- by New Deal democrat

[Programming note: I will hopefully have an updated Coronavirus dashboard up later today.]

One point I make from time to time is that, with seasonally adjusted data, YoY comparisons can miss, or at least lag, turning points. We *may* have such a situation developing with producer prices as evidenced by this morning’s report.

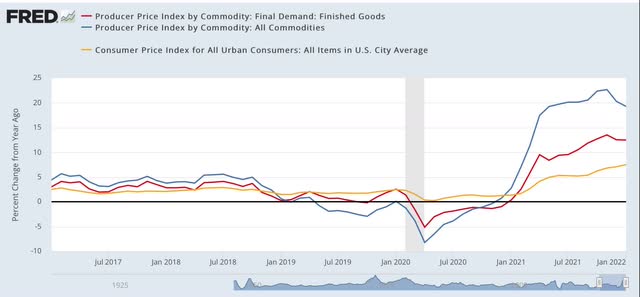

On a YoY basis, producer prices for finished goods (red in the graph below) are up 12.5%, while commodity prices are up 19.3%. Consumer inflation, released last week, is up 7.5%:

Commodity and producer price inflation is off slightly from its level of 13.5% in November.

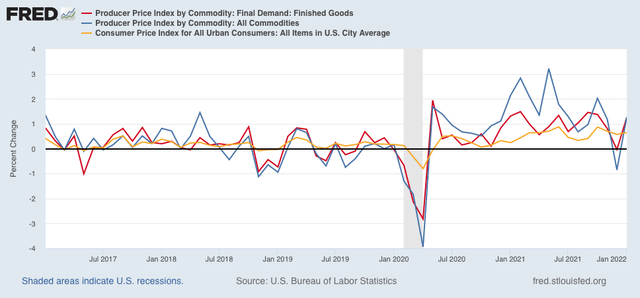

When we look at the month over month increases, we see that there has been a decided cooling in the price increases in the past several months compared with last spring, summer, and early autumn:

*If* this continues, then YoY inflation is going to decelerate sharply in the next few months, back towards more “normal” levels. And since commodity prices tend to lead producer prices, which frequently (but not always!) lead consumer prices - which unlike commodity and producer prices were still rising on a YoY basis in January - then we could see a return to more normal consumer inflation later in the year.

Which means the Fed shouldn’t overreact and slam on the brakes this spring.