Though today's disparity between growth and jobs is especially stark, a jobless recovery wouldn't be new: The past two recessions were marked by firms reluctant to resume hiring right away after demand recovered. The current disconnect could reflect an unanticipated surge in productivity -- companies finding ways to increase output with fewer workers. That could set up the economy to grow rapidly in future years. Rising productivity is the linchpin of economic growth and rising living standards.

But there are darker scenarios. Struggling workers, whose wages also are being squeezed, could drag a fragile economy back into deep recession.

"Final demand and production have shown tentative signs of stabilization," Mr. Bernanke told lawmakers this week as part of the Fed chairman's semiannual report to Congress. "The labor market, however, has continued to weaken."

Job insecurity could lead consumers to further pull back spending, he said, calling it "an important risk to the outlook."

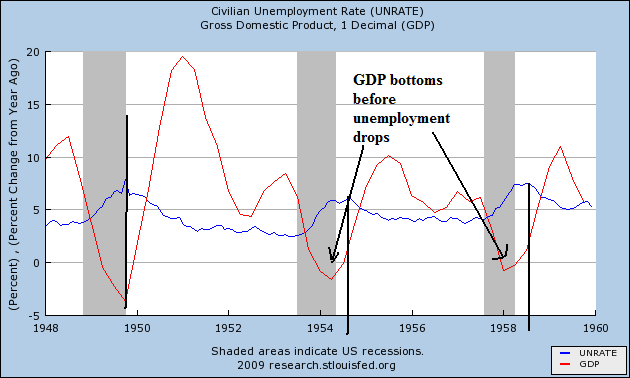

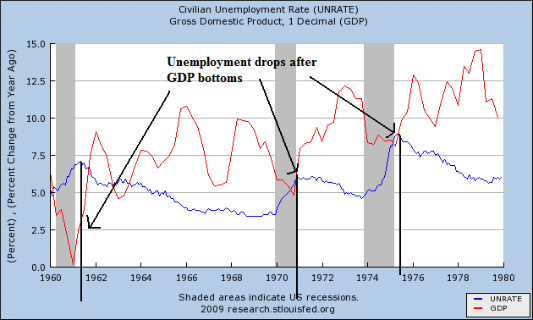

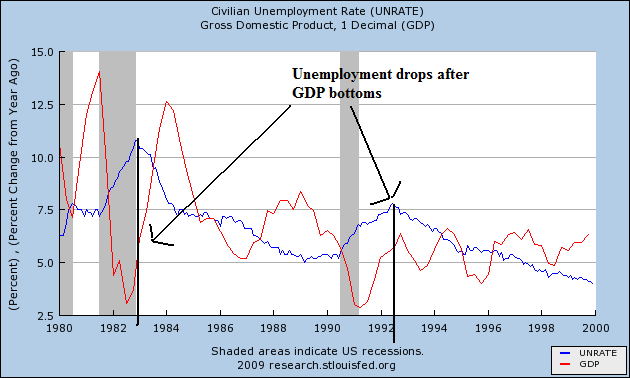

First, below are three charts that show the relationship between the year over year change in GDP and the unemployment rate.

These graphs make two important points.

1.) The year over year rate of change in GDP must turn positive before we even think about talking about a drop in the unemployment rate. In short -- first we need growth.

2.) The length of time between the turnaround in GDP and the drop in the unemployment rate has been increasing. Simply put, companies are waiting for longer and longer periods before they start hiring people.

The Journal article has this illuminating graphic.

This is why we are (again) hearing talk about a jobless recovery. The San Francisco Federal Reserve recently studied this situation and came to this conclusion:

What does all this mean for the course of the labor market? We combine data on involuntary part-time workers with the standard unemployment rate to arrive at an alternative measure of labor underutilization. We plot this measure in Figure 3, which shows that the labor market has considerably more slack than the official unemployment rate indicates. The figure extends this labor underutilization measure using the Blue Chip consensus forecast for the unemployment rate as a benchmark and then adding a share of involuntary part-time workers based on the proportion of workers in that category to the unemployed during the current recession. This projection indicates that the level of labor market slack would be higher by the end of 2009 than experienced at any other time in the post-World War II period, implying a longer and slower recovery path for the unemployment rate. This suggests that, more than in previous recessions, when the economy rebounds, employers will tap into their existing workforces rather than hire new workers. This could substantially slow the recovery of the outflow rate and put upward pressure on future unemployment rates.

So -- what does this all mean?

1.) While anger about the high unemployment rate is justified, it is pointless to talk about a drop in the unemployment rate until we see GDP growth.

2.) Unemployment benefits must be extended to prevent widespread problems related to joblessness. This is the humane policy (and also imminently practical).

3.) Given the low number of hours worked and capacity utilization along with the high measures of labor under-utilization I don't see how we avoid the "jobless" recovery scenario, at least for the first year or so of recovery. In addition, businesses are going to be reluctant to rehire people simply because of the severity of the recession -- business will be thinking "we're too close to a serious recession event to think about going full bore on hiring right now."