- by New Deal democrat

New jobless claims continue to be the most important weekly economic datapoint, as increasing numbers of vaccinated people and outdoor activities have led to an abatement of the pandemic - both new infections and deaths are near their lowest points in a year.

We have hit my objective for new claims to be under 500,000 by Memorial Day. My second objective is for them to be below 400,000 by Labor Day.

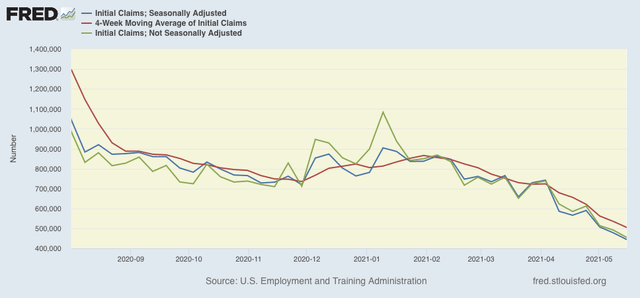

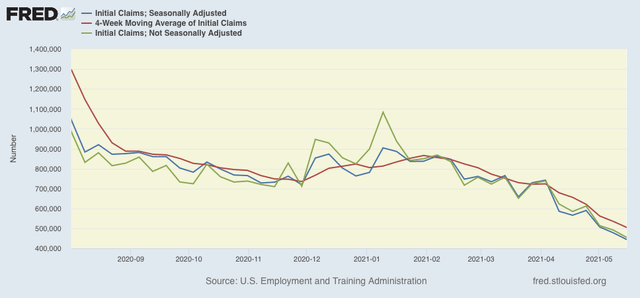

NOTE: Given the unprecedented scope of layoffs during the earliest phase of the pandemic, I have given heightened importance to the non-seasonally adjusted numbers. Once May is over, their importance recedes and I expect to discontinue tracking them.

New jobless claims declined 34,000 to 444,000. On a unadjusted basis, new jobless claims declined 37,395 to 454,634. The 4 week average of claims also declined by 30,500 to 504,750. All of these were new pandemic lows.

At the peak of the pandemic lockdowns, new claims were running 6 million to 7 million per week. Here is the trend since the beginning of last August:

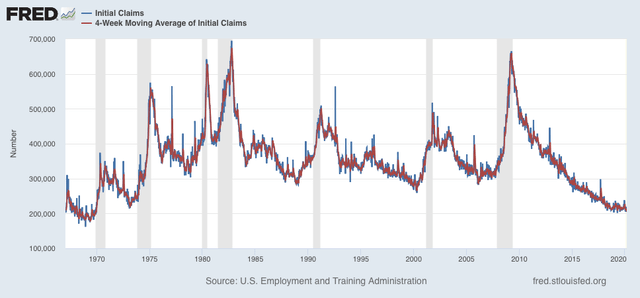

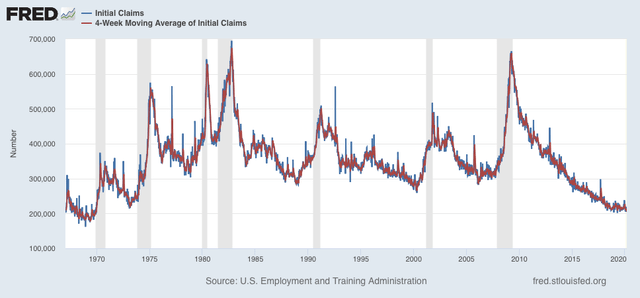

The current level of claims are at levels consistent with either a mild recessions or early in the recovery from a recession in the prior 50 years prior:

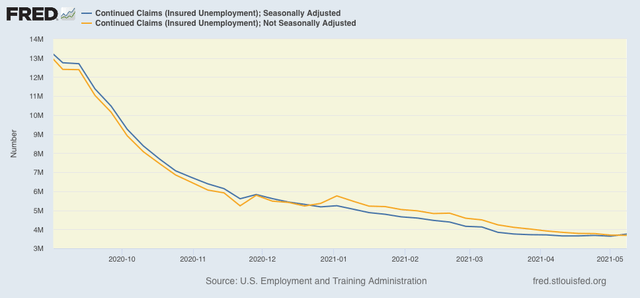

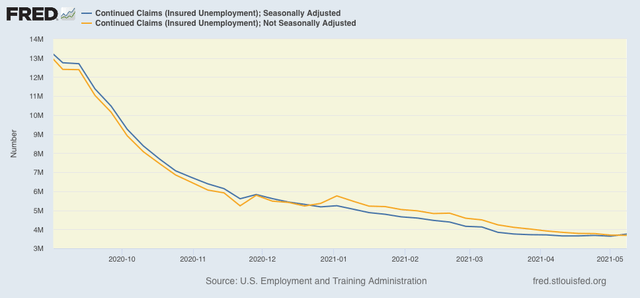

Continuing claims, which are reported with a one week lag, and lag the trend of initial claims typically by a few weeks to several months, declined 111,000 to 3,751,000, (blue). The bad news is that they are 111,000 above their pandemic low. The good news is that the data has been revised - last week was the new pandemic low! On an unadjusted basis (gold) , they declined 10,323 to 3,68408:

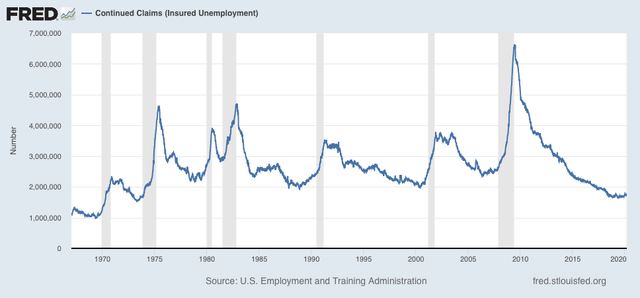

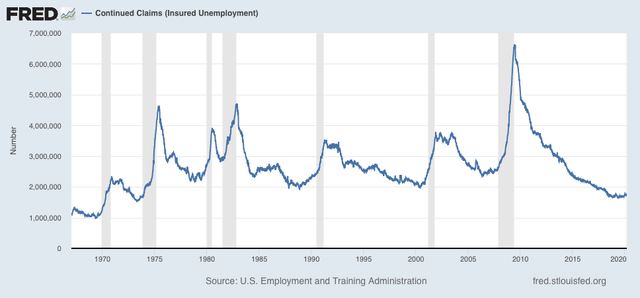

The long term perspective again shows that these are equivalent to the worst levels of most previous recessions:

Finally, the average change in initial claims during the last 4 weeks - the weeks that will coincide with the May jobs report - declined -151,000 from the previous 4 weeks! That is simply unprecedented outside of the pandemic. Since, as I wrote yesterday, March’s employment gains may have been more of an outlier than April’s, and if we simply averaged the 2 months together that would be an average jobs gain of 518,000, then the continued big decline in initial claims would give us a May jobs gain of over 500,000 when that report is issued in 2 weeks.

I continue to think initial jobless claims will continue their recent strong decline, while the failure of continuing claims to make meaningful new lows in the past 6 weeks or so is genuine concern (and I’m working on a historical post on that subject).