- by New Deal democrat

Yesterday the Mortgage Bankers Association reported that purchase mortgage applications dropped to their lowest level yet. Needless to say, this increases the odds of a double-dip in the 3rd or 4th quarter back into negative GDP.

That's certainly the headline, but underneath is the story of continuing household purging of debt. A couple of days ago I posted the latest household debt obligations graphs from the Federal Reserve, showing that through the first quarter of this year, households had decreased their debt obligations by almost half, measured from the beginning of the Reagan era in 1981.

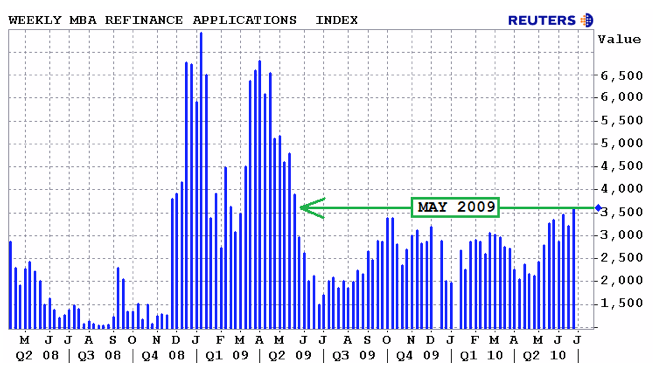

This is the graph of refinance mortgage applications:

You can see that since interest rates cratered in the Panic of 2008, households have taken advantage of new lows in mortgage rates to refinance. With rates once again declining to new lows, refinancing is increasing again.

The odds are extremely good that unlike during the housing boom, refinancing is not being used to buy Hummers and swimming pools and glitz. Most likely, the monthly savings in interest payments is being used to pay down other debt. So long as deflationary forces are at work in the economy, we can expect this to play out in a once in a generation, if not once in a lifetime, purging of debt.

There are avenues of relatively more or less pain along the way, but at the end of the journey, households are going to have much better balance sheets than they did a few years ago.

Yesterday the Mortgage Bankers Association reported that purchase mortgage applications dropped to their lowest level yet. Needless to say, this increases the odds of a double-dip in the 3rd or 4th quarter back into negative GDP.

That's certainly the headline, but underneath is the story of continuing household purging of debt. A couple of days ago I posted the latest household debt obligations graphs from the Federal Reserve, showing that through the first quarter of this year, households had decreased their debt obligations by almost half, measured from the beginning of the Reagan era in 1981.

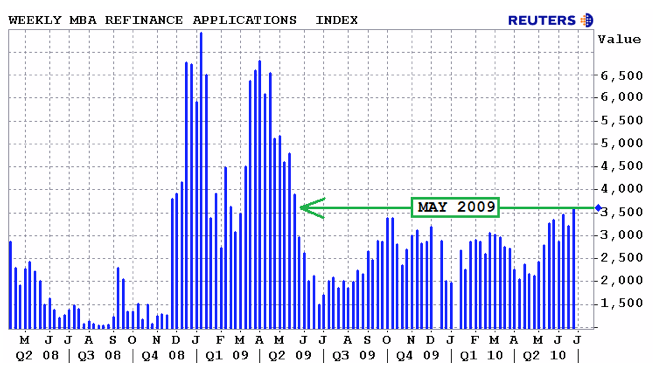

This is the graph of refinance mortgage applications:

You can see that since interest rates cratered in the Panic of 2008, households have taken advantage of new lows in mortgage rates to refinance. With rates once again declining to new lows, refinancing is increasing again.

The odds are extremely good that unlike during the housing boom, refinancing is not being used to buy Hummers and swimming pools and glitz. Most likely, the monthly savings in interest payments is being used to pay down other debt. So long as deflationary forces are at work in the economy, we can expect this to play out in a once in a generation, if not once in a lifetime, purging of debt.

There are avenues of relatively more or less pain along the way, but at the end of the journey, households are going to have much better balance sheets than they did a few years ago.