficult answers that must be implemented.

Priority 1. Balance the Federal Budget.

Here are the benefits of a balanced budget.

It prevents crowding out. This is a fancy way of saying money that would finance the federal budget deficit is instead invested in private capital. Let me use the current situation as an example. According to the Congressional Budget Office, the US had a $318 billion budget deficit in 2005. That means $318 billion dollars was not invested in the private economy, but instead invested in US government bonds. The larger the deficit, the less money available for private investment.

Psychology and uncertainty. A budget deficit detracts from individual's confidence in the market and the overall economy. As individual's look to the federal deficit, they understand that at some time the government must pay back the money it borrows. That means the government will probably have to either raise taxes (more likely) or decrease spending (far less likely whichever party is in control of the government). ;Deficits create psychological uncertainty. The larger and more persistent the deficit, the less happy people are and the less prone they are to take economic risks.

One of the primary reasons for the economic expansion of the 1990s was the prevailing sentiment among business leaders that Washington was finally in control of the deficit. This created an environment of confidence which increases economic potential. It’s that simple.

So, how do we balance the budget? First, we either let the 2003 tax cuts expire naturally with their built-in sunset provision or we raise them. I would argue against raising taxes immediately because of the current slowing of the overall economy. I would argue we wait until at least the 3rd quarter of the next economic expansion before we consider this. We also need to look at several other options on the tax front, including reforming the estate code, increasing the maximum amount of income subject to social security taxes and certain corporate giveaways. This is all subject to Congressional give-and-take. But, the bottom line is that if we want to balance the budget we first need to increase government revenue.

In addition, spending has to be cut. And honestly,all programs must be on the table. That does not mean all programs will be negatively impacted to the same degree. However, the Federal government spends a lot of money; we have to decrease the rate of spending to a large degree. For the last 6 years, federal spending has increased an inflation adjusted 35%. That level of spending growth is simply unsustainable.

This process of balancing the budget will take awhile. I would guess at least 6 years if not longer. It will take constant concerted effort. And it will mean a lot of people will catch a lot of flack for the consensus decisions reached in the process. This is where political skill comes into play – the ability to sell this achievement to the electorate in a away that allows Dems to continue the process. It will be a difficult sell – especially after the Republicans have won elections on easy, something-for-nothing themes. I do not envy any political consultant’s job in this task.

OK – that’s the federal side of the deficit. As promised, it is not a pretty picture. However, it is what must be done. Now, how do we deal with the consumer debt?

The first point to make is consumer debt is really a problem of poor wage growth. Save the 1990s, wage growth for most Americans have been stagnant for some time. What has made the “standard of living” bearable is the cost of many things has come down, allowing consumers to feel richer without really being richer. In other words, the central issue is how to create better paying jobs which actually increase wages for most Americans. So, how do we do that?

We take a page from Asian development which has a track record of success. We coordinate three different policies: education, domestic investment, and industrial policy

Priority 2: Education

American manufacturing has undergone a fairly radical transformation over the last 20 years. We have moved from (for lack of a better phrase) a pure brawn model to a brawn and brains model.

But manufacturers, regardless of size, specialty or location, across the USA are reporting a dire shortage of skilled workers: people such as welders, electricians or machinists with a craft that goes beyond pushing buttons or stacking boxes but does not require a degree.

In a survey of 800 manufacturers conducted by the National Association of Manufacturers (NAM) last year, more than 80% said they were experiencing a shortage of skilled workers. In October, manufacturers surveyed by the Federal Reserve Bank of Philadelphia said "finding qualified workers" was their biggest business problem.

The shortage of skilled workers is the result of a number of factors. One of the biggest is that manufacturing in the USA is becoming more high-tech and skill-based as the more repetitive, less-skilled work is moving abroad. Such jobs require greater expertise.

Innovation in the manufacturing sector means that the jobs require greater skills than ever before. According to an analysis by economists Richard Deitz and James Orr at the Federal Reserve Bank of New York, employment in high-skilled manufacturing jobs rose 37%, or by 1.2 million jobs, from 1983 to 2002. At the same time, low-skilled factory jobs dropped 25%, or by approximately 2 million workers.

A paper titled The Changing Nature of Manufacturing in OECD Countries highlights the problem as well. On page 8, the paper notes, “The graph shows that most of the decline in manufacturing employment over the past three decades has occurred in only two activities: textiles and metal products.” The bottom line is the developed world is moving to increasingly high-tech manufacturing.

However, as the evidence from the Federal Reserve and NAM indicate, the US workforce is not ready to make this transition. This means, quite simply, that Americans must go back to school. And high school education must be expanded in important areas --especially math and science. This is what the Asian countries did and still do for the most part. They concentrate education in the primary areas – the American equivalent of K-12 – and make the program much more demanding than their American counterparts.

In addition, we need to improve access and the cost structure of trade schools in huge proportions. There are industries which are currently in their end—stage, at least in the US. Textiles lead the way, as do other more purely brawn-oriented manufacturing. Employees in these industries must be given the benefit to retraining if they are able to make the transition. If they aren’t, we must insure their respective pensions are secured so they can live-out their retirement in dignity.

Priority 3: Targeting high-growth industries

This is the final area to discuss, and frankly it won’t take long. The bottom line is there are several industrial areas that everybody knows show high-promise as industries of the future. Alternate energy development probably tops the list. The world’s energy resources – particularly oil – are either at their peak or near their respective peaks. The world market is in desperate need of a true alternative to oil/petroleum as a means of energy. And it’s time a country spent the capital necessary to develop one or all of the possible alternatives. I cannot speak to the possibilities. However, I know they are out there.

Two of my personal pet projects are stem cell research and nano-technology. I am sure there are others.

The primary way we target these areas is with money – as in massive amounts of federal dollars going into think tanks, research groups and universities to develop these ideas. Pure research has consistently demonstrated itself to be the mother of most of the greatest inventions. Therefore, funding pure research is the best way to develop these industries.

Paying for all of this.

I mentioned above that this would be the most controversial aspect of this idea. I guarantee I wasn’t lying. However, before we get there, let’s sum up the basic problem. At a time when the US economy needs a large infusion of cash for investment, it doesn’t have it. The Federal government is in debt up to its eyeballs. Foreigners are financing our trade deficit. And consumers have already taken on debt in near-epic proportions.

So where do we get the money?

We open up Alaska and the Coastal reefs for drilling. I realize the controversy this idea will generate in Democratic circles. However, governing is about difficult choices. And we have a ton of them to make. Just as importantly, the US economy stands near a very dangerous precipice. We are completely dependant on foreign investors to finance our way of life. The federal government is facing serious financial problems. The US consumer hasn’t seen a meaningful pay raise is some time. In other words, we have very serious problems. Weighing all of these problems against environmental interests is difficult. However, the long-term benefit of this program (as in 50 years from now) outweighs the drawbacks.

However, we do the following. First, we earmark a large amount of the proceeds from this specifically for investment in the above-mentioned programs. We do this through higher royalty fees and a high tax structure on the companies that develop these areas. Secondly, we put in place stringent environmental regulations. Finally, we put in place provisions about using American resources – as in American manpower resources – to perform the work.

So – why should we do this? Frankly, we have little economic or financial choice. The US economy must make the transition to the 21st century. We have little national savings to pull on. We have a government issuing debt like a drunken sailor. And, we have a set of resources that can develop the cash flow to allow us to pay for the above ideas. Just as importantly, as we make the transition we create a large amount of high-paying jobs. The bottom line is this solves a lot of problems.