- by New Deal democrat

The initial spin on this morning’s delayed retail sales report for January has been positive, with for example the Wall Street Journal calling it a “rebound” and “a sign of solid economic momentum in the first quarter.”

Ummmmm, No.

Both nominally and in real terms, retails sales did improve by +0.2% in January over December.

The problem is, both November and December were revised downward. In particular, December’s initially reported poor -1.2% showing got even worse, to -1.6% nominally. In other words, for the two months combined, retail sales even measured nominally declined by -0.2%.

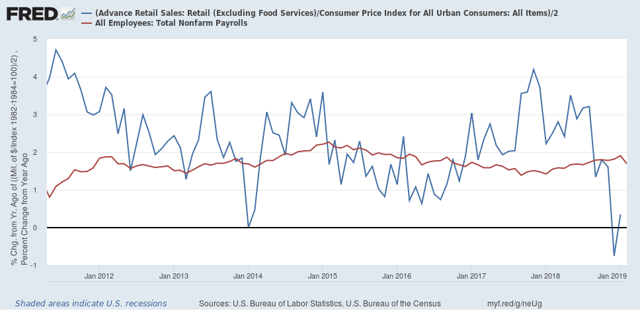

Here’s what they look like in real terms through January:

Because real retail sales tend to lead employment (red in the graph below) with a variable lag on the order of 6-9 months, this downturn in retail sales is more evidence that February’s poor employment report should not simply be dismissed as an outlier:

On a YoY basis, real retail sales peaked over a year ago. They have sharply decelerated since then all the way to roughly zero. We should expect employment gains to also decelerate, and February’s poor report is consistent with such a deceleration having started.

I expect to put up a more detailed look at Seeking Alpha, probably tomorrow. Once it is up, I will link to it here.

I expect to put up a more detailed look at Seeking Alpha, probably tomorrow. Once it is up, I will link to it here.