The Federal Reserve reported this morning that

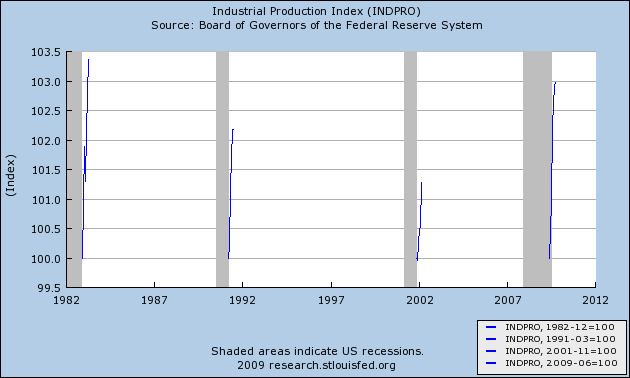

Industrial production increased 0.8 percent in November after having been unchanged in October.

Manufacturing production advanced 1.1 percent, with broad-based gains among both durables and nondurables. The output of mines climbed 2.1 percent, but the index for utilities fell 1.8 percent, primarily as a result of lower output of gas utilities--temperatures in November were unseasonably mild and reduced the need for heating. At 99.4 percent of its 2002 average, total industrial production was 5.1 percent below its level of a year earlier. Capacity utilization for total industry moved up 0.7 percentage point to 71.3 percent, a rate 9.6 percentage points below its average for the period from 1972 through 2008.

From Bonddad: here are some charts from the report:

Notice we've been increasing for a few months. This is good. In addition,

Click for a larger image

Capacity utilization is increasing as well. While we still have a long way to go with both of these numbers, today's numbers are encouraging.

Taking into account the October revisions, these reports were right in line with estimates. Since bottoming in June, Industrial Production is up 3.6% for an annual rate of 8.7%. This is the best rate of expansion off a recession bottom since 1982, and far exceeds the 1992 and 2002 "jobless recoveries," as indicated in this graph (which does not include this morning's data):

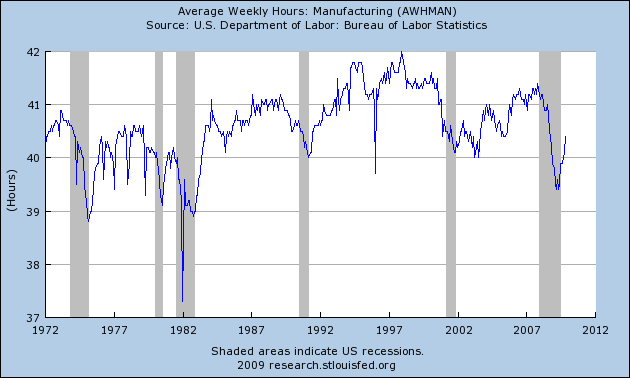

Industrial production and capacity utilization are not the only items producing a "V" shaped industrial recovery. Average hours in manufacturing are up more strongly from the bottom than at any time since 1982:

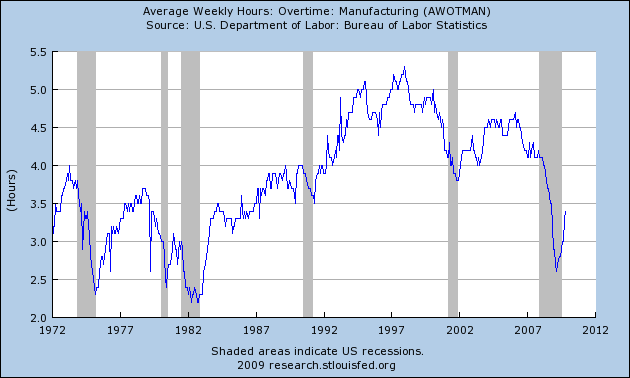

as are hours of overtime in industry:

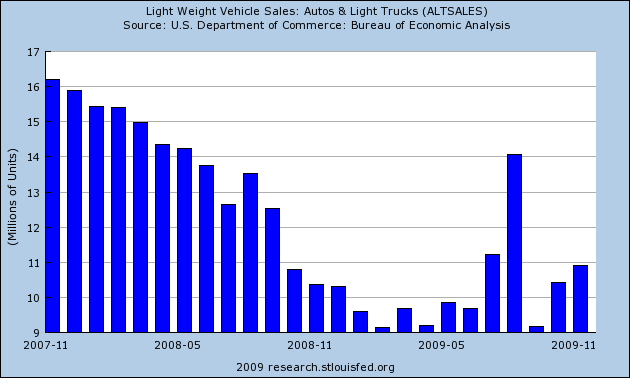

In large part, the V-shaped industrial recovery so far can be laid at the feet of the auto industry, which has increased sales by almost 2 million at an annual rate (from just over 9 million to just under 11 million), although this is only about 1/3 of the way back to the pre-recession level of vehicles sold:

You may recall that Industrial Production is one of 4 data series I am tracking in an effort to forecast when job growth will occur. This data is actually for last month, in which the household survey showed growth, but the payrolls survey was just barely negative at -11,000 (subject to revisions). On Thursday we will get the Big initial claims number, and also be able to calculate real retail sales. Based on the big upside surprise in PPI this morning (almost entirely due to Oil), the CPI is likely to come in "hot" as well.

-----

If Industrial Production and Capacity Utilization came in showing robust growth, then this morning's Empire State survey, showing the barest of growth in the NYC area, is a big disappointment:

The Empire State Manufacturing Survey indicates that conditions for New York manufacturers leveled off in December, following four months of improvement. The general business conditions index fell 21 points, to 2.6. The indexes for new orders and shipments posted somewhat more moderate declines but also moved close to zero. Input prices picked up a bit, as the prices paid index rebounded to roughly its November level; however, the prices received index moved further into negative territory, suggesting that price increases are not being passed along. Current employment indexes slipped back into negative territory. Future indexes remained well above zero but signaled somewhat less widespread optimism than in recent months. Indexes for expected prices paid and received declined moderately but remained well above zero.

That employment contracted is the biggest disappointment. On the other hand, these regional surveys are notoriously noisy, and we have had both upside and downside surprises from various regions in the last few months.

From Bonddad: Here is chart of the Empire State number:

That is one heck of a drop. I would add one caveats. We've had a big bounce in this number, so we could be seeing a simple "we've bought enough stuff for now" situation along with end of the year issues. However, I would call this a clear yellow flag going forward and something that needs to be watched.

End BD.

Some time ago, Bonddad described the likely course of this economic expansion as a "fits and starts" recovery, and that description seems very apt this morning.