- by New Deal democrat

With mortgage rates having risen sharply (as of this morning Mortgage News Daily has the 30 year rate up to 4.19%, the highest in nearly three years), we are at an important moment for the housing market. In that context, let’s look at this morning’s new home sales report for January.

There are two important things to know about new home sales: (1) it is the most leading of all housing reports, leading even permits, so much so that it is more of a mid-cycle indicator rather than a long leading indicator, and (2) the data is very noisy, and heavily revised (December was revised up 3.5% this morning), so much so that it is less useful than single family permits in particular.

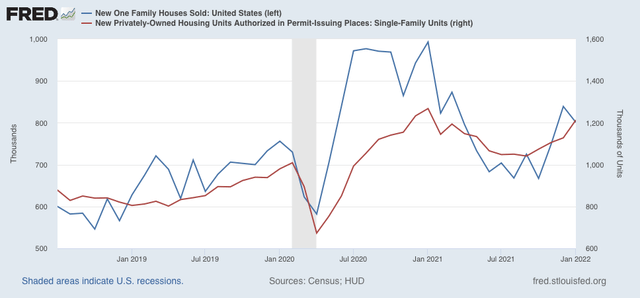

So first, here is new home sales (blue) vs. single family permits (red) for the past 3.5 years:

It’s easy to see that the trend in sales led permits - but also that sales are much more noisy.

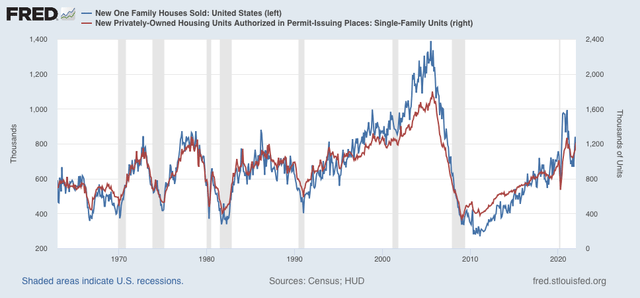

Here is the longer term view of same:

Sales are consistent with the move upward in permits in the past several months.

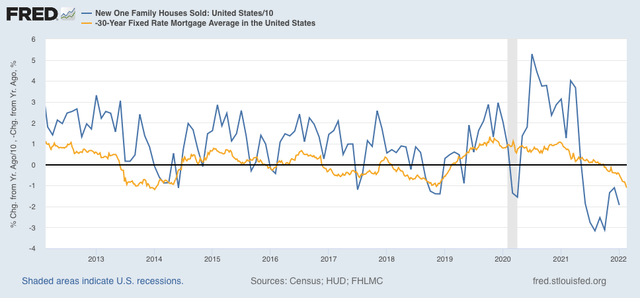

Having said that, as I always say, interest rates lead sales. Here is the YoY% change in mortgage interest rates (gold, inverted, so that an increase in rates shows as a decrease) vs. the YoY% change (/10 for scale) in new home sales for the past 10 years:

Again, it is easy to see that interest rates lead sales by 3-6 months. Note that sales were generally more buoyant that interest rates in the past decade, due to the demographic tailwind of the big Millennial generation, a tailwind that is now abating. Mortgage rates as of last week (i.e., before the further surge this week) were already slightly over 1% higher than one year before.

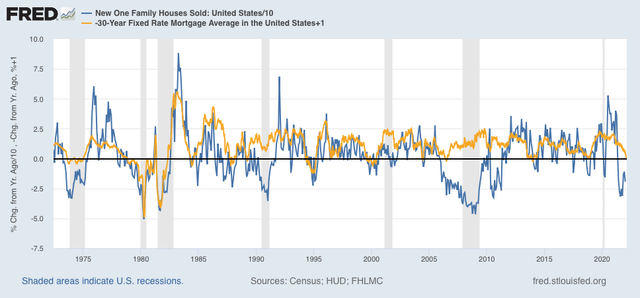

Here is the longer term view. In this graph I add 1% to the YoY change in mortgage rates, so that only changes in mortgage rates of higher than 1% show as a negative:

*Every* time mortgage rates were higher by more than 1% YoY, new home sales declined YoY at least briefly. But they only correlated with an oncoming recession about 50% of the time. So the increase in interest rates to date does not reliably signal a recession next year.

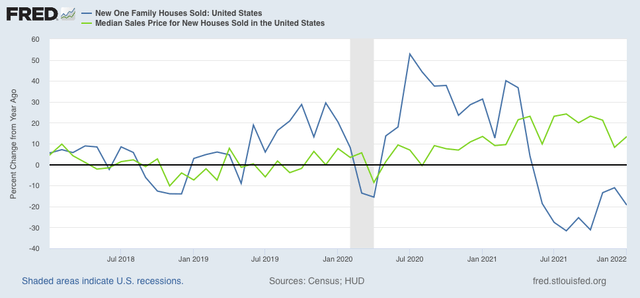

Next, sales lead prices. The below graph compares the YoY% changes in sales with that of prices (green):

The YoY change in sales peaked from summer 2020 through spring 2021; prices followed from spring through autumn 2021. Price increases are now decelerating (just as we saw the other day with the Case Shiller and FHFA house price indexes).

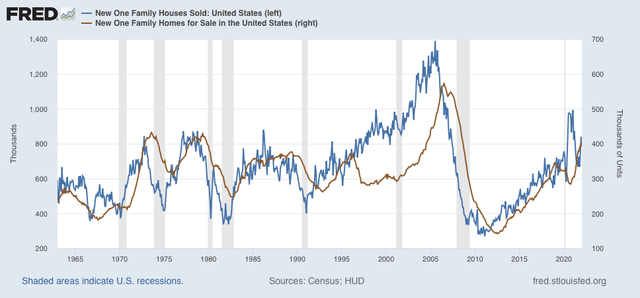

Finally, in the case of new houses, prices lead inventories. The below graph compares sales with new homes for sale (brown):

The inventory of new single family houses for sale rose to 406,000 in January, the highest number since summer 2008, and before the housing bubble previously exceeded only during the 1970s.

In keeping with my mantra, we should expect the continued rise in mortgage rates to lead to a renewed decline in new home sales and construction, continued deceleration with price increases (and an increasing change of outright price *decreases*), and a continued increase in the inventory of new houses for sale. Depending on what other long leading indicators do, this *could* mean a recession in 2023, but not necessarily so at this point.