- by New Deal democrat

Yesterday morning’s JOLTS report for January was confirmatory of the weak jobs report for that month, showing a largely paused recovery. Further, for the second month in a row, hires were down sharply. Let’s examine this in accord with the data from the prior two recoveries covered by this report, which has only a 20 year history.

In the two past recoveries:

What we will see below is that the big decline in hiring in December and January is a big outlier compared with the prior two recoveries. The remaining data is largely in accord with the pattern from the last two early recoveries: the first two data series to turn - layoffs and hires - did indeed turn, while the last two - job openings and voluntary quits - bottomed more gradually and have since risen less dramatically.

In the two past recoveries:

- first, layoffs declined

- second, hiring rose

- third, job openings rose and voluntary quits increased, close to simultaneously

What we will see below is that the big decline in hiring in December and January is a big outlier compared with the prior two recoveries. The remaining data is largely in accord with the pattern from the last two early recoveries: the first two data series to turn - layoffs and hires - did indeed turn, while the last two - job openings and voluntary quits - bottomed more gradually and have since risen less dramatically.

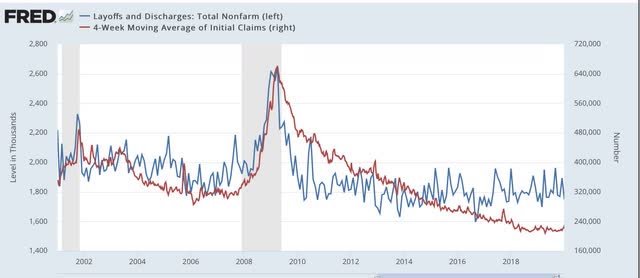

This first graph compares layoffs and discharges (blue) with the 4 week average of initial jobless claims (red) prior to this recession, for reasons of scale since March and April would be “off the charts”:

You can see that, by the end of the recessions, layoffs were already declining, and continued to decline steeply over the next 3-8 months before reaching a “normal” expansion level. The turning point coincides exactly with the much less volatile, but more slowly declining, level of initial jobless claims.

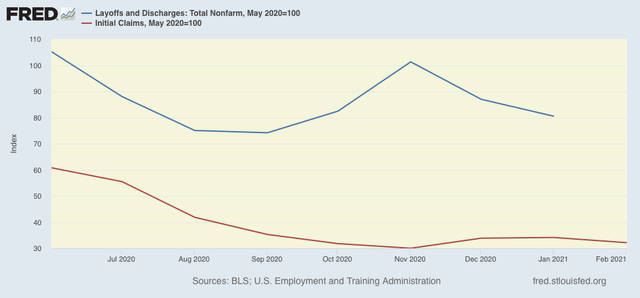

After the initial lockdown period, layoffs and discharges had already declined to their “normal” level in May, while initial jobless claims peaked one to two months later, and continued to decline (slowly) into autumn. In November, layoffs and discharges increased, then decreased in December and January, and initial claims followed suit with a one month delay:

After the initial lockdown period, layoffs and discharges had already declined to their “normal” level in May, while initial jobless claims peaked one to two months later, and continued to decline (slowly) into autumn. In November, layoffs and discharges increased, then decreased in December and January, and initial claims followed suit with a one month delay:

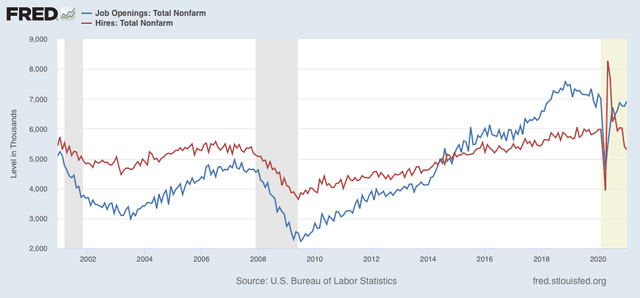

Next, here is the entire historical relationship between hires (red) and job openings (blue) through January 2021:

In the past two recoveries, actual hires started to increase one to two months before job openings.

This time around, the relationship is different. While job openings have been generally in a slow uptrend since last June, hires have reversed, stagnating and then declining sharply since last May:

This time around, the relationship is different. While job openings have been generally in a slow uptrend since last June, hires have reversed, stagnating and then declining sharply since last May:

Basically, there was an initial quick rebound from the lockdown periods, and then actual hiring hit a brick wall.

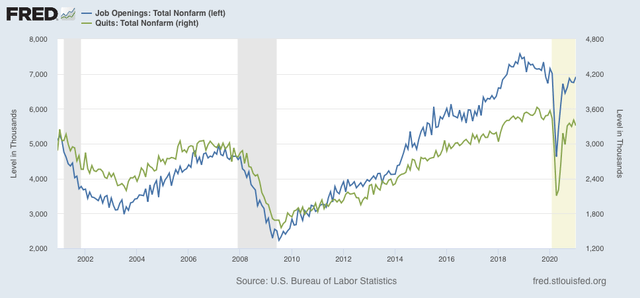

Next, here are quits (green) vs. job openings (blue):

In the past two recoveries, openings rose first, followed by quits, suggesting it is openings that leads to the increase in voluntary quits. That has been the case in 2020 and into 2021 as well.

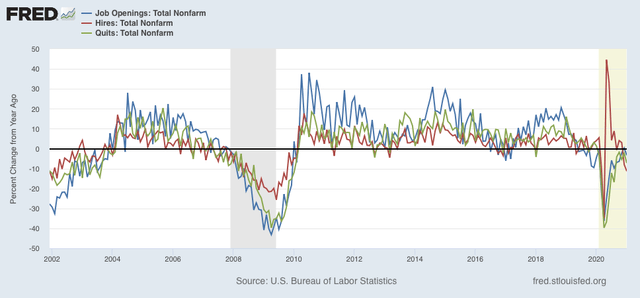

Because of the enormous moves during this pandemic year, seasonal adjustments might not be leaving us with a true picture, so here are job openings (blue), hires (red), and voluntary quits (green), measured YoY instead, for the entirety of the series up through the present:

We can see that hires rebounded first following the 2001 and 2008-09 recessions. Quits and openings moved generally in tandem with a slight lag. The same pattern generally appeared in 2020, with quits perhaps slightly lagging, until the anomalous decline in hiring in the last two months of data. Note also that job openings, as revised, were actually *higher* YoY in December.

In general, the January JOLTS report showed:

1. A pattern generally consistent with the past 2 recoveries, with layoffs having returned to normal levels, then hiring having increased, and finally quits and openings increasing as well; BUT

2. The late autumn and early winter surge in the out of control pandemic resulted in increasing layoffs and separations, and a sharp downturn in hiring.

Last month I concluded by saying “I am expecting a positive reversal, but not until at minimum the JOLTS report covering this month [i.e., February], which will be released in April.” Since February’s jobs report was considerably better than either December or January’s, I continue to expect this to be the case. Further, if I am correct and there will be a sharp increase in hiring in the spring as vaccinations continue to increase and the pandemic abates, the positive reversal is likely to be quite sharp.