- by New Deal democrat

This week we get the final most important data of 2022, with consumer prices tomorrow and industrial production and retail sales Thursday. The Fed will also be making its final rate hike decision of the year. Next week and the week after, the only data will be housing construction and prices, plus personal income and spending.

So let’s take a look at few salient datapoints explaining where the economy is. Remember that my primary purpose in discussing expansions vs. recessions is their effect on jobs and income for middle and working class Americans.

To begin with, gas prices are now at their lowest level in the entire last year - even lower than last winter:

Just as sharply rising gas prices put a damper on the economy in the first half of this year, they are putting a floor under it now. Q4 GDP is expected to be good, and I it is very unlikely that the economy will roll over so long as gas prices continue to fall. But at some point they will bottom out, and that is when I would expect Trouble.

One good reason to expect Trouble is the much-discussed yield curve in Treasury bonds. The below graph shows nearly a complete inversion, with the shortest term yields paying the most:

The graph does not show the 6 month and 1 year Treasuries. If it did you would see that the 6 month Treasury is now the highest-paying, followed by the 1 year, with both paying more than the 2 year. In other words, only the Fed funds rate and 3 month Treasuries are not inverted.

This is a historic leading indicator of recession. At this point the inversions are so deep that it would be unprecedented *not* to have a recession soon.

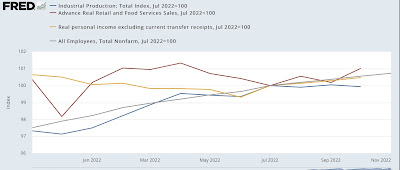

Which brings us to the 4 monthly coincident indicators used to date recessions. Below all 4 - industrial production (blue), real retail sales* (red), real income less transfer payments (gold), and payrolls (gray) - are normed to 100 as of June (*the NBER uses total real manufacturing and trade sales, but those don’t get reported timely, and real retail sales are their most leading component):

Industrial production, the King of Coincident Indicators, has gone nowhere. Both real sales and real income have increased (thank you, lower gas prices!), but are still lower than they were one year ago, and payrolls have continued to increase but at a decelerating rate.

As indicated above, we’ll get updates on two of those four coincident indicators later this week. If industrial production has started to decline, then the remaining shoes will probably drop once gas prices stop dropping.