- by New Deal democrat

No, my magic crystal ball hasn't told me the date it will begin. This is a more general post about the state of what passes for serios mainstream economic discourse and how it is utterly unprepared for the firestorm that may await in the next economic downturn.

Charlie Pierce of Esquire has taken to ending his posts on the economy with "Fk the deficit. People got no money. People got no jobs." That ought to be, front and center, our main concern. Maybe for one day, every single blogger and every single newspaper and every single cable news channel should run that one thought:

"Fk the deficit. People got no money. People got no jobs."

Maybe then the Very Serious People in the MSM and Washington might have a glimmer of a clue.

I've been especially bothered about the fact that our five year plus unemployment rate of over 6% had disappeared from the priorities of the Washington and media elites since I read a column by Ezra Klein shortly after the election -- sorry, I can't find the link -- remarking that the GOP could no longer afford to try to block Obama initiatives because by 4 years from now, come the next election, the economic recovery would probably be really strong.

Huhnh??? Unless Ezra's crystal ball is orders of magnitude stronger than anybody else's, nobody has a clue how strong, or not, the economy will be 4 years from now.

Beyond that, in my opinion the odds are not very good that this recovery, which is already going on 4 years old, is going to last 3 more years or longer. It's close to the weakest recovery on record in terms of restoring us to the prior peaks of employment and personal income and wealth. The cold, hard, fact is that at some point in the next few months, or in a year or two, or in any event almost certainly at some point in Obama's second term, we are going to have the next recession. And in all likelihood it is going to start with an unemployment rate in excess if 6% or 7%. It is going to start with personal income not having recovered fron the last recession. It is going to start with median household income and net worth less than what it was 14 years ago, in 1999.

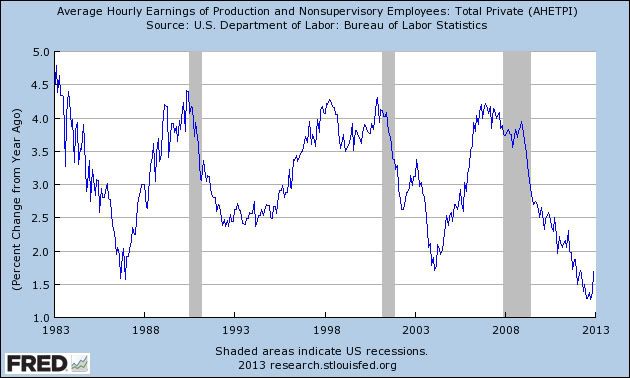

Perhaps worst of all, although there are very recent signs of improvement, the next recession could start with wage growth already a paltry 1.5% YoY. Meaning, among other things, a significant possibility of a wage deflationary spiral:

And is going to get worse from there.

And none of our political or media elites appear to give a damn. _____________________________

Addendum: After I wrote this and put in the publication queue, Bill McBride a/k/a Calculated Risk published his ruminations on Predicting the next recession. In general we have been on the same page for the last several years, and remain on the same page about this year, although he is more sanguine about the impact of the withholding tax increase than I am. After that, our thoughts diverge somewhat, and as this post indicates, I am more pessimistic than he is looking out 24-48 months. I'll give my reasons as a response to his longer term forecast in another post.