- by New Deal democrat

I wrote a piece last week for Seeking Alpha explaining that, while the consumer side of the economy is doing reasonably well, a recession could still com in via the producer side.

https://seekingalpha.com/article/4278010-producer-led-recession-remains-viable

As usual, clicking over and reading should be educational for you, and puts a penny or two in my pocket.

Thus, the idea that no recession can happen absent a 20% YoY slide in new home sales is not correct. In fact, the 2001 recession happened with only a 10% decline from the very top to bottom in sales (and less than that YoY) that ended about 6 months before the recession even began. The decline in new home sales from top to bottom in 2018 was similar.

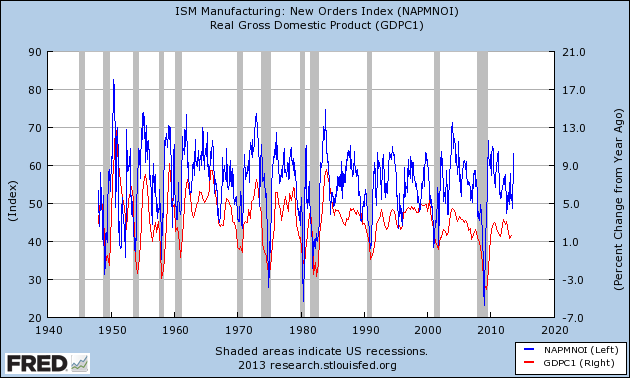

One item that didn’t make it into that post was to note that the ISM manufacturing index, especially the new orders subindex, should give early warning of any producer downturn.

ISM won’t let FRED publish their data anymore, so here’s a graph I created back in 2012 or so showing the relationship going all the way back to 1948. Note that the new orders subindex can decline to about 45 and still be a false positive. In 2000-01, it declined to 40 before the recession actually began:

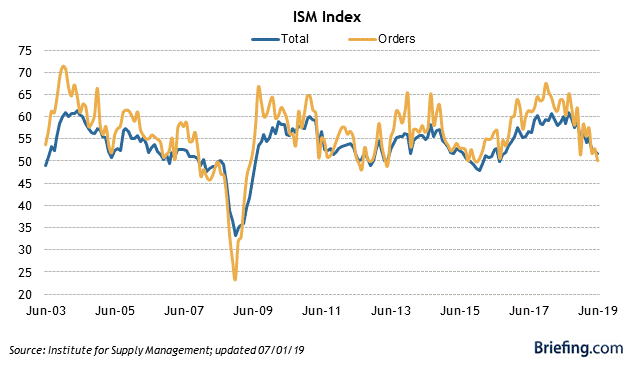

As of last month it stood at exactly 50.0, as shown in the more updated graph of the new orders subindex from Briefing.com:

The July ISM index will be released on Thursday. The average of the regional Fed indexes is a hair above 0, with the final region - Texas - due to report later this morning. I’ll update the average once they report.

UPDATE: New orders in the Texas manufacturing survey increased slightly. This is enough to keep the average of the five regions just slightly positive.

UPDATE: New orders in the Texas manufacturing survey increased slightly. This is enough to keep the average of the five regions just slightly positive.