- by New Deal democrat

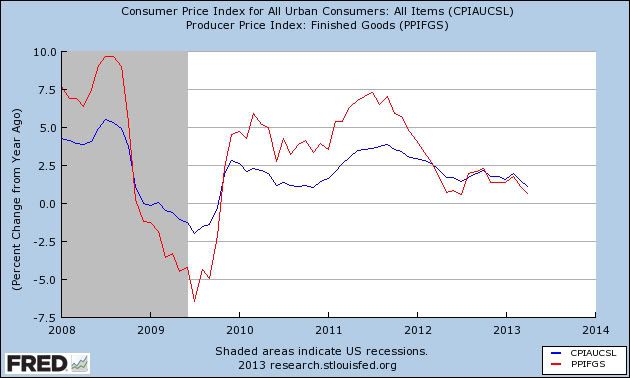

As I expected, the big, surprising decline in gas prices caused April consumer prices to decline -0.4%, one of the biggest declines recorded in the last 50 years outside of the 2008 recession. This brought YoY inflation down to +1.1%, likewise one of the lowest readings outside of the great recession, as shown in blue in the graph below, which also shows YoY producer prices for consumer goods in red [Note: FRED hasn't updated their CPI series yet, so the graphs below don't include April data. I'll update as soon as they do! UPDATE: up to date graphs added.]:

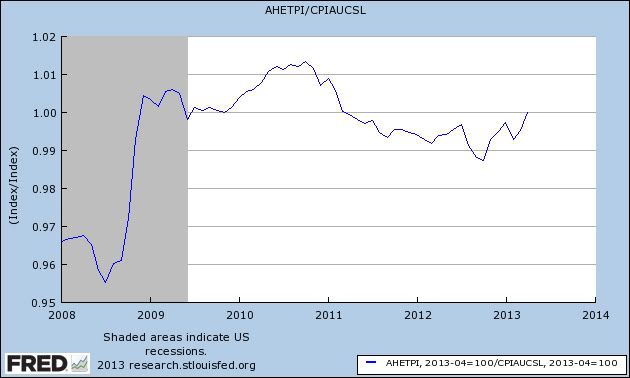

This also raised real, inflation adjusted wages by +0.5% in April, to their highest level in several years:

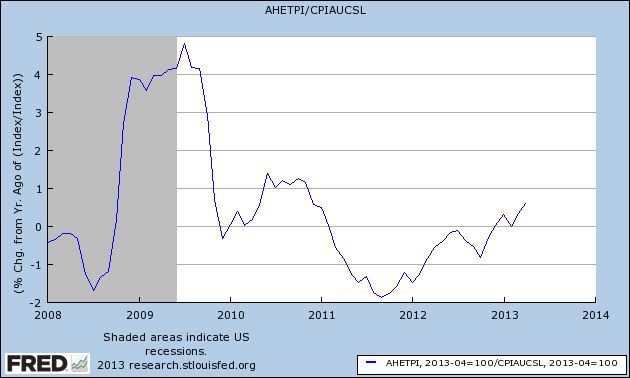

YoY growth in wages is the highest since early 2011 as well:

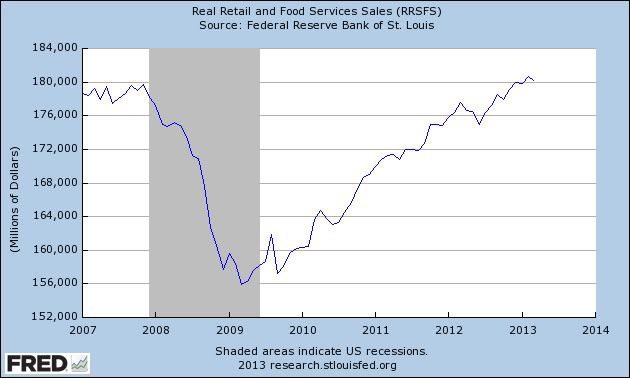

And it also means April real retail sales rose to a new post-recession high:

Because the decline in April prices was due to energy costs, I do not think this correlates with economic weakness, but rather shows how even a temporary loosening of the oil choke collar acts like an economic stimulus.