An initial note: I read all of the comments. I don't always respond because frequently I simply don't have time. As it is I probably only write about half the posts I'd like to. In that vein I haven't been able to flesh out my take on the whole "double dip" issue, which basically is that the most likely near term scenario is that we are going to have just barely positive growth, or just barely negative contraction. While the former is certainly preferable, I can't see getting too excited about which semantic term winds up being the most accurate.(As to why, see Dean Baker this morning). As we surely already know, not all recoveries and not all recessions are created equal. Anyway, I wanted to address briefly a matter that came up in the comments.

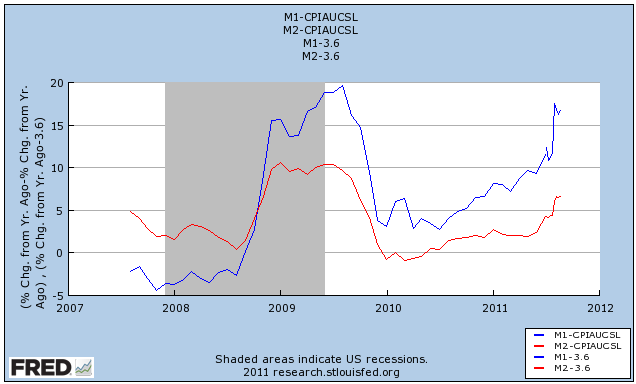

Every week I include in my list of high frequency indicators a paragraph about money supply. That real M1 and/or M2 are important and leading indicators for the economy as a whole goes back at least as far as Milton Friedman's and Anna Schwartz' "A Monetary History of the United States" which won him the Nobel Prize in Economics. You don't have to agree with his politics to accept that he was on to something important. As I've pointed out many times, there have not been recessions without real M1 turning negative and also real M2 being under +2.5%. Here's the longest-term graph available from the St. Louis FRED:

As you can see, in the last couple of months, both real M1 and real M2 have been soaring. In the last few weeks (over a month after it became apparent in the weekly data), there has been a debate about the meaning of this trend. I've referred to it as a "panic" by which I mean an emotional move, not necessarily negative.

Friend of the blog Prof. Jeff Miller of A Dash of Insight, considers the term inappropriate:

There is finally some commentary, centering on the idea that M2 growth reflects panic and a desire for cash. Putting aside the complete lack of correlation between M2 growth and any measure of panic, you might expect panic to show up in brokerage accounts (MZM), bond purchases, or gold purchases rather than M2. This is another example of where some are willing to throw out the entire body of Milton Friedman's work because they think that "this time is different." Do such pundits really believe that there were no other "panics" in the history of the M2 series? My advice is to ignore cheaters who spin current data without reviewing the entire series.Scott Grannis, a/k/a the Calafia Beach Pundit, takes the opposite view:

The issue is the surge in the M2 measure of money supply .... [I]f the extra growth in the money supply results from extra demand for money, then this is ... a reflection of some other problem that is driving people to increase their holdings of dollar liquidity.... [I]t appears that the rapid expansion of M2 in recent months is part of the fallout of the eurozone sovereign debt crisis that is in full bloom. Money is fleeing Europe and seeking safety in the U.S.Grannis' view appears to be strongly supported by Kash Monsori:

European banks are shifting their cash assets out of European banks and putting much of them into US banks. (An interesting question is what European MFIs have done with the remaining money they've withdrawn from the European banking system... but that's a story for another day.) This has happened at a significant rate, with a net transatlantic flow from European to US banks that probably totals close to half a trillion dollars in just six months.Rebecca Wilder at Angry Bear dissents:

If you're wondering exactly who has been the first to lose confidence in the European banking system, look no further. It seems that at the forefront is the European banking system itself.

I respect Kash's work; but it's my view that he jumped to some inaccurate conclusions on European bank flows. The data demonstrate that European bank branches in the U.S. are more likely moving capital back to their local branches, rather than into their U.S. branches.Wilder views the surge in money supply recently as simply the outcome of QE2.

Whether the surge is emotionally based or not, the fact is, it is happening. In fact the present surge in real money supply looks like nothing so much as the similar surge in September and October 2008, when the US financial system was on the verge of total meltdown, as seen in this close-up of the above graph, covering the last 4 years:

It is generally thought that the effect of money supply is seen with a lag, on the order of a full year. If so, then the move into M1 and M2 money in September and October 2008 was both a coincident reflection of panic, and a leading indicator of the recovery that began in the 2nd half of 2009. Panic or not, I see no reason to partake of that most common route to error, that "this time it's different."