Chinese industrial output, investment and retail sales all strengthened in August, the latest evidence of an upswing in growth in the world’s second-biggest economy.

Friday, September 13, 2013

Chinese Economy and Market Rebounding

Chinese industrial output, investment and retail sales all strengthened in August, the latest evidence of an upswing in growth in the world’s second-biggest economy.

Thursday, June 20, 2013

Market/Economy Analysis: China

Manufacturing

After adjusting for seasonal factors, the HSBC Purchasing Managers’ Index™ (PMI™) – a composite indicator designed to provide a single-figure snapshot of operating conditions in the manufacturing economy – posted at 49.2 in May, down from 50.4 in April. This signalled the first deterioration in operating conditions in seven months, albeit at only a marginal pace.

Despite operating conditions worsening, manufacturing output rose for the seventh month in a row during May, albeit marginally. Behind the meagre expansion of output, total new orders declined modestly and for the first time since last September. Demand from abroad also weakened over the month, with new export orders falling for the second month in a row. A number of panellists suggested reduced client demand, particularly in the US,

Here's a chart of the relevant data:

Note that the index spent most of 2012 below 50, indicating contraction. Now traders are concerned we're seeing that trend start again.

Services:

Output continued to expand across both the manufacturing and service sectors for the seventh consecutive month in May. However, production at manufacturing plants rose at the weakest pace since October 2012 and business activity at service providers increased at a modest pace. The latter was signalled by the HSBC China Services Business Activity Index, which posted 51.2 in May. This was broadly unchanged from April’s 51.1 and was one of the lowest readings in the series history.

Total new orders were relatively unchanged in May at the composite level, with sector data indicating differing trends. New work intake at manufacturing plants fell modestly over the month and for the first time since last September, while new business increased at service providers. However, the rate of growth was modest and remained historically weak in the service sector.

Here's a chart of the data:

While still positive, we've seen a few months of lower prints. This is hardly fatal, as this sector hasn't meaningfully contracted in over two years. But it is something to keep your eye on.

Other recent data prints have also disappointed. From Bloomberg:

China’s trade, inflation and lending data for May all trailed estimates, signaling weaker global and domestic demand that will test the nation’s leaders’ resolve to forgo short-term stimulus for slower, more-sustainable growth.

Industrial production rose a less-than-forecast 9.2 percent from a year earlier and factory-gate prices fell for a 15th month, National Bureau of Statistics data showed today in Beijing. Export gains were at a 10-month low and imports dropped after a crackdown on fake trade invoices while fixed-asset investment growth slowed and new yuan loans declined.

.....

Industrial production compared with the median estimate for a 9.4 percent increase, with growth the weakest for a January-May period since 2009. Fixed-asset investment excluding rural areas rose 20.4 percent in the first five months from a year earlier, down from a 20.6 percent pace in January-April, statistics bureau data showed. May’s retail-sales growth of 12.9 percent matched the median projection of analysts.

May exports rose 1 percent from a year earlier, down from 14.7 percent in April, while imports dropped 0.3 percent from a year earlier. The median estimates of analysts were for 7.4 percent export growth and 6.6 percent import gains. The $20.4 billion trade surplus compared with forecasts for $20 billion.

“This shows the real state of the Chinese export situation,” said Shen Jianguang, chief Asia economist at Mizuho Securities Asia Ltd. in Hong Kong. The data give a “pretty depressed” picture, with weak external demand and a yuan that has appreciated substantially against a trade-weighted basket of currencies, said Shen, who previously worked at the European Central Bank.

Bear in mind that China needs rapid growth because of two inter-related factors: the world's largest population and its GDP per capita. In order to create a large enough economic "pie" to spread out over its population and thereby raise people out of poverty, we need to see strong growth figures. That's why industrial production prints of 9.4% are concerning to economists. Now, let's also stipulate the Chinese slowdown is "relative" and no one is predicting a crash. These are still good numbers; they just indicate things are slowing relative to what we've seen.

But most importantly is that the traditional policy avenues to increase growth aren't there. From the Financial Times:

The concern about China’s slowdown is grounded partly in the speed with which credit is growing in China. The figure for total lending, which includes the non-banks as well as the banks, hit nearly Rmb8tn ($1.3tn) in the first four months of the year, significantly higher than the Rmb4.85tn for the same period a year ago, according to JPMorgan. Today, China’s total credit is almost double its gross domestic product.

But more worrying is the declining efficacy of that credit. The amount of capital being put to work is swelling, but the productivity of that capital is plummeting. Five years ago, a dollar invested produced a dollar of GDP growth. But today it takes $3 to $4 of investment to produce a dollar of output – and the quality of that output is suspect. There is overcapacity across many Chinese industries, from shipbuilding to solar.

The decreasing efficacy of Chinese lending is a policy problem, because this is the preferred method for the Chinese government to goose economic growth.

The short version of the above data points is it is becoming more and more apparent that the Chinese growth story is changing. And that has tremendous ramifications for the rest of the world.

The Chinese market is consolidating in a descending triangle formation, with the top part of the triangle connecting the early February and last May highs and the lows established on the 38.2% Fib level. A break of the 2150 level would indicated a move lower. Also note that prices are below the 200 day EMA with the shorter EMAs moving lower.

Friday, March 16, 2007

China Approves Property Laws

After more than a quarter-century of market-oriented economic policies and record-setting growth, China on Friday enacted its first law to protect private property explicitly.

The measure, which was delayed a year ago amid vocal opposition from resurgent socialist intellectuals and old-line, left-leaning members of the ruling Communist Party, is viewed by its supporters as building a new and more secure legal foundation for private entrepreneurs and the country’s urban middle-class home and car owners.

But delays in pushing it through the Communist Party’s generally pliant legislative arm, the National People’s Congress, and a ban on news media discussion of the proposal, raise questions about the underlying intentions and the governing style of President Hu Jintao and Prime Minister Wen Jiabao, experts say.

First a BIG caveat: I have no knowledge of internal Chinese politics, nor do I have any knowledge of its legal system. Therefore I can't comment on the sincerity of this law.

But, this is a very interesting development from a historical perspective. A passing analysis of democratic development indicates property rights are an essential element in the democratic development. I think you can successfully argue that the growth of the middle class was in fact a primary reason for Democratic development during the Renaissance.

Tuesday, December 12, 2006

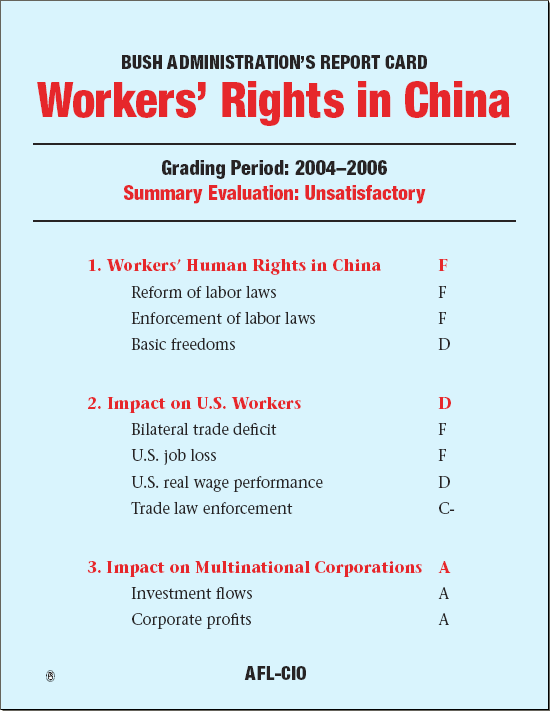

Traveling Again to China, Paulson Forgets to Pack Workers’ Rights

Treasury Secretary Henry Paulson needs a new appointment scheduler.

Someone on his staff failed to notice that as the former Goldman Sachs honcho heads to China this week, the U.S. Trade Representative was slated to released the 2006 Report to Congress on China's WTO Compliance. The report, issued today, is highly critical of the Chinese government's failure to meet their obligations. It places a “particular emphasis on reducing IPR [intellectual property rights] infringement levels in China” and on pressing China to make greater efforts to institutionalize market mechanisms and make its trade regime more predictable and transparent.The timing couldn’t be worse for Paulson.

When Bush and the Republican Congress rammed through China’s membership in 2001, they assured us that making China a full partner would ease the path for that nation to lower its trade barriers and bring its laws and regulations into compliance with international standards. In fact, the opposite occurred: Since China joined the World Trade Organization (WTO) in 2001, the U.S. deficit has grown to more than $200 billion. In 2005, the trade deficit with China grew by 25 percent to $202 billion—the largest bilateral deficit in world history.Behind this unsustainable trade deficit are two major factors: China’s policy to devalue its currency and its abysmal workers’ rights record. In fact, the Treasury Department once again is delaying the release of its semi-annual report on currency—so as not to embarrass Paulson while in China. Although the undervaluation of China's currency has become accepted fact, every Treasury report to date has failed to suggest taking any action.

While Paulson will chat with China’s leaders about the China’s currency devaluation, he has no intention of bringing up workers’ rights.He should—if not because ethical principles call for providing fellow humans with decent working conditions and living wages, then for our own self-interest as a nation. Because addressing China’s human rights violations is one important step toward reversing the declining U.S. trade balance with China.

The deterioration of working conditions in China continues every year, with nearly non-existent enforcement of wage, overtime, safety and health and environmental laws. Oppressing Chinese workers is the functional equivalent of devaluing currency. In failing to address the systematic abuse of its workers, the Chinese government further displaces U.S. jobs.American companies like Wal-Mart rack up billions of dollars in profits by taking advantage of the artificially low wages made possible by the Chinese government’s repression of democracy, political dissent and fundamental human and workers’ rights.

Application of an International Trade Commission model shows that up to 973,000 manufacturing jobs and 1,235,000 total jobs are displaced by China's repression of labor rights. The nonprofit Economic Policy Institute (EPI) estimates 410,000 manufacturing jobs were lost to China between 2002 and 2004. U.S.-China Economic and Security Review Commission studies conclude that between 70,000 and 100,000 jobs are moved annually to China, and those numbers accelerated after 2001.The 2006 annual report of the U.S.-China Economic and Security Review Commission (a bipartisan, congressionally appointed commission) also provides evidence that China has been seriously inconsistent in meeting its obligations as a member of the WTO. The report backs up conclusions in the AFL-CIO’s Bush administration report card on China and an AFL-CIO Solidarity Center study on workers’ rights in China.

- Chinese mines are the most dangerous in the world, with more than 10,000 Chinese miners dying in industrial accidents each year (some 80 percent of the worldwide total).

- Rates of illness and injury have never been higher in China’s manufacturing sector as officials of China’s own Work Safety Administration conceded as recently as February 2006.

- There are as many as 10 to 20 million child workers in China—from one-eighth to one-quarter the number of factory workers.

- China’s minimum working age standard is widely violated, and the Chinese government does little to enforce the standard. As the U.S. State Department stated in its 2005 Human Rights Report on China, “The government continued to maintain that the country did not have a widespread child labor problem.”

- The Chinese government implements an extensive system of forced labor camps. The precise number of forced prison laborers is unknown, but estimates range from 1.75 million to 6 million and higher.

According to figures from China’s Ministry of Public Security, there was a sharp rise in officially registered public disturbances in 2005. Large-scale incidents of "mass gatherings to disturb social order" rose by 13 percent. In one report, "mass protests" or "mass incidents," including riots, demonstrations and collective petitions, rose from 58,000 in 2003 to 87,000 in 2004.

These abuses allow producers in China, including many multinational and U.S. corporations, to operate in an environment free of independent unions, to pay illegally low wages and to profit from the widespread violation of workers’ basic human rights.

The second factor behind China’s trade advantage, the nation’s deliberate undervaluing of its currency, the yuan, enables the Chinese government to export products at an artificially low price—running up the U.S. trade deficit and costing good American jobs. In fact, the yuan is estimated to be undervalued by as much as 40 percent.

An AFL-CIO report shows China’s fixed currency rate artificially lowers the price of its goods by 40 percent and subsidizes exports, putting U.S. companies and workers at a disadvantage. The lack of currency flexibility has been a major factor in U.S. job losses and a trade deficit with China that hit $202 billion last year.

In a letter to the Wall Street Journal earlier this year, AFL-CIO Secretary-Treasurer Richard Trumka said the Chinese government’s deliberate undervaluing of its currency is an anchor “that is dragging down American manufacturing and the middle class:”

Currency manipulation is one of the primary reasons for the massive bilateral trade imbalance between the United States and China, as well as for the flood of investments by U.S and other multinational companies. On top of the Chinese government’s record capital investments in manufacturing, foreign direct investment (FDI) in the country increased from $46.8 billion in 2000 to $60.3 billion in 2005. Seventy percent of China’s FDI is in manufacturing, with heavy concentration in export-oriented companies and advanced technology sectors. The dangers of this model of development are apparent: job and technical capacity loss in the U.S., growing inequality and political and financial instability in China, and the accumulation of nearly $1 trillion in U.S. dollar assets by the Chinese government. This is also a development model based upon the brutal repression of workers’ rights and human rights.Last year, the Senate introduced legislation sponsored by Sens. Charles Schumer (D-N.Y.) and Lindsey Graham (R-S.C.) that would have imposed a 27.5 percent tariff on all Chinese imports if that country did not raise the value of its currency within 12 months. The bill was never introduced in the House, and Senate leaders chose not to bring it up in the last session.

Paulson fears the next Congress will pass a tariff, and this is his last-gasp trip to convince China to voluntarily devalue its currency.

But unlike the 109th, the new Congress not only is more likely to take a firmer line on China’s currency devaluation, it will insist that the administration include workers’ rights as a key part of trade agreements and bilateral negotiations.

And the AFL-CIO will be working with Congress to ensure that going forward, trade deals aren’t just free but fair.