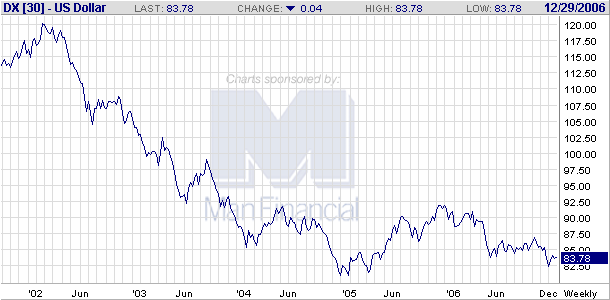

This is what happens when you run trade and fiscal deficits. Countries start to lose confidence in your currency. Over the last few years we have seen a large number of central banks announce they will diversify away from the dollar -- usually to add the euro to their reserves. OPEC, Russia, China, South Korea, Iran, and Venezueala are all in this camp. Now we can add the UAE to the "we like euros as much as the dollar" camp.

The United Arab Emirates will convert 8 percent of its foreign-exchange reserves to euros from dollars before September after the U.S. currency slumped this year, the country's central bank governor said.

The U.A.E. has started ``in a limited way'' to sell part of its dollar reserves, Sultan Bin Nasser al-Suwaidi said in an interview in Abu Dhabi on Dec. 24. ``We will accumulate euros each time the market appears to dip,'' as part of a plan to expand the country's holding of euros to 10 percent of the total from 2 percent today, he said.

The Gulf state is among oil producers including Iran, Venezuela and Indonesia, looking to shift their currency reserves into euros or sell their oil, which is currently priced in dollars, in the 12-nation currency. The total value of the U.A.E.'s current reserves is $24.9 billion, 98 percent in dollars and 2 percent in euros, al-Suwaidi said.

Standard economic thinking would argue the US trade deficit should lead to a dollar correction. The problem is when a large number of people start to sell dollars. Right now there is a giant international game of chicken going on -- no one wants to be the one who starts a dollar drop, but no one wants to see the value of their reserves decrease either. It's a most difficult game that can lead to sudden and painful currency moves.