- by New Deal democrat

Yesterday I said it appeared likely that manufacturing - but not necessarily the economy as a whole - had slipped into recession. One reason is that the stock market continues to make new highs.

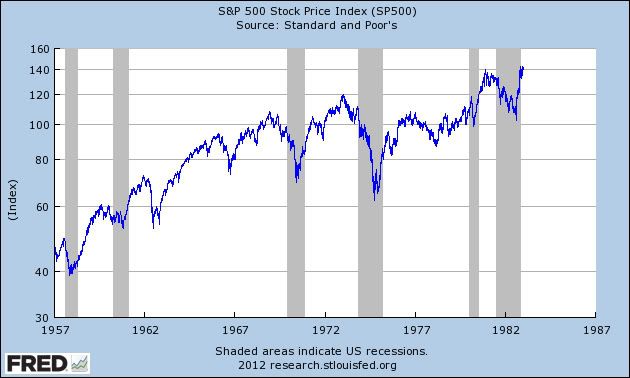

While it has happened that stocks have made new highs after a recession has begun, it is unusual, and the lag time has been brief. Here are two graphs showing the S&P 500 in log scale, first from 1957 to 1982:

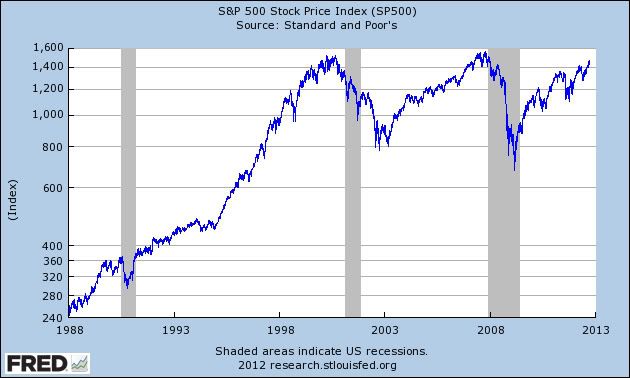

And here it is from 1988 to the present:

In case you can't tell from the graphs themselves, of the 9 recessions that have happened during that period, the stock market has peaked first 7 times. In both cases where it did not, 1980 and 1990, the market made its final high within 45 days of the recession starting. Although it does not involve the S&P, in 1929 the DJIA made its final high 3 months into the recession.

The bottom line is , while it is possible that a recession may have already started, it is unlikely by this metric, and it is almost certainly the case that any such downturn did not start in June or before.