- by New Deal democrat

With yesterday's reports on housing permits and starts, we now have 3 of 5 monthly reports that have turned negative YoY: in addition to starts, pending sales and existing home sales already turned negative YoY in November and December, respectively.

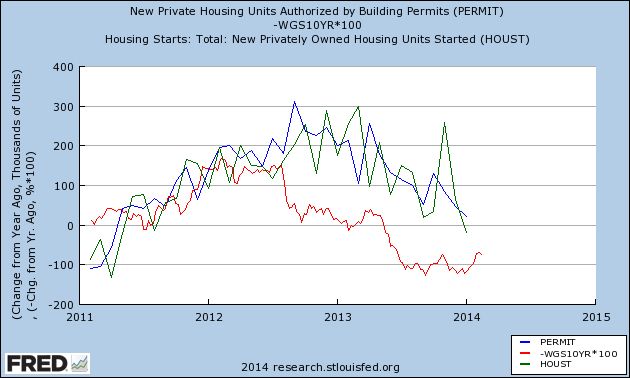

First of all, as I've documented a number of times, even in the post-World War 2 era where there was over 15 years of pent-up demand, typically a 1% rise in interest rates led to a -100,000 decline in nonfarm housing starts or permits within about 9 months. Here's an update of that relationship covering the last 3 years, showing the YoY change in 1,000's in permits (blue) and starts (green), and comparing that with the YoY% change in treasury bond rates, expressed in basis points (red):

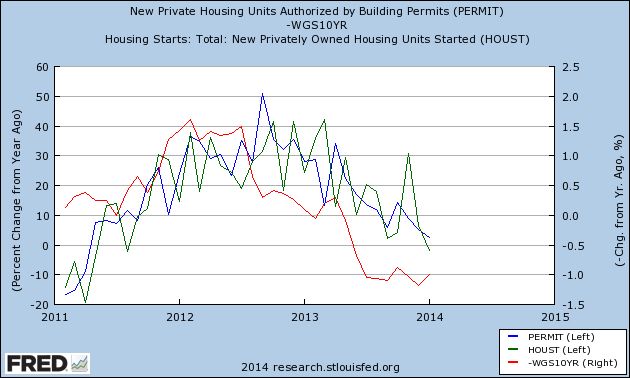

Now let's look at the same data, expressed as the YoY% change in permits and starts, and YoY change in treasuries by percent averaged monthly:

Permits and starts follow interest rates, it's just about that simple (with the exception being those few times when "buy now or be forever priced out" was a dominant theme, which may actually have played into the October and November 2013 spike).

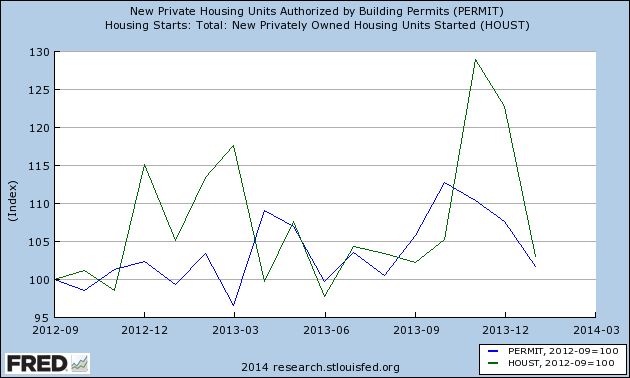

The YoY low in interest rates was in early 2012 as shown in the above two graphs. This next graph norms permits (blue) and starts (green) to 100 as of September 2012, about 8 months later:

Permits have failed to advance more than 5% above their level in September 2012 in 10 of the ensuing 16 months. Starts are more erratic, with several spikes, but generally show the same pattern.

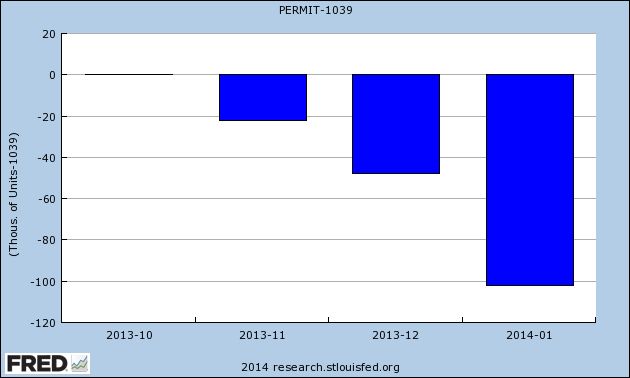

Finally, in the past I have documented that housing permits have typically declined 200,000 from their expansion high prior to a recession beginning (the notable exception was just prior to 2001, where they declined by 175,000. This final bar graph shows the declines in permits from their October highs:

While the housing data continues to confirm my belief that 2014 will be marked by a deceleration in the growth of the economy, the decline above isn't serious enough to cause me to think the economy will actually contract anytime soon. Further, I agree with Bill McBride that, over the longer term, the fundamentals favor a housing recovery.

Meanwhile, existing home sales will be reported this Friday, and new and pending home sales will be reported next week.