Treasury Secretary Henry Paulson's $700 billion proposal to stabilize the banking system may push the national debt to the highest level since 1954, threatening an erosion of foreign appetite for U.S. bonds.

The plan, which asks Congress for funds to buy devalued securities from financial institutions, would drive the debt above 70 percent of gross domestic product and the annual budget gap to an all-time high, possibly exceeding $1 trillion next year, economists estimated.

``This is sobering, absolutely sobering, even to someone who doesn't drink,'' said Stan Collender, a former analyst for the House and Senate budget committees, now at Qorvis Communications in Washington.

.....

``The market is very, very negative because of the consequences of raising the debt ceiling and the increase in debt in general,'' Manfred Wolf, head of currency sales in New York for HVB America Inc., a unit of Germany's second-largest bank. ``Foreigners may not be that attracted anymore to U.S. assets.''

Gross U.S. debt, which includes debt held by the public and by government agencies, this year reached about $9.6 trillion, or about 68 percent of gross domestic product.

The Treasury is already borrowing to fund Federal Reserve efforts to inject liquidity into credit markets. Last week it announced sales of $200 billion in short-term debt.

``We've all used the phrase `uncharted waters' so often, yet we keep finding new uncharted waters,'' said Louis Crandall, chief economist of Wrightson ICAP, a research firm Jersey City, New Jersey. ``The fact that the Treasury's borrowing operations are now being affected on such an unprecedented scale adds new uncertainties'' to bond markets.

Bad-Debt Purchases

The Treasury's potential use of all $700 billion to purchase impaired assets would raise the country's debt to more than 70 percent of GDP. The last time American taxpayers owed as much was in 1954, when the nation was still paying down costs incurred during World War II.

``It's an alarming level of debt given that we're not fighting something like World War II,'' said Robert Bixby, executive director of the Concord Coalition, a non-partisan budget watchdog group.

The government reaching the requested debt limit would entail every man, woman and child in the U.S. owing more than $37,000 each. The median U.S. income last year was $50,233.

``We're putting a lot of debt on the books and people are going to be spending a lot of money paying that off for a long time,'' Bixby said.

Why is all of this so scary? Here is why:

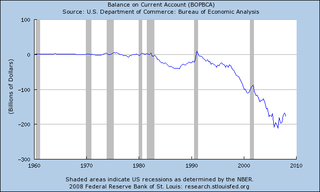

Above is a chart of the current account. All this means is the following: the US buys more stuff from abroad then we sell abroad. The problem is we don't have the money to pay for all of this. Why? Because the US savings rate is terrible:

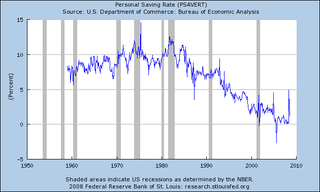

Notice how the US is saving less and less. That means we have to borrow money to buy all of this great stuff.

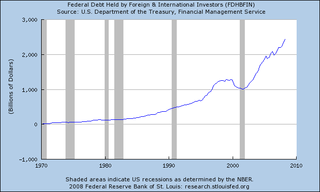

Above is a chart of foreign ownership of US government debt. Notice how it has doubled over the last 8 years. In other words -- we're in debt to foreign central banks up to our eyeballs

So let's review:

-- The US is living beyond it's means; we buy more stuff than we make.

-- As a result, foreigners lend us money. This is the equivalent of vendor financing. Think of it like the global GMAC account.

-- Now the US really needs to increase it's debt level. The problem is we've been doing that during the good times. So now we're near the point where a massive issuance of debt could spike interest rates, sending the rate ever higher on the mammoth amount of debt we already have. Great news, huh?