- by New Deal democrat

I normally do not pay much attention to producer prices, but with the huge increase in spending earlier this year and the ensuing supply bottlenecks taking center stage, the course of inflation has emerged as the most pressing economic issue.

To recap briefly, with the second round of pandemic stimulus checks early this year, retail spending increased over 10% between last October and this past March; and has only backed off by about 1/4 of that gain since. This has stretched supply lines to the breaking point. Increased demand + constrained supply —> an inflationary surge.

To cut to the chase, as has often been the case since I started highlighting them, weekly high frequency indicators give us the best notice of incipient turning points - and are doing so currently with inflation.

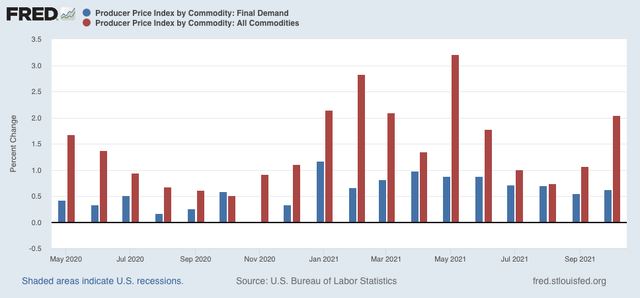

This morning’s producer price index showed a monthly increase for October of 0.6% (blue in the graph below), while raw commodity prices increased 2.0% (red):

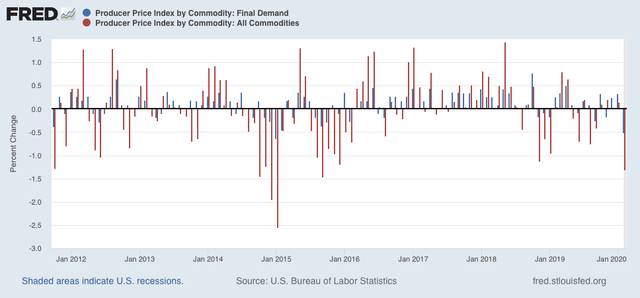

This contrasts with average producer price increases of less than 0.4% in the 10 years prior to the pandemic, with typical raw commodity price changes of between -0.2% and +0.5%:

Perhaps most worrisome is (or would be) the renewed spike in commodity prices of +2.0% (red) in October, the highest since May.

So, where is this renewed commodity price push coming from? In the below three graphs, I’ve broken them down between finished goods (blue), energy (red), and all commodities ex-food and energy (gold).

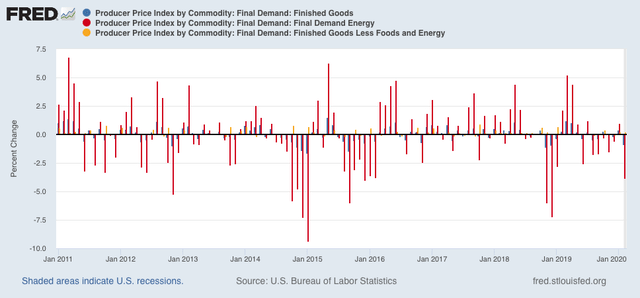

Here is the 10 year period before the pandemic:

Energy costs rarely rose more than 2.5% in any given month, and finished goods and prices ex-food and energy rarely rose more than 0.5%.

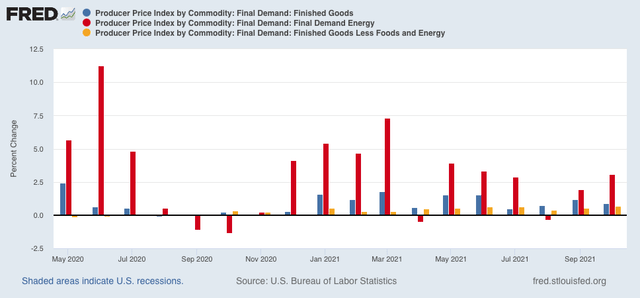

Now here is the post-pandemic recession data:

Monthly price increases ex-food and energy have been running at 0.5%-0.6% monthly, and finished goods at 0.5%-1.5%. But energy costs have increased between 2.5%-5.0% in most months.

In other words, the biggest culprit in producer price inflation in the past 16 months has been energy costs.

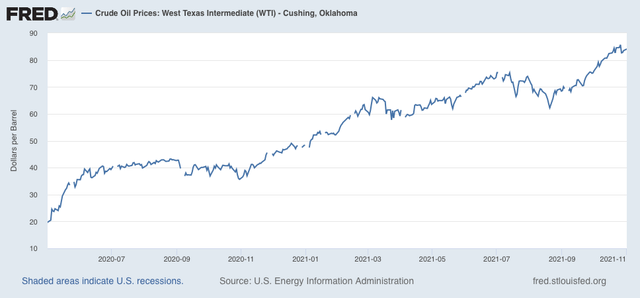

Indeed, oil prices have doubled in the past year, and increased 20% in September and October alone:

But the above shows a peak on October 26, which remains the recent high as of today.

In other words, the big commodity price increase in October is all about the price of oil. But prices have backed off slightly in the past 2 weeks, which as readers of my “Weekly Indicators” columns know, is of a piece with recent declines in the prices of shipping transport and industrial metals. If these are indeed the peak prices from the supply bottleneck, than producer prices should ease from here.