- by New Deal democrat

For a full year now I’ve been hammering the fact that the official CPI measure of housing inflation, “owners’ equivalent rent,” seriously lags actual house prices as measured by the most popular housing indexes. I said then, and I have reiterated almost every month since, that because of this serious lag, OER was going to rise probably to 7.5% YoY or more, and drag core CPI along with it. That remained evident in this morning’s October CPI report.

Here are the headlines:

Total CPI +0.4% +7.8% YoY (-0.4% YoY decrease from last month, and down -1.2% from June’s high of +9.0%)

“Core” CPI +0.3% +6.3% YoY (-0.4% decrease from last month’s 40 year high)

The below graph shows the monthly change in total (blue) and core (red) inflation since January 2021:

It’s clear that there has been a significant deceleration in the past 4 months.

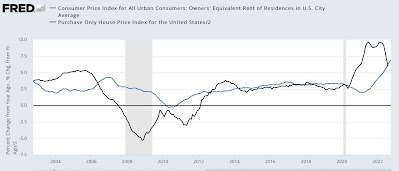

Owners’ equivalent rent rose +0.6% for the month, making a new +6.9% all time high YoY (exactly as I started forecasting a full year ago) compared with the FHFA purchase only house price index (black, /2 for scale):

Here’s what core inflation excluding OER looks like m/m (it was unchanged!):

And YoY (up 5.9%):

In other words, in the last 4 months, since gas prices peaked, total inflation has increased at a rate of 3.6% YoY. Core inflation minus OER has increased at only a 2.8% annual rate.

Here are some other highlights of the report.

Energy prices increased 1.8% for the month:

Used vehicles: -2.4% +2.0% YoY (down from +41.2% in February

New vehicles: +0.5% +8.4% YoY (down from +13.2% in April)

The YoY sharp deceleration in used car prices doesn’t mean they’re cheap: they’re still almost 50% more expensive than they were when the pandemic lockdowns ended. But they are about -5% down from their January peak. New vehicles are still very problematic:

In sum, high inflation at this point is primarily a function of housing. And while actual house prices have turned down slightly in the past several months, and are sharply decelerating YoY (but still up 12% vs. their 20% YoY high), the fictitious and lagging measure of housing - owners equivalent rent - that is used by the Census Bureau continues to misrepresent the true picture.

To repeat how I closed this report last month, in hiking rates, the Fed is chasing a phantom menace.