- by New Deal democrat

Housing is a very important long leading indicator, and it reflects both the consumer and producer sides of the economy. And this morning, at least in terms of starts, it hit a grand slam.

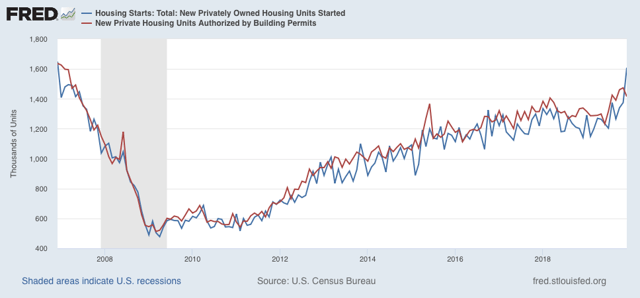

Total housing starts were 1.608 million units annualized, the highest number since the end of 2006. The less volatile and slightly more leading permits declined slightly to 1.416 million units annualized, but the three month average of each made new expansion highs:

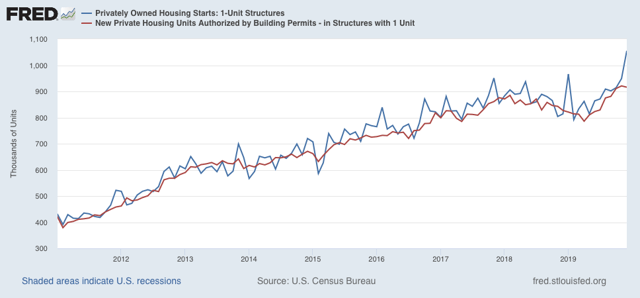

The story is the same with the less volatile single family starts and permits:

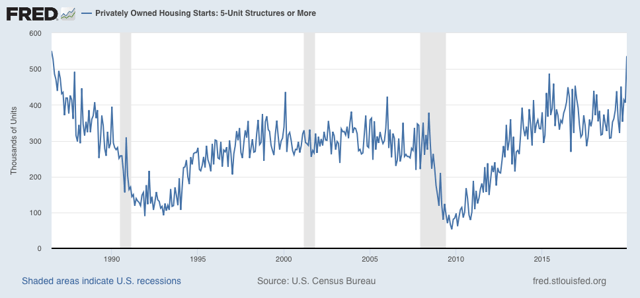

Finally, one point of difference I have had with That Other Blogger who writes about housing is that, because multi-unit housing, especially for younger buyers, can be something of a “substitution good” where single family house prices are beyond reach, I have suspected that multi-unit housing had not yet made its high for the cycle. And in terms of starts, that’s what this morning showed (permits made a huge spike high about 5 years ago the month a special housing program in NYC expired). Not only that, but multi-unit starts made a nearly 25 year high last month:

Lower mortgage rates have done what I expected them to do. It is an important reason why I expect the overall economy to improve later this year. And it is a *very* big argument against the producer slowdown turning into a full-blown recession.

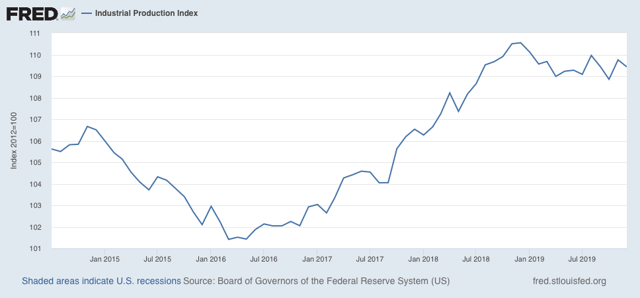

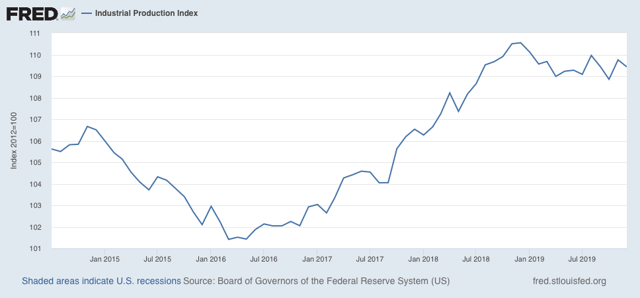

UPDATE: We also got December industrial production this morning, down -0.3%. Industrial production is the King of Coincident Indicators. Here’s what it looks like since July 2014:

Note that, while it is down (in fact it is down -1.0% YoY), it hasn’t gotten any worse since last spring. And it isn’t down nearly as much as it was during the 2015-16 shallow industrial recession. This is one more brick in the wall of slowdown vs. recession.

UPDATE: We also got December industrial production this morning, down -0.3%. Industrial production is the King of Coincident Indicators. Here’s what it looks like since July 2014:

Note that, while it is down (in fact it is down -1.0% YoY), it hasn’t gotten any worse since last spring. And it isn’t down nearly as much as it was during the 2015-16 shallow industrial recession. This is one more brick in the wall of slowdown vs. recession.