- by New Deal democrat

Two years ago I ran a post entitled, "This is the graph that scares me," featuring the below graph of median wage growth:

Below is an abbreviated version of what I wrote then:

----------------------

It has been running at under 2% at all times since the financial collapse of 2008.

So, even if inflation runs at the very modest rate of only 2% (and for most of the time since the bottom of the recession in 2009, it has been higher than that), more than half of all workers fail to keep up.

You simply cannot have a durable economic expansion where most workers are consistently falling behind.

Lower mortgage rates in the last several years has enabled a huge number of consumers to refinance ... [and therefore] the average household has a lower carrying cost of debt, compared with their income, than at any point in the last 30 years.

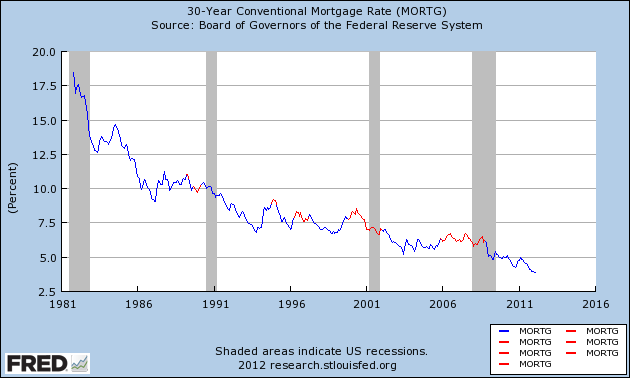

In the past 30 years,as shown in this graph of mortgage rates, which highlights those periods where interest rates are higher than they were 3 years prior in red, once households have been able to refinance, it took at least 3 years without new lows being established, before the economy fell back into recession.

We just set new lows.

It's difficult to imagine any further round of refinancing once this one is done. Can rates really go much lower?

If median wage growth doesn't improve soon, there will be no escaping another recession once the effect of refinancing has run its course ....

This time around, we managed to escape without actual wage deflation (although laid off workers may not have been able to find work at the same salary they were making previously). I doubt we will be so lucky a second time ....

--------------------------

Two years later, we can see that mortgage rates bottomed only a few months later in July 2012. We'll hit the "red zone" of three years later 14 months from now.

Meanwhile, YoY growth in median wages rose as high as 2.5%, but has recently fallen back under 2% again.

You have probably noticed the increasing caution in my outlook over the last few months. That second graph in particular is what is in the back of mind. Real median wages have not made a new high. Refinancing has stopped cold with increasing interest rates. It doesn't look like there is some appreciating asset that average families can cash in or borrow against to sustain more spending.

So I watch with increasing concern to see if the long leading indicators start to turn south, as they normally would at least one year in advance of an economic downturn. Interest rates, real private residential spending as a share of GDP, and possibly corporate profits deflated by unit labor costs already have.

This week we will get updated readings on two more: real retail sales per capita and housing permits.