- by New Deal democrat

Today exactly two full years have passed since Lakshman Achuthan of ECRI appeared on all of the cable business channels and announced that the US was "tipping into recession." Here he is on WSJ:

At the 30 second mark, one of the hosts asks, "When?" and Achuthan responds "Now."

At the 50 second mark, he gets more specific: "It might have started last month. It might start next month. But sometime I think it's going to wind up in the 3rd or 4th quarter" -- of 2011!

Subsequently Achuthan repeated his call, revising the timing to Q4 of 2011 through Q2 of 2012. Although Bloomberg no longer has the video on its site, here is a link to a copy in which Achuthan specifically says, at the 1:20 mark, "If there's no recession in Q4 or in the first half I'd say of 2012, then we're wrong. You're not going to know whether or not we're wrong until a year from now." That would have been 9 months ago, in December 2012.

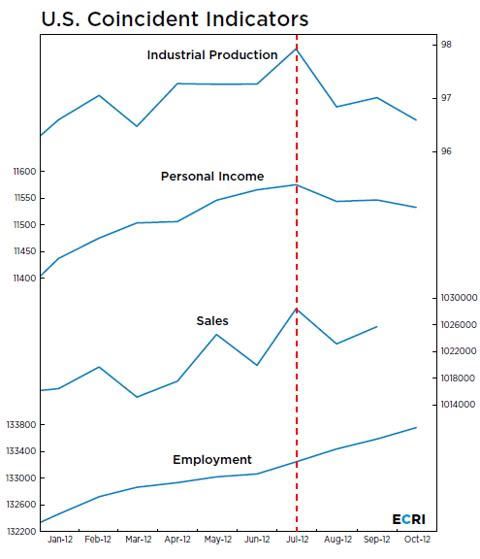

Subsequently ECRI revised its call again, saying that a recession started in July 2012. In December of last year, to justify this latest call, ECRI premiered what they called their tell-tale chart, opining:

Reviewing the indicators used to officially decide U.S. recession dates, it looks like the recession began around July 2012. This is because, in retrospect, three of those four coincident indicators – the broad measures of production, income, employment and sales – saw their high points in July (vertical red line in chart), with only employment still rising.Here's the chart:

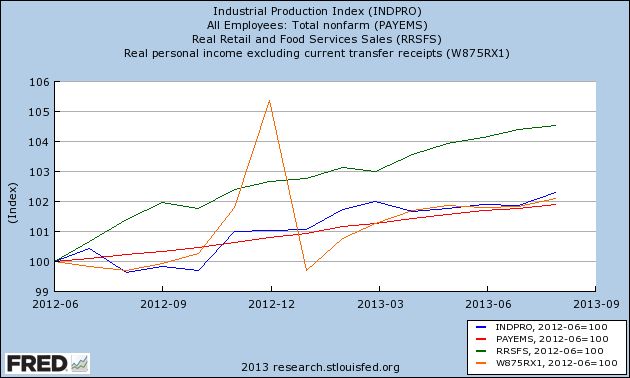

That chart too has vanished down the memory hole, but here's what it looks like updated through August 2013:

Since that time, ECRI has reeled like a punch-drunk boxer from data series to data series to data series, latching on to whichever one has in the past been consistent with a recession. Last week Achuthan was reduced to tweeting about how industrial production stayed positive for 5 months into the 1974 recession (which is one-third of the amount of time that has passed since July 2012. And don't mention to him that payrolls have never risen this far or this long since the onset of a recession). The simple fact is, barring massive downward revisions of all sorts of economic data, ECRI's call was wrong.

I've been leaving ECRI alone for about 6 months now, but it's worth noting this anniversary because by now we are long past the time when their call might be redeemed. But it is also sad that they can't simply admit it, publish as much as they can consistent with their proprietary data about what they have learned from this call, and move on. Let's face it, when someone makes a (hilarious) Hitler "Downfall" parody of your predicament:

it's over.

Even sadder is that I totally respect - and try to emulate - the quantitative and sequential long leading/short leading/coincident/lagging indicator approach they inherited from their founder, Prof. Geoffrey Moore. In 2011, they made the human error of reading the temporary air-pocket caused by the debt ceiling debacle as something more lasting.

Perhaps saddest of all, out there somewhere, maybe far and maybe near, is the onset of the next recession. By continually defending their 2011/2012 call, they will also miss that next recession's real starting date when it happens as well. My plea is that they at least consider a "recession 2.0" watch. That watch would be premised on the idea that, even if their existing call is wrong, the new data when it occurs will justify a recession call totally independnent of their pre-existing 2011 recession call.

Until ECRI does that, it is an unhappy two year anniversary.

P.S.: At the 1 minute mark of the December 2011 video, Bloomberg host Tom Keene says, "Amateurs look at the timing of the call. ... The pros looks at the vector, or direction, of the call." In the July 2012 video, at the 0:25 mark, Keene says "You nailed the vector." ECRI came nowhere even close to nailing the timing or the vector of the economy, and Keene, who was cheerleading the ECRI call, owes his viewers an apology.