Information received since the Federal Open Market Committee met in November suggests that economic activity has continued to pick up and that the deterioration in the labor market is abating. The housing sector has shown some signs of improvement over recent months. Household spending appears to be expanding at a moderate rate, though it remains constrained by a weak labor market, modest income growth, lower housing wealth, and tight credit. Businesses are still cutting back on fixed investment, though at a slower pace, and remain reluctant to add to payrolls; they continue to make progress in bringing inventory stocks into better alignment with sales. Financial market conditions have become more supportive of economic growth. Although economic activity is likely to remain weak for a time, the Committee anticipates that policy actions to stabilize financial markets and institutions, fiscal and monetary stimulus, and market forces will contribute to a strengthening of economic growth and a gradual return to higher levels of resource utilization in a context of price stability.

Let's look at some of the charts to get a better idea of what the Fed sees. As always, click on each image for a larger image.

Existing home sales have been picking up for most of the year as have

New homes sales (h/t Calculated Risk).

Real retail sales have bottomed. Note: I originally used the non-inflation adjusted chart for this. Sorry for the mistake.

Real PCEs are increasing, although weakly.

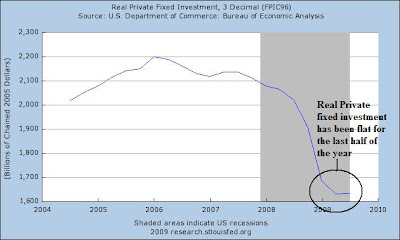

Real private fixed investment has been flat for the last ~6 months.

Initial unemployment claims are dropping. That tells us that the rate of job losses continues to deteriorate. In addition,

The rate of establishment job losses continues to moderate as well.

Bottom line -- and I've been saying for about 7-9 months now -- the economy is stabilizing and in some cases improving. It's not the greatest expansion we've ever seen, but considering where we were it's about what we should expect.

The Committee will maintain the target range for the federal funds rate at 0 to 1/4 percent and continues to anticipate that economic conditions, including low rates of resource utilization, subdued inflation trends, and stable inflation expectations, are likely to warrant exceptionally low levels of the federal funds rate for an extended period.

BUT .. the Fed is not expecting a strong economy (and they shouldn't) so they're keeping things easy for now.