- by New Deal democrat

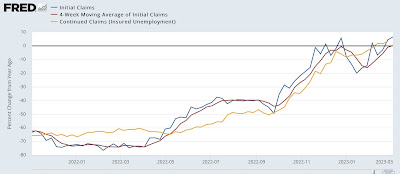

Initial jobless claims increased 21,000 last week to 211,000, still a very low number even if it is the highest since the beginning of January. The 4 week average increased 4,000 to 197,000, also still an excellent level. Continuing claims, with a one week delay, increased 69,000 to 1.718 million, tied for the highest since January 2022:

Just like the JOLTS report yesterday, continuing claims tell us that the labor market, while still objectively very strong, has softened compared with last year.

The YoY% changes also indicate relative softness, with continuing claims up 3.2%, initial claims up 6.6%, but the most important 4 week average only up 0.1%:

For initial claims to warrant even a cautionary yellow flag for recession, the 4 week average would have to be up 10% YoY. Needless to say, we’re nowhere near that marker.

Finally, initial claims are a leading indicator for the unemployment rate, typically with a lag of several months. Here is what the last 16 months look like:

In general, the unemployment rate in tomorrow’s jobs report should be within 0.1% of unchanged, and is a little more likely to increase than to decrease, given the lag compared with November and December’s increase in jobless claims.

I expect tomorrow’s report to revert to the general trend of deceleration that we’ve seen over the past year, since unlike January in February seasonally the data “expects” some hiring vs. massive layoffs as in January. I’ll be especially focusing on whether there is weakness in the leading temp help, manufacturing, and residential construction sectors. We’ll see then.