- by New Deal democrat

Let me start out by saying that, in terms of their importance for the economy, existing home sales are the least signficant number, even though existing sales are about 90% of all sales. That's becuase the impact from construction trades, suppliers, landscaping, furniture, appliances, etc., is much less for existing that new home sales.

But since they are 90% of the market, they dominate the housing slowdown.

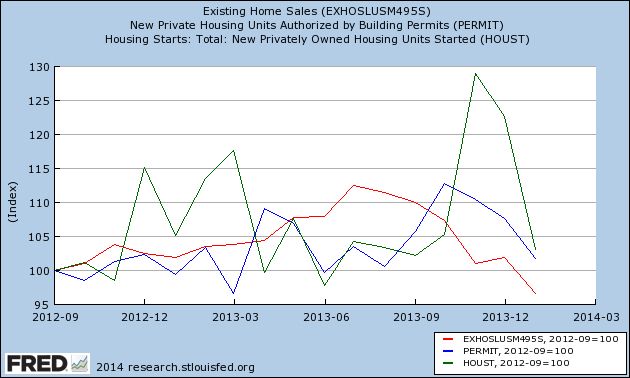

Let me start by taking my graph of housing permits (blue) and starts (green) normed to 100 in September 2012, and add in existing home sales through this morning's report (red):

Existing home sales peaked earlier and are now lower than they were 16 months ago.

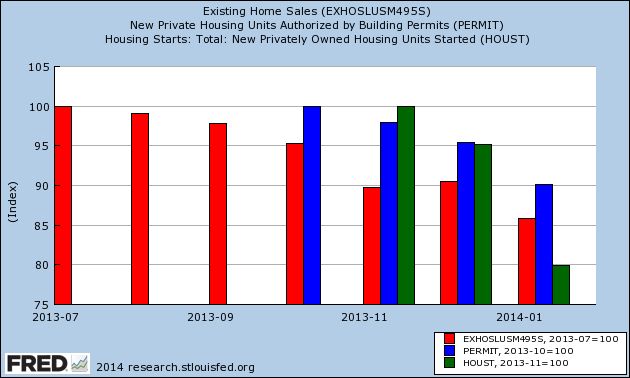

Next, to give you another perspective other than a YoY one, here are ths same three series, normed to 100 at their respective 2013 peaks:

All of them have declined at least 10% from those peaks.

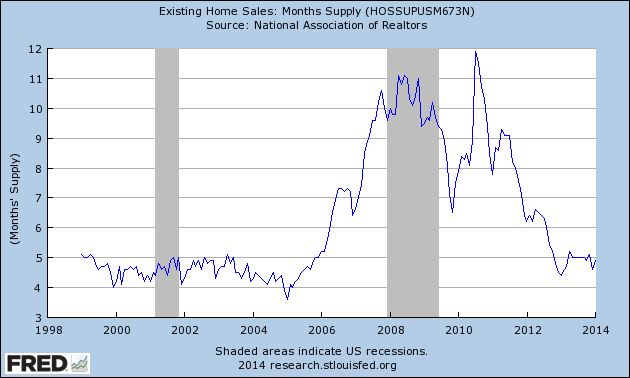

Next, here is months' supply of inventory:

This is a little higher than during almost all of the housing boom. It may be a neutral reading, or it may be slightly supportive of prices.

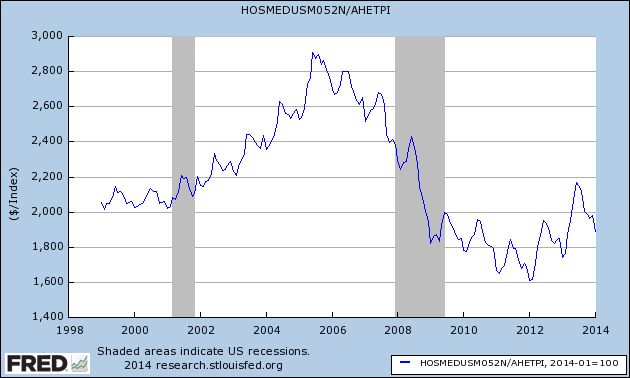

Finally, some writers are claiming that there has been a second housing "bubble." There may have been some merit to that claim in terms of new home prices, but that claim has no credibility when applied to existing home prices. To show you why, let's take a look at the median price for an existing home, divided by the average wage for nonsuperivosory workers. I use this measure becuase housing itself is a component (the largest) of inflation, so measuring affordability by wages is probably a better "real" measure (note that these are not seasonally adjusted, hence the sine-wave pattern):

So measured, prices of existing homes, while more than 20% higher than they were at the bottom two years ago, still are slightly less than they were in 1999 and 2000, still far below what they were during the bubble. I appreciate that people in California may be seeing a different situation, but that's the premium you pay to live in a beautiful climate, and the astronomical cost of living in California is a big reason for the outmigration to the interior West for the last 10-20 years.

All that being said, with home prices up 20% in two years, and interest rates having risen such that the monthly interest payment on a mortgage is about 30% more than it was for a mortgage in the same amount several years ago, it's no surprise that home sales have been falling.