- by New Deal democrat

The Census Bureau released September and October new home sales and median new house price data this morning, and that gives me a chance to update a post I wrote 6 months ago.

They reported that 444,000 new homes were sold in October, which is just below June's 454,000 for the highest number of sales since the Great Recession. September sales were only 354,000, however, which was the lowest since April of 2012. In general, sales as reported look to be going sideways. I suspect that increased mortgage rates will continue to pressure the housing market, and it will be interesting to see if October's blowout housing permits report is an outlier for a flattening or decreasing trend or not.

The Census Bureau also reports on median new house prices, however, and that gives me the perfect opportunity to finish off the debunking of the "second US housing bubble" claim that raised its head this past spring.

About 90% of all housing sold in the US is from existing sales. Only about 10% of houses sold are new houses. Back in June, I debunked a dishonest Zero Hedge graph that divided nominal increases in house prices by inflation-adjusted disposable income, predictably showing that, so measured, house prices were even higher than at the height of the housing bubble. Of course, it turned out that when you did the honest comparison, i.e., nominal-to-nomial or real-to-real, there was no bubble at all.

But the Political Calculations blog was doing a real-to-real comparison of new homes, and there there had been a run-up in late 2012 to April 2013 in prices to near the 2005-06 peak. I suspected it was a short-term phenomenon and not a real bubble, or at best a "minibubble" that would shortly be reversed.

And indeed we now have confirmation that neither new nor existing median house prices in the US have formed any kind of bubble at all.

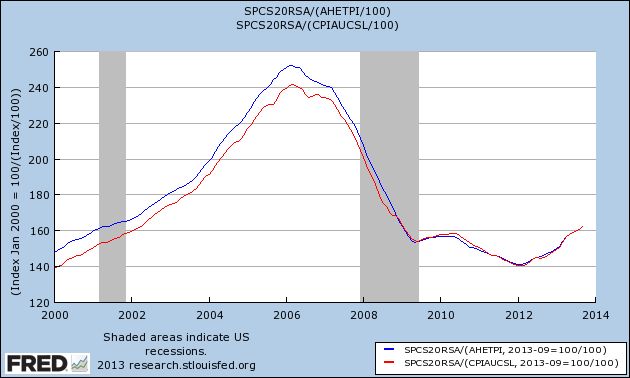

First of all, let's look at the Case Shiller 20 city index. In the below graph I have deflated the raw price data by average hourly income (blue) and by consumer inflation (red):

As you can see, existing houses are selling at the price levels they were at in 2001 or 2002, a far cry from the top of the bubble. In fact, since 2009 the general trend is pretty flat. Yes there has been a rebound, and it's certainly possible that the rebound has overshot a little, but this looks nothing like a bubble.

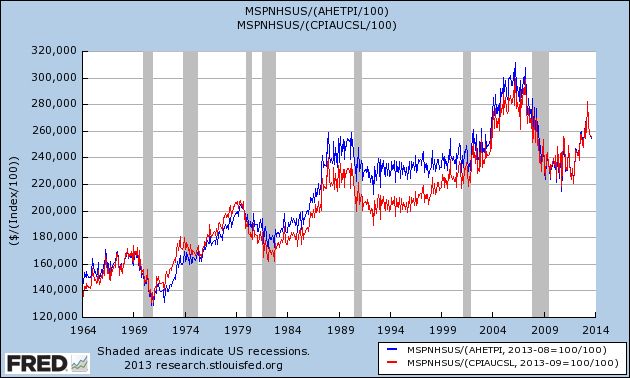

Now let's turn to median new house prices. As measured over 50 years, and once again deflated by average wages (blue) and consumer prices (red) there has been an increase in new home prices:

But it's well to keep in mind that the average square footage of a new house increased by something like 25% from 1600 s/f to 2000 s/f over that period. So on a square-foot basis, the overall trend is probably closer to flat.

Further. in the long graph we can see the bubble forming in the early 2000's and then deflating, before rising again to near its former peak in 2012.

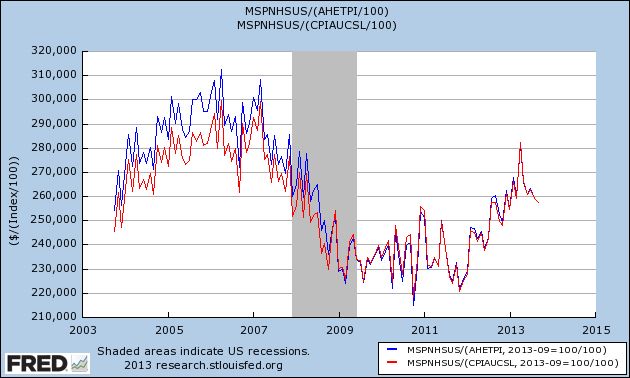

Now here is the same data in close-up, better to show the recent trend (note: this does not include this morning's October report showing a median price of $245,800):

And with this morning's release of new home data we can see that the late 2012/early 2013 run-up in prices has entirely been given back. In fact, the median house price in October 2013 was $1400 lower than October of 2012, even before taking average wage growth of about 2% or inflation of 1% into account.

Keep in mind that the same Doomers who are telling you now that there is a housing bubble are the same Doomers who predicted foreclosure tsunamis that never arrived, and that housing prices wouldn't bottom in early 2012. On the other hand, besides yours truly who called both the top of the bubble as it happened and in summer 2011 that the bottom of the bust would occur in the early months of 2012, three other people who have a, shall we say, pretty decent record in calling the housing market - Bill McBride a/k/a Calculated Risk, Nobel Prize winner Robert Shiller, and Fed Chair nominee Janet Yellen - all agree with me that there is no new US housing bubble now.

Sorry, Doomers. But keep at it, some day things will turn down again.