- by New Deal democrat

Last month I said to keep an eye on the temporary employment number in the jobs report, because it is a leading indicator for jobs overall.

But it isn’t the only such leading component. Manufacturing jobs, construction jobs, and the average number of hours worked in manufacturing jobs per week are also leading indicators for jobs overall.

I have two posts up showing this relationship for each of these sectors over at Seeking Alpha. Here are the links:

As usual, clicking over and reading not only helps you understand why you should pay attention to these sectors, but also helps reward me for my work.

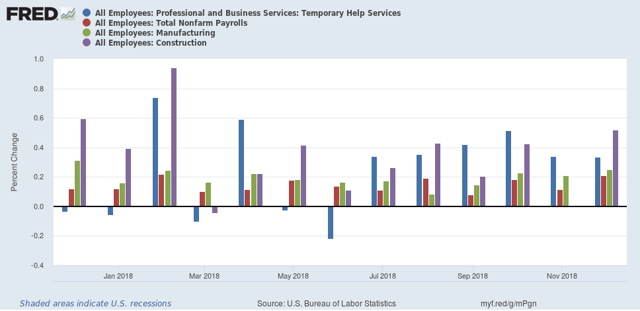

As a bonus, here are the monthly % changes in total jobs (red), temporary employment (BLUE), manufacturing jobs (green), and construction jobs (purple) in the twelve months just before the last three recessions, plus 2018:

1989-90

2000-01

2006-07

2018

In the year prior to each of the last three recessions, at least two of the three leading jobs sectors — and sometimes all three — declined for months before the total number of jobs created monthly went negative. By contrast, with a couple of exceptions, all throughout 2018 all three leading sectors remained quite positive. This strongly suggests that, left to its own devices, the economy is not near a recession.

So I will highlight all three sectors when I summarize the jobs report tomorrow, looking for any changes.

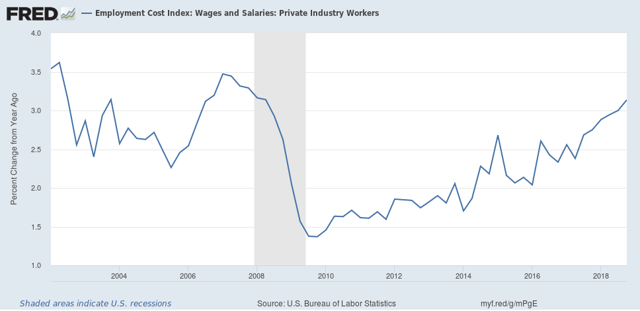

BONUS BONUS! I’ll report on this more next week, but I wanted to point out that the Employment Cost Index for Q4 was reported this morning, and showed that the YoY change in *median* wages rose 3.1% in 2018 (+0.9% in Q4 alone). That’s the most in a decade and the highest during this expansion:

The labor market is finally tight enough that employers are starting to have to fork over some wage increases to average workers.