- by New Deal democrat

Back in 2006, Prof. Edward Leamer of UCLA made a splash with his paper, “Housing IS the Business Cycle,” delivered at Jackson Hole. It is an excellent paper, and one I have often made reference to. His preferred long leading metric, private residential fixed investment as a share of gross domestic product, is one I update every quarter and forms part of my array of long leading indicators.

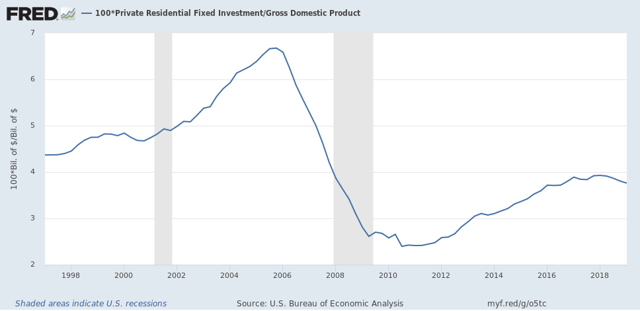

Here’s what it looks like now, going back 20+ years:

From late 2005 on, needless to say, it fell like a rock. But take a look at the late 1990s: it declined from a high of 4.84% in 1999 to 4.67%, or -0.17% - and then rose slightly - before the onset of the 2001 recession.

Compare that with the past year: it has declined from 3.92% to 3.76%, or -0.16% - almost exactly the same decline as before the 2001 recession.

Now, there are other, steeper declines in this metric that did not give rise to recessions. But the point is, a decline almost identical to a decline in housing as we have seen since the end of 2017 has been consistent with a subsequent recession.

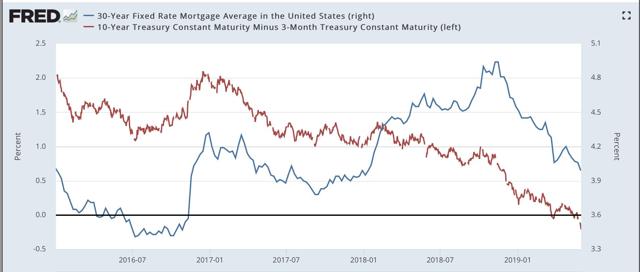

But, you say, mortgage rates have had a steep decline in the past six months, and indeed they have. Here’s a graph comparing mortgage rates (blue, right scale) with the 10 year minus 3 month treasury yield spread (red, left scale) since the beginning of 2016:

Mortgage rates have declined -0.95% from 4.94% last November through 3.99% last Friday, while the yield inversion as of the close yesterday was -0.29%.

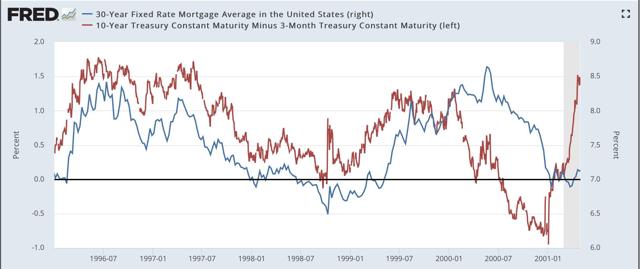

But that doesn’t solve the problem. Here’s the same graph from the late 1990s:

Mortgage rates declined -1.75% from 8.64% to 6.89% in 2000, while the yield curve inversion was roughly -0.75%.

In short, if all you are relying on is housing and mortgage rates for your forecast, then you completely missed the 2001 recession. And the status of housing, mortgage rates, and the yield curve looks very close now to what it did in 2000. In fact, the primary difference is in the yield curve, which hasn’t inverted so much or for so long a period of time.

This is why I make use of a model - actually, several concurrent models - that try to look at all the potential sources of an oncoming recession.