- by New Deal democrat

After 3 days of a data desert, today there is a cornucopia of data: not just initial claims, but housing starts and permits, and industrial production as well. On top of that, a large stretch of the yield curve in the bond market is close to inverting after yesterday’s Fed rate hike. I’ll report on housing and production later; below is the read on new and continuing jobless claims.

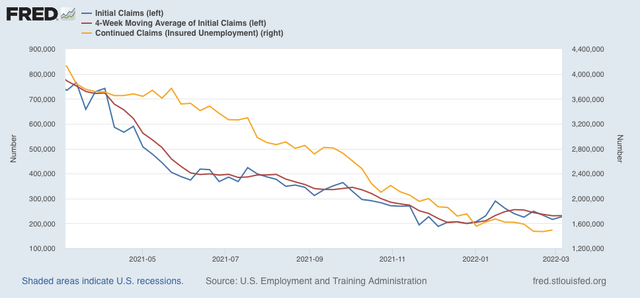

Initial claims (blue) declined 15,000 to 214,000 (vs. the pandemic low of 188,000 on December 4). The 4 week average (red) declined 8750 to 223,000 (vs. the pandemic low of 199,750 on December 25). Continuing claims (gold, right scale) declined 71,000 to 1,419,000, which is not only a new pandemic low, but also the the lowest number in over 50 years: