- by New Deal democrat

In the last few months, I’ve been paying extra attention to the weekly reports of initial jobless claims. Today I want to compare them to long-term claims (15 weeks or over) for unemployment benefits.

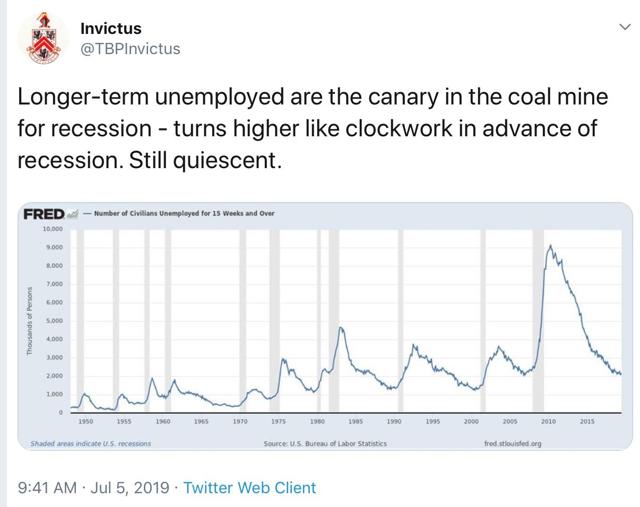

Way back about a decade ago, one of the occasional co-bloggers here was Invictus, who personally knew and subsequently was scooped up by Barry Ritholtz. Well, he still writes, and his Twitter feed is worth checking out.

So anyway, last week he tweeted this:

It had been a long time since I checked this series, so I wanted to double-check the claim that it always turned up before a recession. The answer is, usually that has been true, but it made its expansion low in the exact month that a recession started three times (1948, 1953, and 1981), and made its low one month after a recession had already started once (1960).

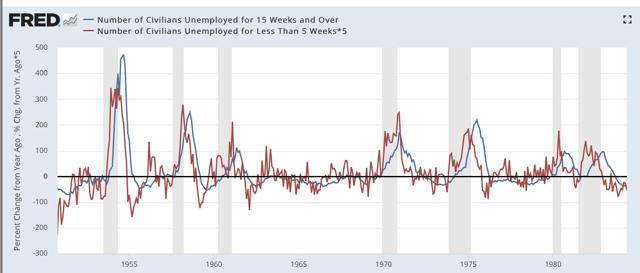

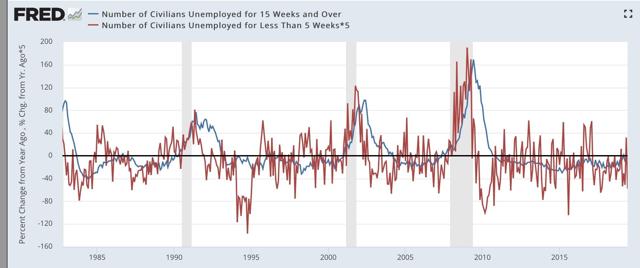

Also, my recollection was that short term unemployment turned up first (0 to 5 weeks), then intermediate term (5 to 14 weeks), before longer term 15+ weeks turned up. That is still correct, but the drawback is that short term claims are much noisier and unreliable compared with long term claims:

Here is the YoY% change perspective (divided into two time periods), which better shows that short term unemployment leads long term unemployment — but is too noisy to be of much use:

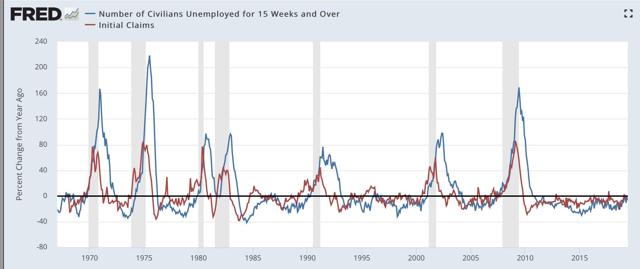

But of course, we don’t have to rely on the monthly unemployment numbers when we have weekly initial claims. As the graph below shows, these *also* lead long term claims, but are much less noisy than the monthly short term unemployment number (note I have averaged initial claims monthly to cut down further on noise in the below two graphs):

The leading/lagging relationship is easy to see when we graph the YoY% change in the two series:

One of the two ways I measure signal in initial claims is if they turn higher YoY on a monthly basis, but there are some false positives. It turns out, when we add long term claims as a confirmatory signal, we only get two false positives, in 1985 and 1996, for only one month each. That’s five accurate signals to two false ones. If we insist on two months in a row, there are no false positives — although as set forth above, there are two false negatives since 1960 in the sense that you don’t get the signal until the month the recession starts or one month later.

Still, using long term unemployment claims as a confirmatory signal looks very useful in terms of adding to the reliability of the forecast. And speaking of initial claims, their monthly average between July and September was between 212,000 and 215,250 - so the likelihood that they will send a negative signal in the next several months looks high.