- by New Deal democrat

Back in March I wrote that the pattern of consumer spending did not support a recession call, showing via graphs that in the past:

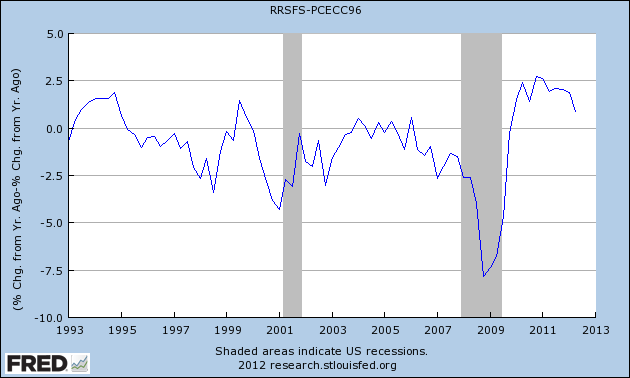

early in economic expansions, YoY real retail sales growth far outstrips YoY PCE growth. As the economy wanes into contraction, YoY real retail sales grow less and ultimately contract more than YoY PCE's. You can see that by noting that retail sales minus PCE's are always negative BEFORE the economy ever tips into recession. That's 11 of 11 times. Further, in 10 of those 11 times (1957 being the noteworthy exception), the number was not just negative, but was continuing to decline for a significant period before we tipped into recession. This makes perfect sense, as retail sales generally include many far more discretionary purchases. As the economy accelerates, consumers make more discretionary purchases. As it slows, the more discretionary retail purchases are the first things cut.So, now that we have one more quarter's worth of data, what does the relative strength of the two consumer spending metrics tell us? Here's the updated graph:

YoY growth in real retail sales still outstrips YoY growth in the wider category of PCE's. At least as of the end of the second quarter, this metric still indicates an expanding economy.