- by New Deal democrat

The last of the 4 monthly coincident markers for whether the economy is in recession vs. expansion was reported this morning for May. Let’s take a look.

Personal income declined -2.0% in nominal terms, which on top of April’s decline of -13.1%, has taken back most, not by no means all, of March’s big 20.7% gain. The Census Bureau specifically noted in its press release that “the decrease in personal income for May reflected declines in pandemic-related assistance programs.”

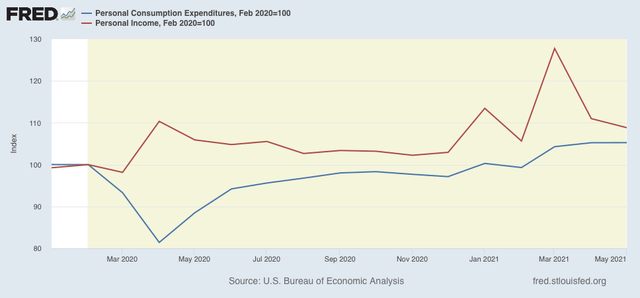

Personal spending was unchanged in nominal terms. But both are still ahead, by 8.8% and 5.3%, respectively, of where they were in February 2020 just before the pandemic hit:

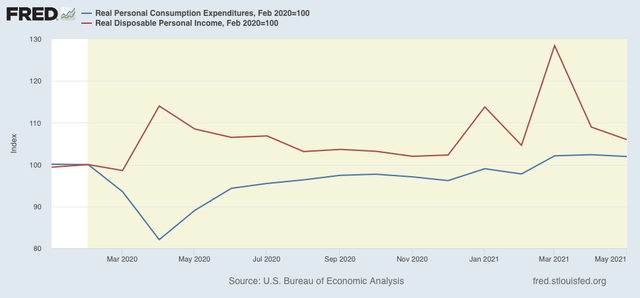

The price deflator, i.e., the inflation measure used in this release, was -0.4% (meaning in essence a 0.4% increase in prices). The below graph takes that into account and shows both real personal consumption expenditures (spending) and real disposable personal income:

Again,both real income and spending are above their pre-recession levels by 6.0% and 1.9%.

Simply put, in this crisis decisive action by the government to put cash in consumers’ hands has worked.

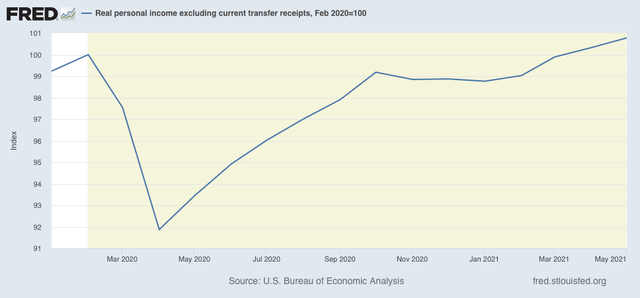

The “official” recession vs. expansion metric is real personal income less transfer receipts (things like unemployment insurance), shown below:

This was already above its pre-recession level in April, and with its 0.4% gain in May, is now 0.8% ahead of February 2020.

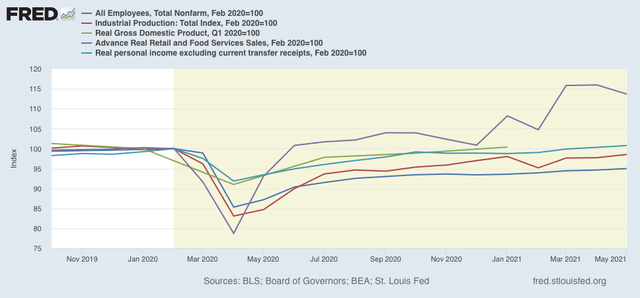

Finally, here are employment, industrial production, real gdp, real retail sales, and real personal income less transfer receipts together:

The last two are already above their pre-recession levels. Real GDP for Q2 is also expected to exceed its pre-recession level when it is reported next month. While industrial production is down by -1.4% from February 2020, its manufacturing component is only down -0.3%. Only employment remains severely down.

Thus, while “happy days are [certainly not] here again” as to employment, unless there is a nasty negative surprise next month, I expect the NBER to shortly declare that the pandemic recession has ended, most likely with the trough date in April 2020.