- by New Deal democrat

Late last year I introduced the idea that the jobs market was similar to a game of musical chairs, where employers added or took away chairs, and employees tried to best allocate themselves among the chairs. Because of the pandemic, there have been several million fewer players trying to sit in those chairs, leaving many empty. Additionally, there is 10% greater demand for goods and services in total in the past year than there was before the 2021 stimulus payments. As a result, wages have continued to increase sharply, as employers attempt to attract potential employees to sit in the continuing big number of empty chairs.

I’ve further posited that the game of musical chairs will only slow down once some employers throw in the towel, and the number of job openings signficantly declines.

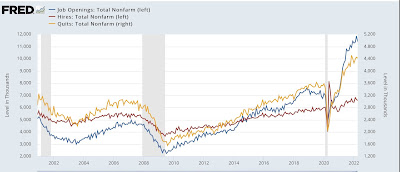

In April, as yesterday’s Census Bureau JOLTS report shows, the game of musical job chairs in the jobs market has actually intensified to all-time levels. Specifically, both job openings and quits made all-time highs, and total separations during their entire 20 year history were only higher in March and April 2020.

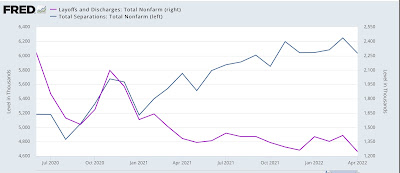

Layoffs and discharges (violet, right scale in the graph below) declined -170,000 to 1.246million, a new all-time low. Total separations (blue) declined -215,000 to 6.033 million (graph starts in June 2020 for reasons of scale):

For all intents and purposes, nobody is getting laid off.

Meanwhile, job openings (blue in the graph below) declined -455,000 to 11.4 million vs. their all-time high of 11.855 million one month ago. Voluntary quits (the “great resignation,” gold, right scale) declined -25,000 to 4.424 million. Actual hires (red) declined -59,000 to 6.586 million, vs. February’s all-time high of 6.832 million:

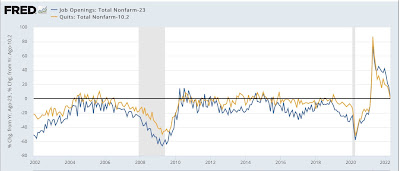

Importantly, there has been a sharp *deceleration* in the rate of YoY growth of both quits (to 10.2%) and job openings (to 23.0%). But those rates still constitute red hot growth vs. virtually any other time in the past 20 years:

In particular, in the past 6 months, vs. 23.0%, openings have grown at a 5.6% annualized rate, and in the past 3 months, at a 4.2% annualized rate. Openings could have peaked in March, or may continue to slowly rise for another 3 or 6 months.

In summary, the competition by employers to attract employees is still near a record. Employers aren’t laying anybody off, and the trend of workers quitting for better-paying jobs also continues at a near record pace. As a result, I expect wages to continue to increase sharply. Only when the trend in job openings rolls over, based on a 3 month average, do I expect to see a change in the underlying job market.