Crude oil fell from near a nine-month high in New York as some traders speculated recent gains that followed unrest in Nigeria were unjustified.

Nigeria's two main oil unions said yesterday they planned to join a general strike scheduled to start tomorrow. In addition, Chevron Corp. and Eni SpA reported raids on facilities in the West African nation, Africa's biggest oil producer.

``How much these situations are priced in is hard to measure,'' said Wolfgang Kraus, chief energy and commodities trader at BayernLB in Munich. ``The fact is that the market is willing to react to negative headlines, so the risk is there.''

Crude oil for July delivery fell as much as 35 cents, or 0.5 percent, to $68.74 a barrel in after-hours electronic trading on the New York Mercantile Exchange. It traded at $68.75 at 9:24 a.m. in London. The contract jumped $1.09, or 1.6 percent, to $69.09 a barrel yesterday, the highest close since Sept. 1 and the fourth straight day of gains.

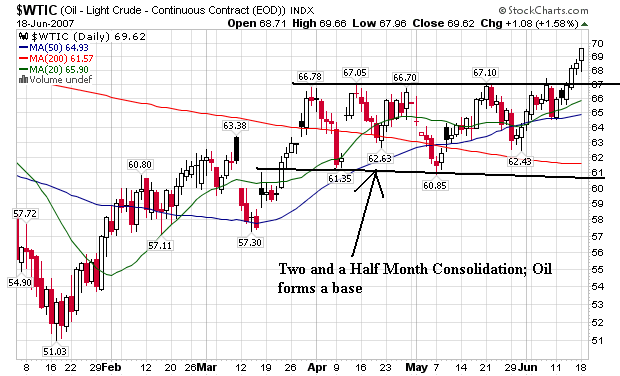

It's been awhile since we've looked at the oil chart, so let's see what the chart says.

The most striking feature of this chart is the two and a half month consolidation that occurred between roughly $61 and $67. Anytime you see a channel that is anywhere up to about 10%, think consolidation channel/forming a base (10% is simply a best guess rule of thumb). That's exactly what he have here.

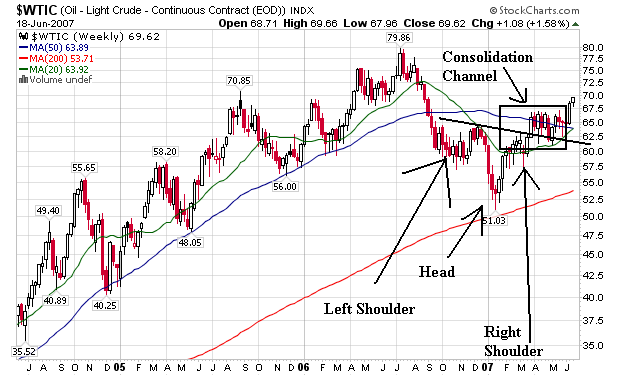

Let's pull the lens back to the weekly chart to see what it looks like.

Notice he have an upside down head and shoulders formation forming since October of last year. In addition, the recent consolidation occurred just above the head and shoulder's neckline. And we have the 20 day SMA just about to cross the 50 day SMA. In other words, we've got a lot of technical reasons for the market to move higher or remain at these levels.

All of this occurred right before the summer driving season. We also know from the Department of Energy that gasoline demand is up and refineries are just now getting up to snuff for gasoline production. And while gas prices have fallen for the last three weeks, they are still 17 cents above year-ago levels.

On top of this, recent price increases are due to geopolitical tensions -- another wild card in the oil market.

So, we have strong fundamental reasons for oil to remain at these levels plus strong technical reasons for oil to remain at these levels.