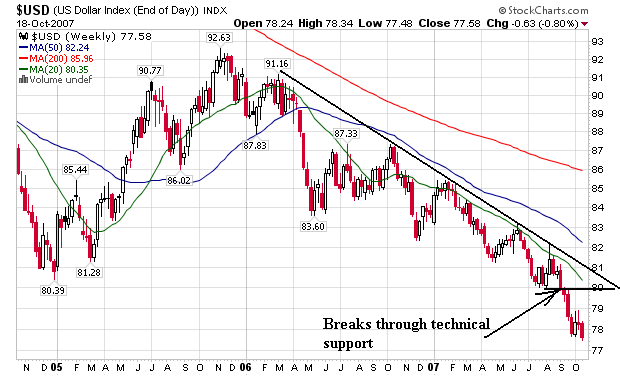

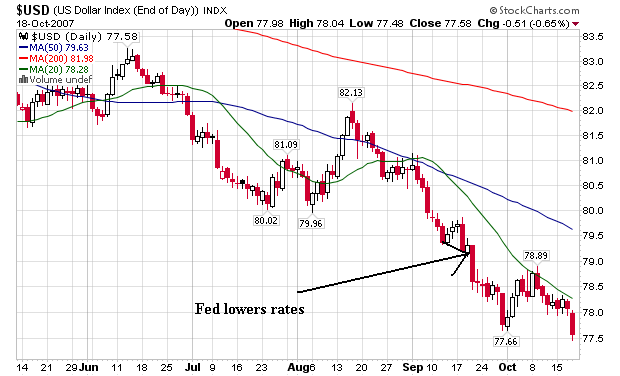

Since then the dollar has continued to drop in value:

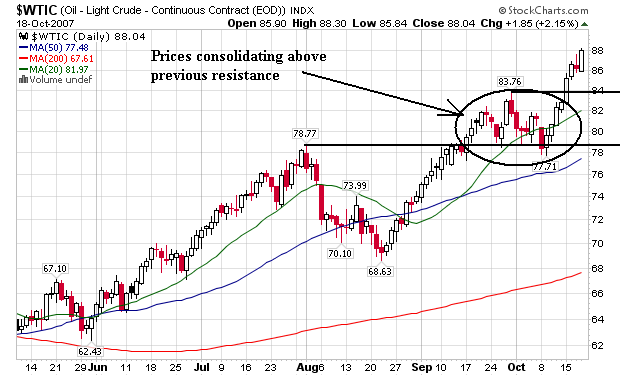

At the same time, we have seen oil rally over the last few weeks.

While there are important geo-political reasons for oil's rally, there are also important fundamental reasons:

Oil prices held near an all-time high of $90 a barrel Friday, crossed for the first time in after-hours trading Thursday in New York, as a weakening U.S. dollar lifted prices.

Light, sweet crude for November delivery rose to $90.02 a barrel in Thursday evening electronic trading on the New York Mercantile Exchange. By midday Friday in Europe, the contract was trading at $89.92 a barrel.

Analysts said investors were buying more oil to hedge further losses in the currency. The dollar fell to a new low against the euro Friday and sagged against the yen.

Should oil maintain it's lofty price level we can expect more energy related inflation. But remember -- it's not part of core inflation, so it really doesn't matter.