- by New Deal democrat

Back in the day, I used to tease Bonddad whenever he did a “What in the hell happened in the stock market today?” posts. I figured it was a sure sign of a short term bottom.

I’m at risk for the same sort of thing here, so, first of all ... I have no clue what will happen tomorrow. The DJIA could bounce back 1000 points for all I know. When sentiment gets extreme and there are emotional moves, some wolves step in to make a killing.

In any event, there were probably three important reasons for today’s 4% selloff, on top of the declines earlier in the week.

In reverse order of importance, they were:

3. The first apparent community transmission of coronavirus in California. This suggests that containment may already have failed, and coronavirus is spreading to non-target groups in the US. Put another way, that this was just the tip of the tip of the iceberg that is, to mix metaphors, dead ahead.

2. A vote of no-confidence in Trump’s press conference last night. Wall Streeters may, by and large, be right-wingers, but they’re not stupid. And what they saw was that Trump is treating this as a re-election issue. He has put his partisans in charge of the response, and is muzzling the government scientists. In short, he is not taking the steps necessary (like ordering thousands of test kits, I dunno, a week ago) to in any way contain the virus.

1. A realization that corporate profits are going to be strongly negatively affected. The stock market trades on “forward profits,” in other words, what they anticipate profits will be in the quarters just ahead.

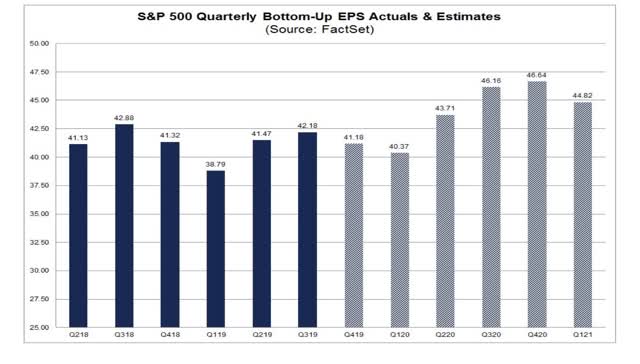

Here’s what the estimates for the quarters ahead looked like one month ago:

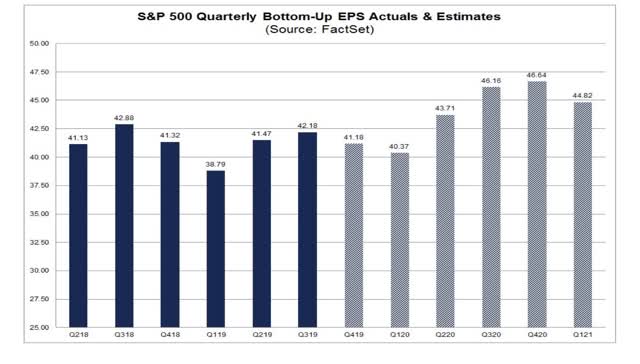

Here is what they looked like last week:

Notice that they were revised down somewhat - but that is typical. Once the Quarter at issue hits, usually a majority of companies are able to “beat” these estimates.

But what has been happening this week is a re-evaluation of what corporate profits in the next few quarters are likely to be. I don’t have the link at hand, but a major Wall Street bank came out this morning and said that they now anticipate *NO* profit growth whatsoever this year. That, dear readers, is a major downward re-evaluation. And the cold-blooded sharks on Wall Street are adjusting their portfolios accordingly.