- by New Deal democrat

A big focus of political discourse in the past two weeks has been about why Biden seems to be pollling so poorly against Trump, and in particular has not consolidated support among younger voters.

Since the economy is always a very important component of voter intentions, unless there is a major superseding event like 9/11, economic performance has historically been a good predictor of Presidential election outcomes.

So let’s take a detailed look.

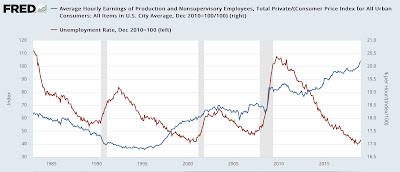

First of all, remember that the election is between two people, Biden and Trump. And the economy was actually doing pretty good during Trump’s mal-administration before COVID. Here’s what real hourly wages and the unemployment rate looked like:

Real wages for non-supervisory workers, increased 3.3% between January 2017 and the end of 2019. Meanwhile the unemployment rate fell from 4.7% to 3.5%.

And that wasn’t just something ho-hum. In the case of real wages, they were the highest since the end of the 1970s. The unemployment rate was the lowest since the end of the 1960s.

So people remembering that the economy was good while Trump was in office, before the pandemic, is not a fluke. It’s the truth, even though it is virtually 100% certain that he had nothing to do with it.

Now let’s take a look at how some important economic sectors have performed under Biden.

The unemployment rate has varied between 3.4% and 3.9% in the past year, about even with Trump’s best year - but not better. More importantly, while real wages for non-supervisory workers are up 2.2% since right before the pandemic hit, measured from when Biden came into office they are actually *down* -1.5%:

[Although I won’t bother with the graphs, other measures like the employment cost index and real personal income give similar results].

Some of this is compositional. That is, a lot of low-paid workers in sectors like restaurants and hotels were out of work during 2020 and have returned since. So their lot has improved. But this changes the averages, because more lower paid workers are in the mix. But the fact is, in the aggregate, real average hourly wages are down.

But perhaps more important is to compare the costs for some of the most important items with those wages.

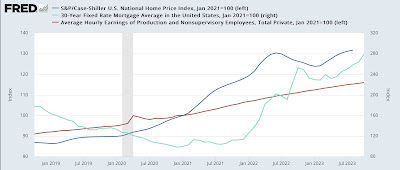

Let’s start with housing, which has gotten a lot of good and insightful attention from commenters.

Below is a graph in which I compare average hourly earnings (nominal, not real) for non-supervisory workers (in red) vs. house prices (dark blue) and mortgage payments (light blue). All of these values are set to 100 as of January 2021 so you can see what has happened during Biden’s Administration. All of these are nominal, not “real,” so that we compare apples to apples:

Nominal average wages have increased 16%. But existing house prices have increased 32%, and monthly mortgage payments for new buyers have increased 279% (!!!), i.e., from roughly 3% to roughly 8%.

Is it any wonder younger workers who would like to buy their first home, or upgrade to a bigger home, would be upset?

A similar phenomenon is in place as to cars:

New car prices have increased 20%, and used car prices 23%, compared to 16% for wages (at least used car prices are down from their 40% increase 18 months ago). And new car loan payments have increased almost 70% (from about 5% to 8.3%).

Houses and cars are the two biggest purchases that most people ever make. and affording them has gotten much harder since Biden took office.

How about a couple of items the prices of which that people see almost every day, namely groceries and gas?

Grocery prices are up 29% since January 2021 (again, vs. 16% for average wages):

And gas prices, even after coming back down recently, are still up 55% since January 2021:

Now let me ask you: if you knew nothing about the personal qualities of the two Presidential candidates, i.e., if they were generic Candidate A vs. generic Candidate B, and you saw the two economic records shown above, who would you be most likely to favor?

That’s the problem Biden has.

Because I don’t like being a Doomer, let me point out that much of this is the doing of the Fed, which has raised rates at the most aggressive pace since Volcker over 40 years ago. And part of that is that the Fed fell behind the curve. Without going into all the gruesome detail, the Fed could started raising interest rates sooner but much more gradually, likely never reaching the level they are now.

Since the Fed will not want to lower rates right before an election, Biden should use whatever soft or hard clout he has to cajole the Fed into lowering rates at least some in the next 4 to 6 months. Additionally, he should explore regulatory actions, which won’t need Congress, to help out especially younger people trapped by higher loan rates. He can also propose actions to Congress, which will allow him to run against them when the GOP predictably yells that such actions are Commie Soshulist!

Also, because house prices all but stopped increasing about a year ago, housing inflation as measured in the CPI should continue to retreat. If Saudi Arabia and Russia are not successful in causing gas prices to skyrocket next year to hurt Biden, CPI on the whole should continue to moderate or at least not re-accelerate. And as supply chains continue to un-kink, we may see sellers actually lower prices on some things like groceries and yes, even cars.

Finally, and maybe most importantly, history shows that voters generally focus on the economy for the last 6 to 9 months before the election. In 2012, the economy improved a lot, and when the unemployment rate finally fell below 8% one month before the election, I knew Obama was in good shape. Contrarily, the economy was weakening close to recession in 2016. If we get better news on inflation and interest rates next year, Biden will be in much better shape.