- by New Deal democrat

This is a follow up about “real” wages, in the wake of the February CPI.

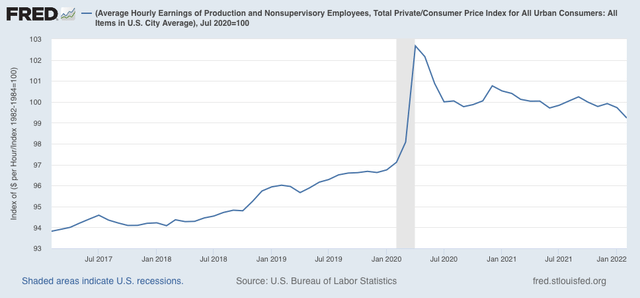

Yesterday’s CPI report showed that prices increased 0.8% in February. Meanwhile, the jobs report indicated that average hourly wages for nonsupervisory workers increased 0.3%, so real hourly wages declined -0.5% for the month:

As shown in the above graph, real wages had been essentially flat since July 2020, varying from 0.8% above, to -0.3% below. Pending revisions, February marked a downward break in that trend.

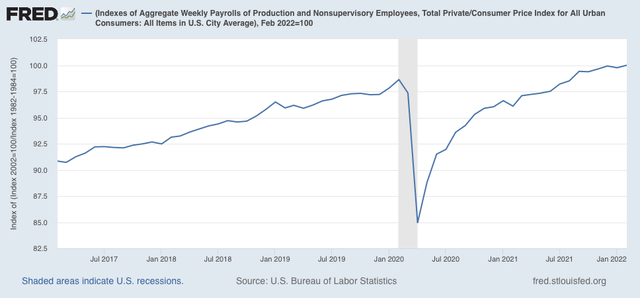

Now let’s turn to real aggregate payrolls, which are an overall measure of consumer health. For nonsupervisory workers, these rose 0.2% for the month to a new high:

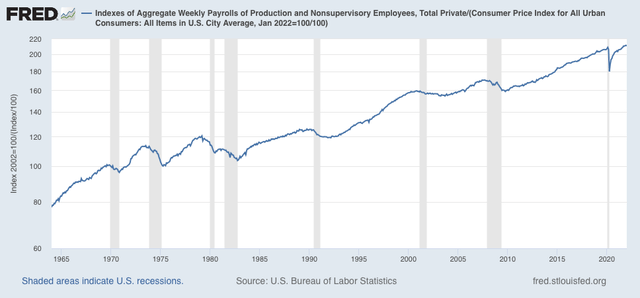

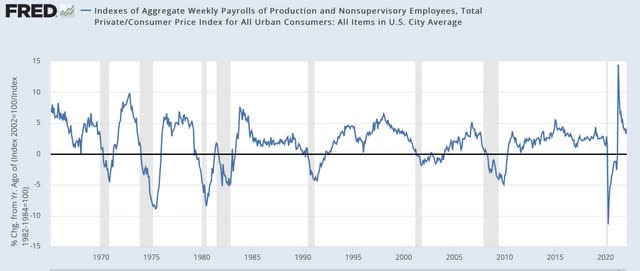

With the (understandable) exception of the pandemic, for the past 50+ years, only when aggregate real wages for have retreated from peak for 3 to 9 months, has recession typically followed:

Here’s a YoY% change view of the same data:

As you can see, from just before to just after the onset of a recession, real aggregate wage growth turns negative YoY. With the exceptions of 1981 and the pandemic, where it hasn’t turned negative before the onset, it has been rapidly plummeting, by over 50% in the previous 6 months.

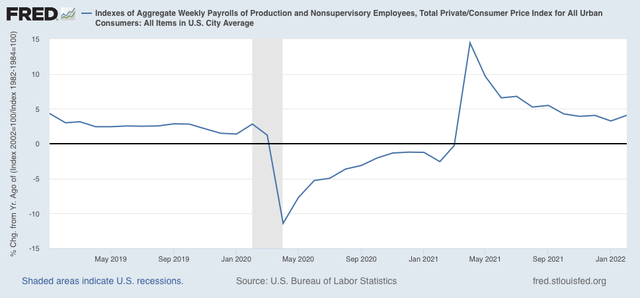

Here’s a close-up of the last 3 years:

In the last 6 months, real aggregate income growth has decelerated from just over 5% to just under 4%. This is a gradual decline that is not consistent with the long-term pre-recession pattern.

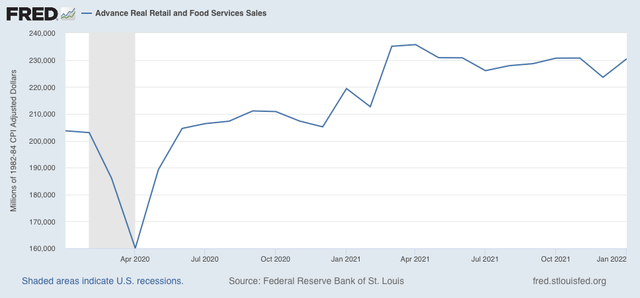

In other words, real wages indicate that a near term recession is off the table, although it certainly is consistent with a deceleration in the consumer sector of the economy, as indeed appears to have started in real retail sales, shown below: