Over at Firedoglake, David Dayen wonders how economists can say the economy will be "good" in 2011 if unemployment remains above 9%. Atrios agrees.

Bill McBride at Calculated Risk has updated his graph of "Okun's Law" showing that we need growth of 5%+ to cause the unemployment rate to decline under 9%.

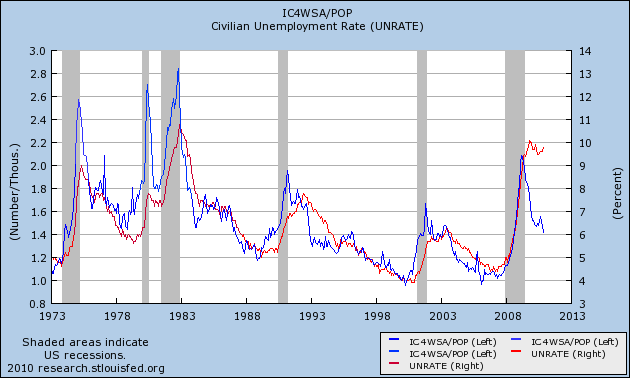

In the last couple of weeks, I have been discussing the anomaly of high unemployment compared with the relatively average number of first time jobless claims adjusted for population. 2010 has been one of only two exceptions in nearly the last half century where the unemployment rate has been more than 2% higher than that predicted by the "initial jobless claims rate:"

Which leads to an update on the subject of the "real personal savings rate" that I have written about several times in the past, notably here and here.

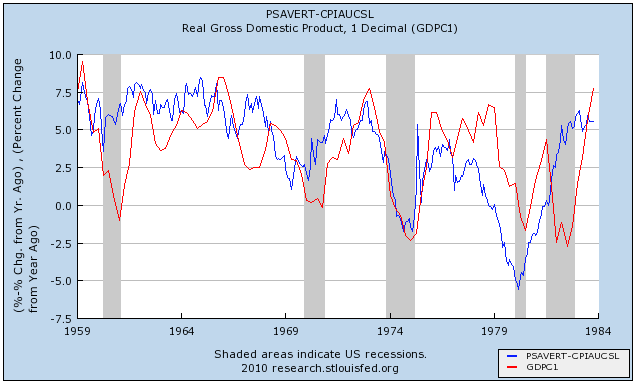

To recap the points I made previously, the relationship isn't perfect, but the lagged correlation is clear. A substantial change in the real personal savings rate is mirrored by a similar substantial change in real GDP about 6 to 18 months later, and then via "Okun's law" to a predictable change in the unemployment rate. The logic of this isn't hard to follow: increased savings serve as the "tinder" that ignites subsequent spending. That spending leads to growth, and then that growth leads to the creation of jobs.

Thus an increase in savings is a "long leading indicator" for employment in a range of 18 to 30 months later. Here are the historical graphs of the "real personal savings rate" vs. real GDP, first for the period of 1959 through 1984:

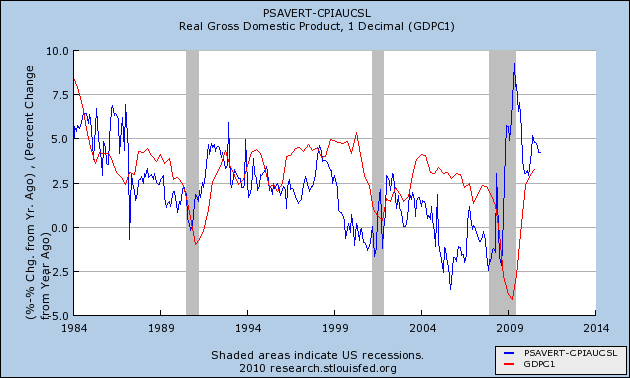

and the updated graph from 1984 through November 2010 based on the data released last week:

We are now 18 months past the June 2009 peak. This relationship predicts further increases in YoY job growth beginning about now and continuing in 2011. While the relationship is "noisy," subsequent GDP increases are generally similar to the precursor real personal savings rate -- which has been above 5% for much of the last 18 months. Which means that an unemployment rate significantly under 9% by the end of 2011 is quite doable.

UPDATE: Just to be clear, I'm not suggesting that an unemployment rate of 8% or even 7% would qualify as "good," either. The point is, it is by no means a foregone conclusion that we will endure 9%+ unemployment all next year.