At the end of 2007, I had an argument with democratic activist Dana Houle (a/k/a DHinMI), who argued that 2008 would likely be a fundamental turning point, a realignment of the economy and the electorate, just as the 1932 election had been.

To the contrary, I argued that 2008 would be like 1968, in which the new electoral majority began to emerge, but fundamentally reversed none of the prior paradigm. In fact President Nixon established the EPA and said "We are all Keynesians now." Barring an economic calamity that would force people to jettison long-held precious ideological beliefs, I did not see how 2008 could produce anything other than a transitional presidency.

One year later and it seemed like we were in the process of undergoing that calamity. But whereas the Great Depression saw increasing Democratic Congressional majorities in each election from 1930 through 1936, instead in 2010 the Democrats gave back most of their 2008 gains in the Senate, and all of their gains from 2006 in the House. If there was no 1932 style realignment, what about Reagan's signature 1980 victory, which produced a Republican Senate for 6 years, even though there were losses in 1982? Or was 2008 indeed more like 1968, where established party dominance of the political narrative was largely unbroken, or even extended?

In 1932 and 1980, the country "crossed the Rubicon" in its political and economic thinking. Fundamental ideological paradigms were changed. Has Obama "crossed the Rubicon" as well, for good or ill? I envision this being a periodic series, for I as a voter am also strongly considering "crossing the Rubicon" as it pertains to Barack Obama and the institutional Democratic party.

So let's begin by stacking up how Obama's economic performance compares with that of Reagan. [Note: keep in mind that in the graphs below, a 24 or 27 month period of Obama's presidency is being compared with the entire first 4 yeas of Reagan's presidency.]

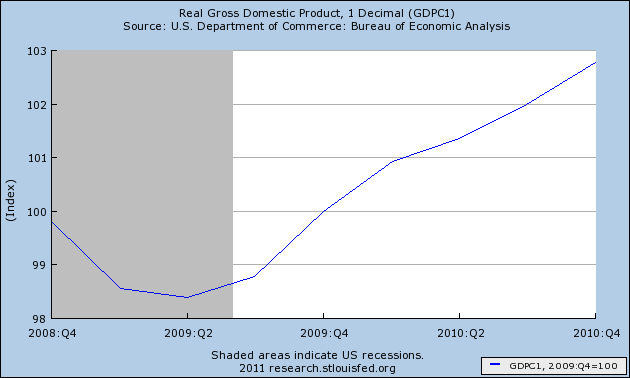

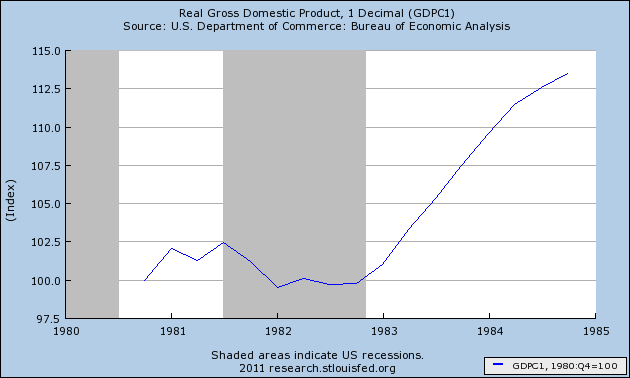

GDP:

In Obama's first two years, real GDP has gone up 3%:

During Reagan's first two years of office, GDP had barely budged, up 1%. But it gained 12% in the next two years. Thus, for Obama to equal Reagan's record, GDP must go up 5% a year in real terms this year and next:

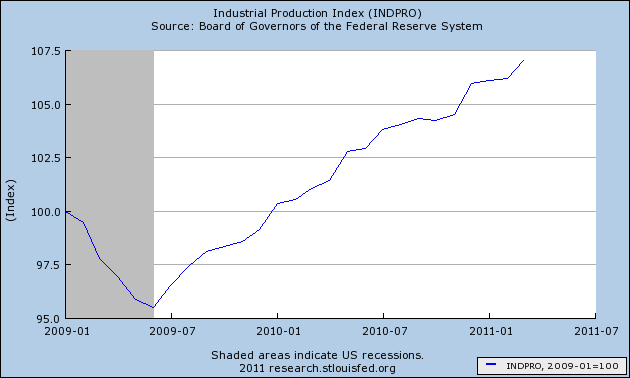

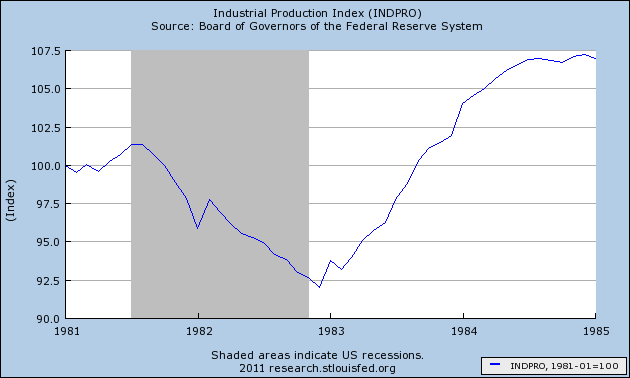

Industrial Production

Two years and three months into Obama's term, Industrial production is already up 7%:

Industrial production only reached 7% growth at the end of Reagan's first term of office. At this point in Reagan's first term, Industrial production was still off about 4%:

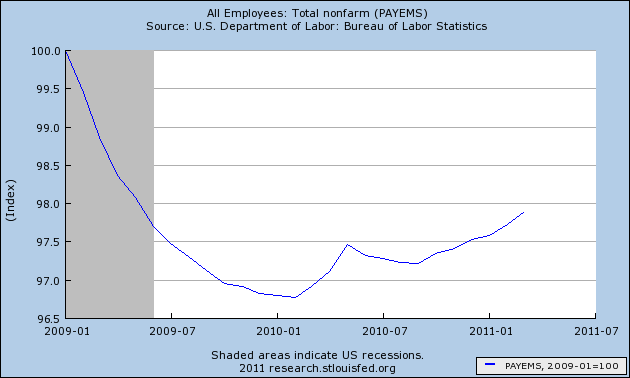

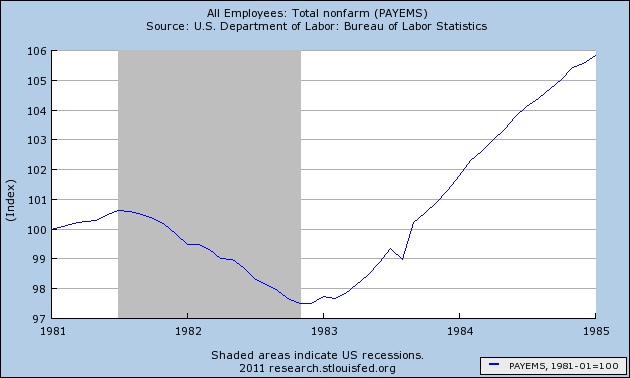

Employment

Employment has shrunk about 2% in the first 27 months of Obama's term:

Reagan posted a similar 2% loss after 27 months, but over the next 21 months, employment grew another 8%:

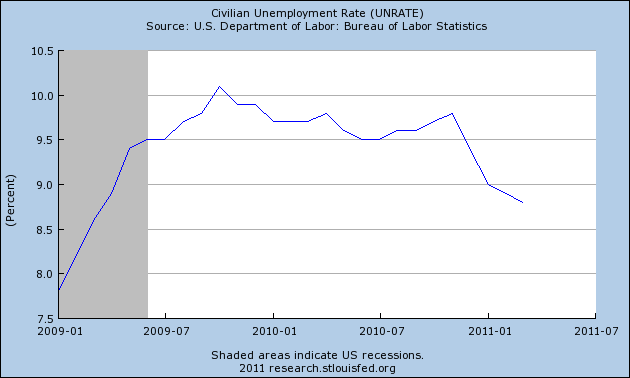

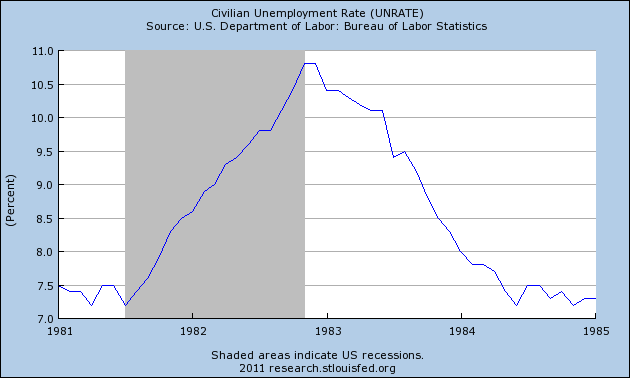

Unemployment

At 8.8% unemployment is about 1% higher than when Obama took office:

Twenty-seven months into Reagan's first term, unemployment was still over 10%, but it would shrink all the way down to under 7.5% in the next 1 3/4 years:

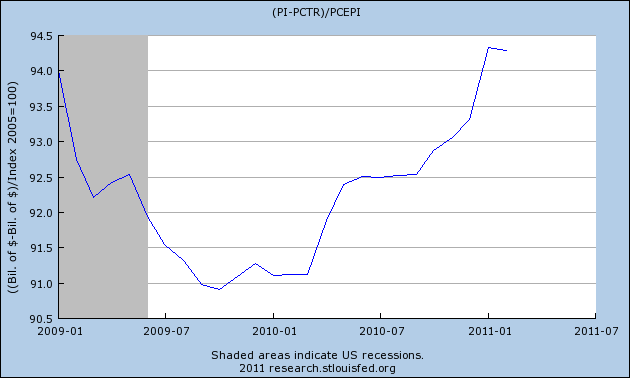

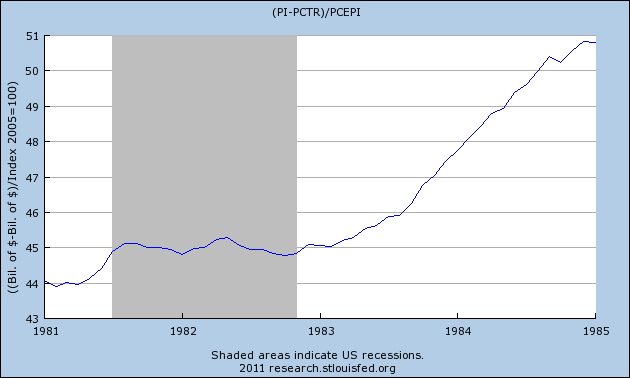

Real Income

Real income is barely higher than what it was when Obama took office:

By this point in Reagan's first term, real income was up about 2%. It would go up another 12% before his first term ended:

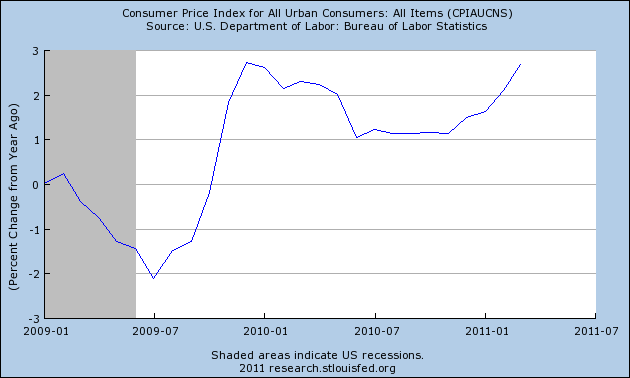

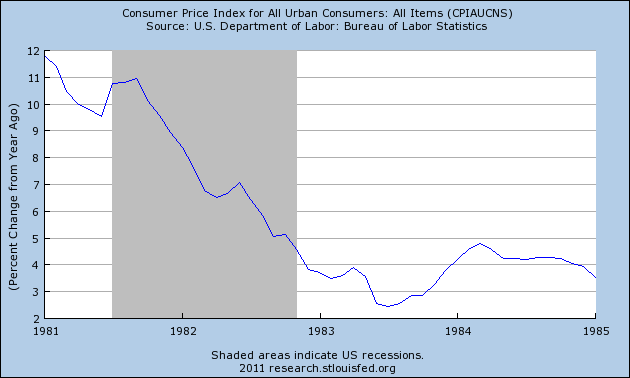

Inflation

When Obama took office, the country was on the verge of a deflationary spiral. It was reversed, with inflation now running at close to 3%:

The economic Rubicon that Reagan had to cross when he entered office was that of high inflation and the wage-price spiral that had accelerated in the 1970's. Two and one quarter years into his first term, it had been conquered, going down from 12% to 3%:

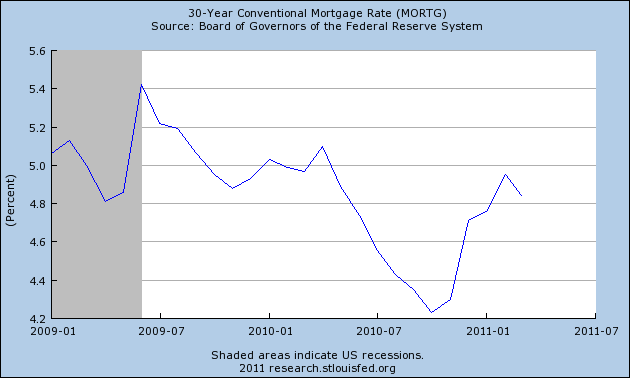

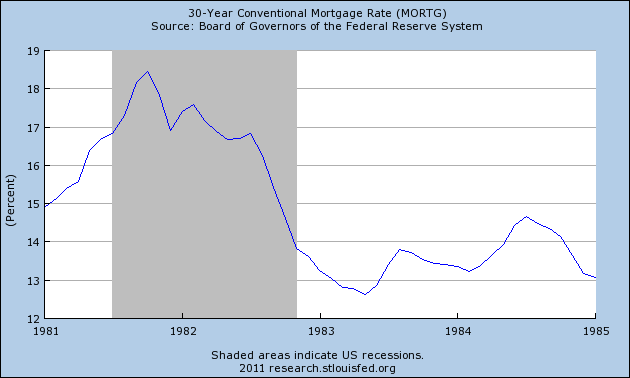

Mortgage Rates

During Obama's term, conventional mortgage rates have meandered between 4.2% and 5.4%:

With the slaying of high inflation, mortage rates during the first 2 1/4 years of Reagan's first term declined all the way from over 18% to under 13%, a huge difference in terms of a family's income that was required to pay this most important monthly bill:

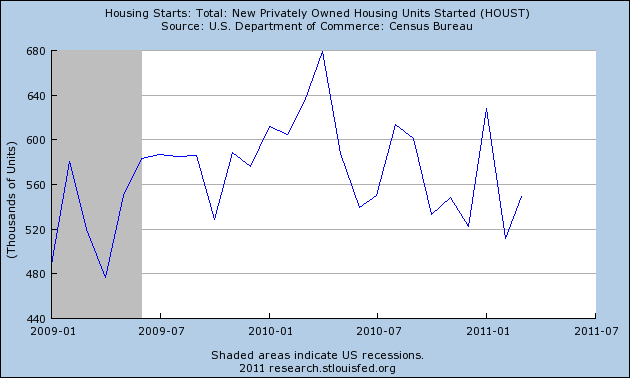

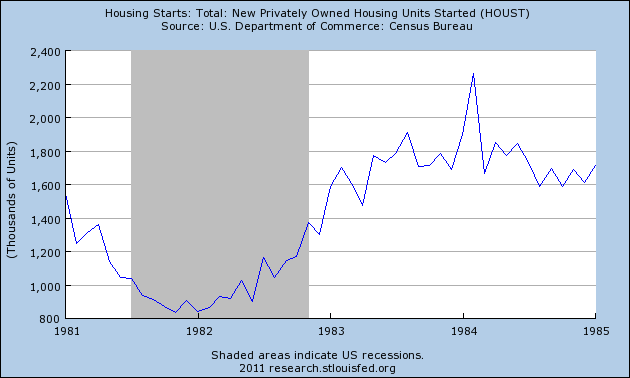

Housing starts

Housing starts have meandered in the 500,000-650,000 range during Obama's term:

Because of the large decline in mortgage rates, 27 months into Reagan's first term, housting starts had increased nearly 900,000 from their bottom, although they were only about 100,000 annualized than when Reagan took office:

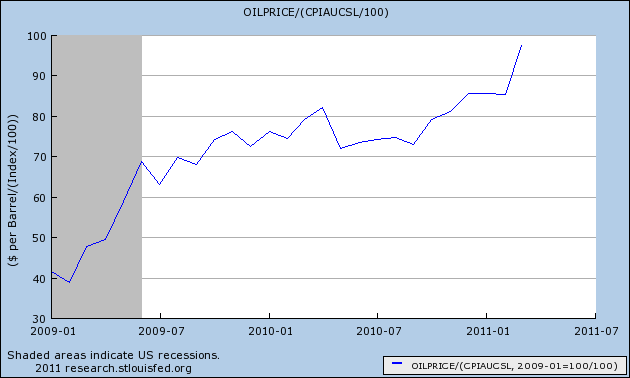

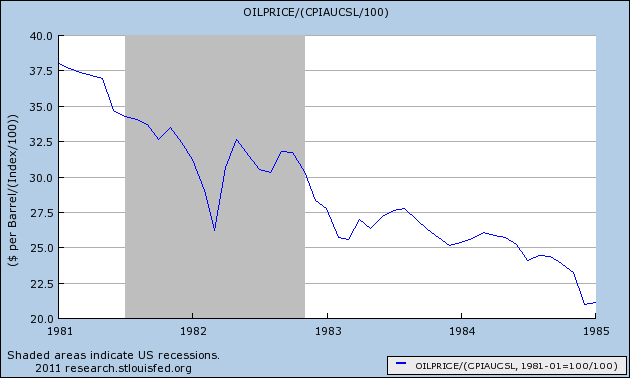

Oil prices

Twenty seven months into Obama's presidency, Oil prices have more than doubled:

At the same point in Reagan's presidency, Oil prices had declined by about 30%. They would fall nearly by half, by the end of his first term:

In summary, while Reagan's progress lagged Obama's in a few metrics like Industrial Production, by this point during his first term Reagan had crossed his economic Rubicon. With the assistance of a Fed-induced brutal recession, inflation had been broken. The last two years of his first term saw strong growth not just in the broad economy, but in such measures as real income, employment and unemployment, and housing starts. The Oil shocks of the 1970's receded. He was re-elected in 1984 by a landslide, and the GOP kept control of the Senate.

By contrast, while Obama has made progress against the economic declines of the great recession, unless the housing market shows real signs of a strong rebound in the next year, (contra Calculated Risk who is predicting at least 3 more years until it does so), and unless Oil miraculously goes into a long lasting decline without harming economic demand in the process, he will have failed to resolve the secular economic problems which brought him to power. 2008 will be seen as a failed turning point, or at most a 1968 style election where the next electoral majority began to emerge, but failed to fundamentally change the existing course.