- by New Deal democrat

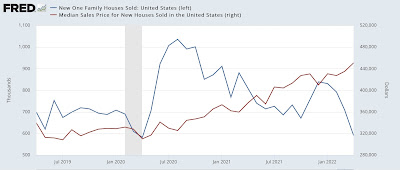

New single family home sales got walloped in April, declining -16.6% for the month compared with March, and down -26.9% from one year ago. Measured from their most recent peak last December, they are off -29.6%, and measured from their pandemic peak of August 2020, they are down a whopping -43.0%! :

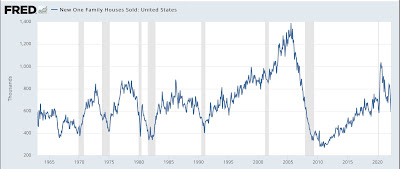

In the long term perspective, a decline like this is usually recessionary:

But not always: from November 1965 to September 1966, sales declined -41.9%; from March 1986 to January 1988, they declined -33.5%; and from December 1993 through February 1995, they declined -31.2% - in each case without a recession following, although in each case real GDP decelerated sharply to nearly zero, even if it remained positive.

Further, new home sales are heavily revised after the first report. It is not unusual at all for big monthly moves like this to suddenly look much less severe when the number gets revised one month later. I would not be surprised in the slightest if that happened to this month’s cliff dive, when next month’s report comes out.

As to prices, in the first graph above note that the median price of a new home continued to rise (red). As shown in the below graph of YoY changes, prices are still up 19.6% from one year ago, even as sales are down:

This confirms for the umpteenth time that sales lead prices, as shown in the longer term YoY perspective (note: graph averaged quarterly to cut down on noise):

In the past prices have continued to rise sometimes for over a year after sales went into steep declines.

Finally, here is a comparison of housing starts (blue), single family permits (red), and new home sales (gold), all normed to 100 as of February 2020:

Although it is a very noisy number, new home sales frequently do peak and trough before either of the other two numbers - and it appears they did so again during this expansion. Keeping very firmly in mind my above note about revisions, today’s new home sales number suggests that more substantial declines in permits, and ultimately starts, will soon take place. This does not portend recession now, but is a significant piece of evidence adding to the heightened possibility of recession next year.