- by New Deal democrat

This morning’s two reports on industrial production and retail sales for December were a case of good news and bad news.

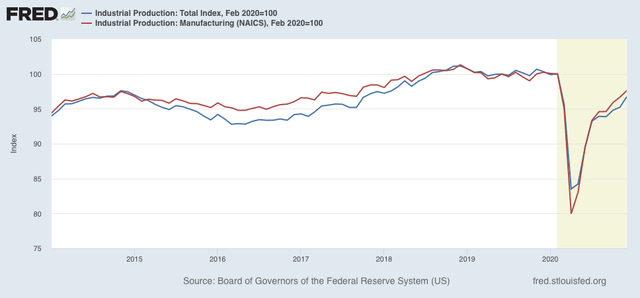

Let’s do the good news first. Industrial production, the King of Coincident Indicators, rose 1.6% in December. The manufacturing component rose 1.0%. Needless to say, these are a strongly positive numbers. As a result, overall production is only -3.3% below its February level, while manufacturing is only down -2.4% since February:

Manufacturing has consistently been one of the biggest bright spots in the economy ever since April.

Now on to the bad news.

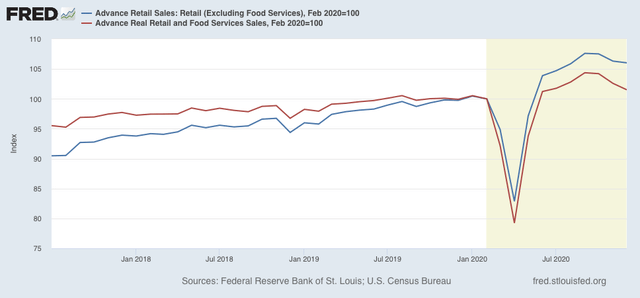

Nominal retail sales declined -1.0% in December. Excluding the food services sector which has been especially hard hit by the pandemic and lockdowns, sales were nevertheless down -0.3%. Total sales are down -2.7% since September; excluding food sales they are still down -1.5%:

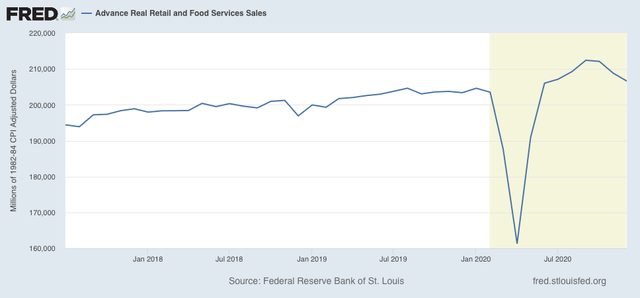

In real terms, retail sales declined -1.0%, and are down -2.7% since September:

The silver lining is that this type of decline doesn’t necessarily mean a steep decline back into recession lows. Similar declines happened several times during the last expansion. And they are still up 1.5% since February.

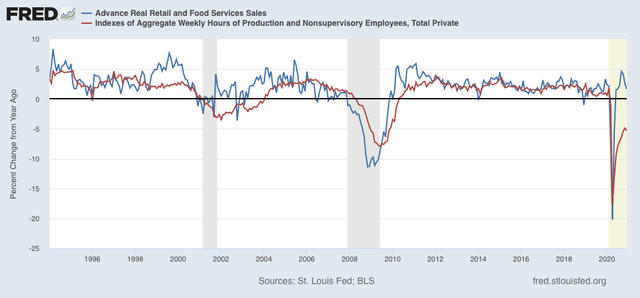

As I have pointed out many times, consumption leads employment. It’s even a better match for aggregate hours worked in the economy, as shown in the long term graph below:

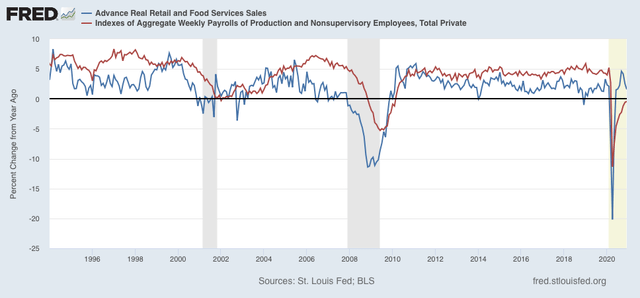

And here’s what it looks like YoY compared with aggregate payrolls:

Last month I wrote that “I continue to expect employment to continue to rise - with a lag, and quite possibly a pause during this winter as the pandemic continues to rage - to match the level of sales.” Well, we certainly got the “pause” in December’s employment report, and if we get more initial jobless claims reports like yesterday’s, a further downturn. But I still expect employment to rise to meet sales once the winter surge in cases and shutdowns of outdoor activities including dining both abate.