- by New Deal democrat

Consumption leads employment. Increasing demand for goods and services leads employers to hire more people to fulfill that demand. That, in a nutshell, is the biggest reason why real retail sales is one of my favorite economic indicators.

In July, nominal retail sales increased by less than 0.1%, rounding to 0. Consumer prices declined by less than -0.1%, also rounding to 0. But the combination was just enough to push real retail sales to round to +0.1%:

Still, real retail sales remain -1.1% below their April peak:

Interestingly, while as noted above nominal total retail sales were unchanged, retail sales excluding motor vehicles increased 0.4%, and retail sales excluding both vehicles and gas increased 0.7%. Since March 2021, total nominal retail sales are up 9.6%, and ex-vehicles and gas up 9.4%, but excluding vehicles only up 13.4%:

[Note: retail ex gas and vehicles has not updated yet on FRED, so June and July of that series are not shown]

This indicates that consumers are avoiding the purchase of motor vehicles, given their big price increases as shown in this graph which I ran when CPI was updated earlier:

And it further suggests that a big reason for the dampened consumer spending this year is the big increase in car and SUV prices. In other words, the chip shortage is a Big Economic Deal.

That being said, YoY real retail sales, which were negative for the past several months, are now up 1.7%:

This is a good sign, since negative YoY real retail sales typically have been a recession marker, but positive YoY real retail sales have historically only happened either in expansions or late in recessions (i.e., a short leading indicator of an incipient recovery). In other words, yet another sign that the US economy is not currently in a recession.

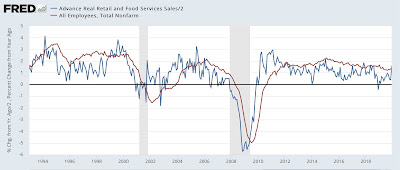

Finally, as noted above, real retail sales is a good short leading indicator for employment. Here’s the long term view from 1993-2019:

And here is the last year:

Even with the blowout July employment gains, on a YoY basis job growth has continued to decelerate, and I expect it to decelerate further, perhaps sharply.