- by New Deal democrat

Aside from being a monumentally poor policy outcome, and aside from the hardship it caused nearly a million workers, the government shutdown may also have caused a general contraction in production, sales, and income, and a slowdown in employment, that if it were longer would qualify as a recession.

Because the affected three months straddle Q4 2018 and Q1 2019, both quarters will likely show positive real GDP growth, it won’t be a recession. Let’s call it a mini-recession.

Although shorthand for a recession is two quarters of GDP contraction, that wasn’t the case for 2001, and the NBER has indicated that a general downturn in production, employment, sales, and income are the crucial criteria. So let’s look at each.

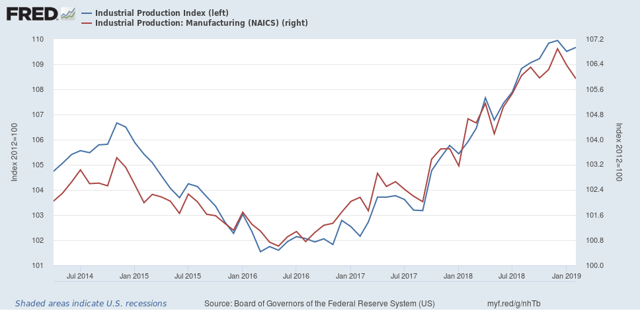

Industrial production declined significantly in December, and the small rebound in January was not enough to overcome that downturn. This is especially true of the manufacturing component:

The same is also true of real retail sales:

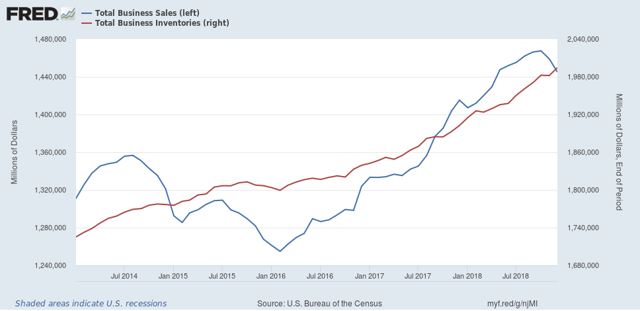

But lest you think that retail sales were an outlier, here are general business sales (including manufacturers’ and wholesalers’ sales)(BLUE) which also peaked in November, and inventories (red):

I included both because sales lead inventories, as is shown for the 2015-16 “shallow industrial recession” in the graph.

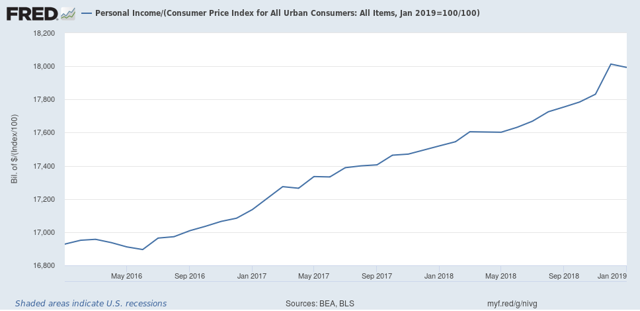

The NBER pays attention to “real personal income less transfer payments.” Since we don’t have the deflator for January, nor the amount of transfer payments, I am making use of CPI as a placeholder for the deflator:

These increased strongly in December, but declined in January.

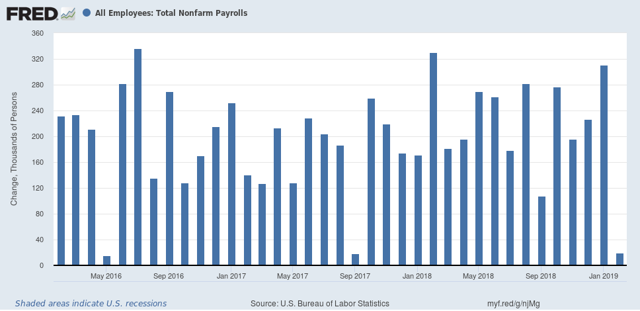

Finally, here is employment:

No decline here, but one of the three lowest monthly readings in February. And of course, this is well within the range of being revised to a negative over the next several months.

Put the four series together, and you get a picture of an economy that in terms of production, employment, income, and sales suddenly contracted in December and January.

Assuming these series bounce back no later than March - which I expect to happen - the downturn isn’t deep enough nor long enough to qualify as a recession. But the government shutdown may have done significantly more damage than was projected at the time. And this highlights how poor pubic policy, whether it comes from the Fed, the Congress, or the Administration, can very quickly topple a slowing economy into outright recession.